Entertainment magnate Disney (NYSE:DIS) recently put on its D23 event, revealing upcoming dates and events on the Disney release calendar. However, several unexpected holes emerged and left fans scratching their heads. Most of Disney’s recent losses seem connected to the D23 event. The event revealed that the release of “Star Wars” spin-off movie “Rogue Squadron” had been removed from the slate altogether.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score a data driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Streaming releases of “Star Wars” properties are all still in play. One upcoming release will feature relative newcomer Ahsoka Tano. However, the confirmation that “Rogue Squadron” is out of the running left fans, and investors, clearly disappointed.

Disney shares have been declining over the past 12 months until recently. The company is still well below its highs for the year. Last year at this time, Disney shares were just over $183. They spent most of June and July under $100 per share. As July gave way to August, shares began an uncertain rise that has since backed off. Shares currently are just over $108.

Disney’s shaky release schedule is doing it few favors. Pushing highly-anticipated content back to the nether realm of “maybe coming eventually” isn’t a great plan. Especially when the planned replacement is “not much.”

Back in May, I was bullish on Disney. Now, however, the termites in the House of Mouse seem to be winning. That’s not a good sign for its long-term prospects, so I’m pulling back to neutral.

Disney Stock’s Overall Investor Sentiment Trend is Fairly Confident

Investors are moving away from Disney based on the declining share price. However, that sentiment isn’t the case everywhere. In fact, much of Disney’s investor sentiment metrics seem to be quiet. Disney has a Smart Score of seven out of 10 on TipRanks currently, which puts it at the highest level of Neutral. That suggests a slightly better than even chance Disney will ultimately outperform the broader market.

Disney’s insider trading figures, however, display at least some confidence in the firm. Insider trading at Disney in the last three months is almost entirely buying. For the last three completed months, Disney insiders staged 10 buying transactions and just one selling transaction. However, none of these transactions were informative.

To find an informative transaction, you have to go back over a year. Thus, we can only proceed in terms of the aggregate, which does show a marked interest in buying.

Over the last 12 months, Disney insiders staged 53 buying transactions and 24 selling transactions. Buyers leading sellers better than two to one demonstrate a clear interest in buying.

Dissatisfied and Tight-Fisted Customers Pose Risks for Disney Stock

Disney’s biggest problem in the near term is that it is almost exclusively a discretionary operation. Granted, the kids will be woefully disappointed if a planned Disney vacation is canceled. Yet, they will not die from a lack of Vitamin Disney. That means Disney-related expenses are likely to be among the first cut in households looking to save money. Especially as gas prices remain high—though somewhat lowered in recent days—and food prices remain catastrophically high.

That’s bad enough for Disney. Yet Disney’s response to this is perhaps the most bewildering of all: it’s raising prices almost universally. Just back in August, Disney announced a price hike for Disney+, going from $7.99 per month to $10.99 per month.

The company plans to release an ad-supported tier. Yet this is almost a cruel irony; the ad-supported version will cost $7.99 per month. That’s what it previously cost for a version with no ads. The price hikes may be all right here, however, as Disney has clear plans to keep content rolling out.

The D23 event revealed several new releases either arriving soon or in the future. Sadly for those waiting for a “Rogue Squadron” spin-off, that movie seems to be pretty much off the table. Multiple scheduling conflicts seem to have emerged, keeping the lid on that one.

However, several other Disney releases will land. “Haunted Mansion” is on the list, though it moved from March to August. Meanwhile, Disney’s “Wish” will hit just ahead of Thanksgiving 2023.

That’s not all; reports suggest that a Disney vacation will cost “thousands more in 2023.”. As noted by CEO Bob Chapek: “For all visibility we have into the future, we’re not seeing any softening of our demand.” With reports noting that ticket demand is actually above capacity, price hikes are a reasonable response.

Disney rolling out new extras like MagicBand+ systems allows for entirely new ways to charge customers to get the “full” experience. Issues of the supply chain hit food prices in the parks every bit as hard—or harder—than they do at the grocery store.

However, increasingly disgruntled customers may derail this strategy. Demand will likely fall if this level of dissatisfaction keeps up.

Disney guests are increasingly hitting social media to describe troubles at the parks. One report related the nightmarish experience of being stuck on one ride for over an hour. The ride? “It’s a Small World.” Perhaps worst of all, reports note the accompanying song played during that entire hour.

That’s hardly the only case, either. Back in July, a car at Splash Mountain reportedly started sinking and required emergency evacuation. Increasingly expensive food is declining in quality, with one report comparing it to “prison food.”

It does seem that there’s a resurgence of demand as lockdowns fade and COVID-19 related countermeasures shut down. However, Disney’s combination of rising prices and declining quality doesn’t seem to be a good plan to keep that stratospheric demand high.

What is the Target Price for DIS Stock?

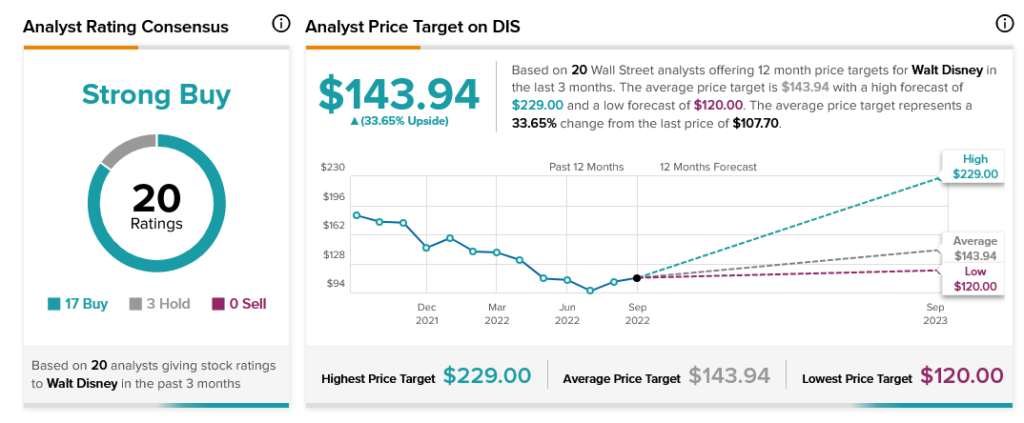

Turning to Wall Street, Disney has a Strong Buy consensus rating. That’s based on 17 Buys and three Holds assigned in the past three months. The average Disney price target of $143.94 implies 33.65% upside potential. Analyst price targets range from a low of $120 per share to a high of $229 per share.

Conclusion: Disney Stock Looks Attractive, but Discretionary Spending Likely to Fall

Disney is an attractive buy right now. It’s currently trading just off its lows for the year and significantly under its lowest price targets. That makes its upside potential very attractive. The problem is that Disney needs to be able to achieve that upside potential. Disney is a largely discretionary operation. Current macroeconomic conditions all but assure discretionary funds will be under pressure for some time. That’s not good news for the company.

With Disney also relying on suppressed demand to drive performance—even in the face of declining quality—its ability to hike prices on worsening experiences is likely also minimal.

That’s why I’m neutral overall on Disney; it’s got a good thing going right now, but how long that good thing can continue is anyone’s guess.