Among Chinese tech companies, JD.com (JD) has actually been one of the best-performing stocks in the market.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Currently, JD stock remains approximately 21% off its 52-week high, which isn’t that bad, considering the declines of many of its peers. This is a company that has posted continuous earnings beats, and a broadly positive outlook. This is also a company that’s been less-impacted by regulatory concerns coming from the CCP.

Given JD’s comparisons to Amazon (AMZN), many domestic investors like the growth potential of this company. JD’s focus on building out the e-commerce infrastructure China needs to tackle the 21st century has many investors looking decades down the road at this company’s growth prospects.

I remain bullish on JD’s long-term growth potential, and think this is a stock that could continue much higher from here. (See Analysts’ Top Stocks on TipRanks)

Financials

JD released its Q3 earnings mid-November, and much to the surprise of investors, beat to the upside. JD.com saw revenues and earnings surge, driven by strong growth in the domestic e-commerce market in China.

Revenue grew by 32.2% to $33.9 billion for JD this past quarter. Strength in the company’s growth rates in its e-commerce and logistics businesses largely drove these results. Additionally, JD saw active annual customers increase 25% on a year-over-year basis to 522.2 million.

The scale of JD’s business is really something to consider. JD.com continues to grow its core general merchandise business. However, the company’s focus on penetrating new markets such as supermarkets and pharmacies, electronics and appliances has continued to drive outperformance.

JD’s numbers look appealing from most angles. However, adjusted operating margins did dip slightly, to 2.1% from 3% a year ago. Adjusted earnings per share also dropped to $0.49 from $0.54 over this same period.

However, most analysts and investors following this stock note that these slight profitability dips are a result of JD aggressively working to eat market share in China.

JD Expanding

In addition to diversifying the company’s product lines, JD.com is making other somewhat unconventional moves to grow. This past quarter, JD.com opened its first physical mall, and boosted the company’s offline retail plans. In a bid to capture more of the overall consumer market, JD appears to be innovating in how it thinks about an omnichannel approach.

Essentially, JD plans to offer more than 200,000 items from more than 150 brands at this mall. Many of these brands, such as Further, LVMH Moët Hennessy, Louis Vuitton, and Sephora are on the higher end of the consumer spectrum. Investors looking for higher-margin sales seem to like this targeted move into physical retail right now.

The hope is that JD can utilize these physical locations to deliver beauty products and other high-end consumer items to buyers within an hour. Doing so will provide the company with a logistics advantage, and allow JD to continue to build out its moat.

Additionally, JD appears top be looking beyond its own borders to add growth. The company’s focus is on adding international customers, as JD continues to near saturation in its domestic Chinese market.

Until recently, JD utilized investments in joint ventures to expand internationally. This is likely to remain the case, though the company may look to advance its interest internationally directly. We’ll have to keep an eye on this.

Balance Sheet Health

JD.com is a company with a rather pristine balance sheet. JD’s low long-term debt (only $1.9 billion) has come about via nearly five years of debt repayment that has seen approximately $4 billion cleared off the company’s books.

This has eliminated the majority of the company’s annual interest expense (only $168 million currently). However, JD.com is able to generate approximately $425 million every year from net interest on cash and other short-term investments on its books.

In other words, JD.com is in excellent financial health. The company’s $15 billion in cash and cash equivalents, along with another $11.7 billion in short-term investments, provide this company with a massive war chest to use to continue expanding.

Wall Street’s Take

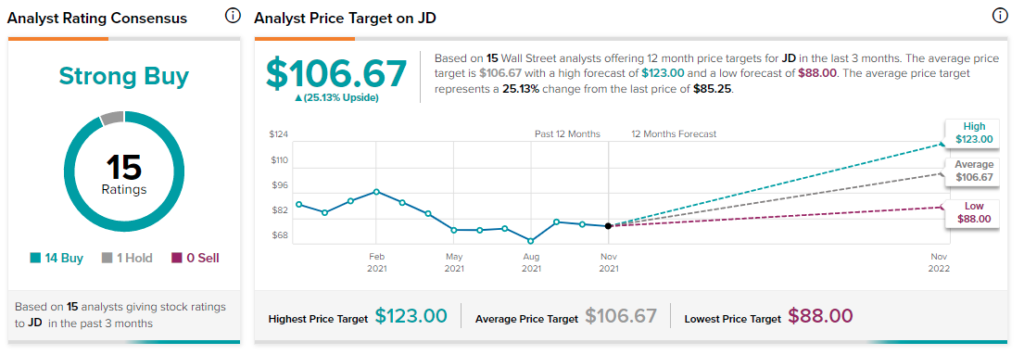

As per TipRanks analyst rating consensus, JD stock is a Strong Buy. Out of 15 analyst ratings, there are 14 Buy recommendations and one Hold recommendation.

The average JD.com price target of $106.67. Analyst price targets range form a high of $123 per share to a low of $88 per share.

Bottom Line

JD.com is growing aggressively, despite various headwinds that have taken the company’s peers lower of late. These catalysts and drivers remain robust, and long-term investors have reason to believe JD.com can be a long-term winner in the race for e-commerce market share in China.

Disclosure: At the time of publication, Chris MacDonald did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >