It’s been anything but a magical year for Disney (DIS) stock, now down around 40% year to date. Though many may question CEO Bob Chapek’s performance, the man is staying at the House of Mouse for at least another three years.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Chapek’s reign has not been great for shareholders thus far; with unneeded controversies and other issues plaguing the company, Chapek is still the man that transitioned the firm into the age of streaming.

Also, given profound macro headwinds weighing on streamers and media titans, it’s hard to gauge Chapek’s relative performance. Over the next three years, we’ll find out if Chapek’s plan will work out as Disney looks to steer through a potential consumer-facing recession and economic slowdown.

Of late, it’s been mostly negative news relating to Disney and the economy’s fate. Still, Disney is doing a lot of things right that could help the stock find a bottom and begin to rally off of it as soon as the second half. With Shanghai reopening its doors for summer after COVID-19 lockdowns, the parks business may finally lift a coming quarter rather than weighing it down.

Disney Stock: Too Much Bad News Baked In

It’s not just parks and amusements; the Disney+ platform could begin to make significant strides over its competitors through the summer. The streaming platform also serves as an excellent hedge against a late-summer or early-fall COVID-19 resurgence.

The BA.4 and BA.5 variants of Omicron are becoming dominant strains. With seasonal booster shots and a reluctance to close the economy again, a return in 2020 is highly unlikely. That said, if worse comes to worst, anything is possible – and Disney is better prepared for such a worst-case outcome in the unlikely event that COVID-19 restrictions return.

I am bullish on Disney stock heading into the second half, even if Chapek can’t pull another rabbit out of a hat going into a period of economic instability.

What’s Bob Chapek’s Next Move at Disney?

Chapek will be known for dragging Disney out of the gutter in 2020 with its Disney+ streaming platform. Looking ahead, Disney seems poised to continue growing Disney+ as new releases continue flowing out of the pipeline. With such a strong content slate, it’s arguable that Disney+ has the edge over Netflix, as it bleeds subscribers.

Further, Disney may wish to explore new frontiers in the digital realm. The metaverse and virtual experiences of tomorrow have been a hot topic. Many big-tech firms are committed to investing heavily in the effort.

Though the metaverse is still nascent, I do think Disney can make moves to ease such a transition — whenever it arrives. With Apple (AAPL) slated to pull the curtain on its headset in early 2023, the metaverse could be propelled to the forefront over the next three years of Chapek’s contract.

Is Disney ready for the metaverse? Recent comments from Chapek regarding the nascent technology have been quite vague. However, Disney’s newest cruise ship seems to incorporate compelling augmented-reality technologies.

Disney’s cruise app reportedly has a “skyglass” augmented-reality feature that overlays constellations in the sky. It’s an intriguing feature, to say the least. That said, many constellation apps have been in existence for quite some time.

In any case, Disney seems more than willing to embrace technologies to enhance the customer experience. However, that may not be good enough to make a big splash into the metaverse if it’s poised for prime time within the next two years rather than the next two decades.

If Disney+ was the first act of Chapek’s reign, a push into the metaverse and video games could be the second. The acquisition of a video-game behemoth could be the way to propel Disney into a new era of virtual experiences.

Of late, it’s hard to ignore the growing number of video games leveraging various Disney brands. From Guardians of the Galaxy, developed by Eidos-Montreal, to the numerous slate of Star Wars games, it’s clear that Disney’s brands translate very well into gaming.

Rather than partnering up with developers, Disney may wish to acquire one, like Electronic Arts (EA) outright, to take gaming to the next level.

The video-game industry has undergone quite a bit of consolidation in recent years. Electronic Arts seems to be a great fit for Disney, given it’s developed many of its Star Wars games and its expertise with sports titles, which would complement ESPN quite well.

Wall Street’s Take

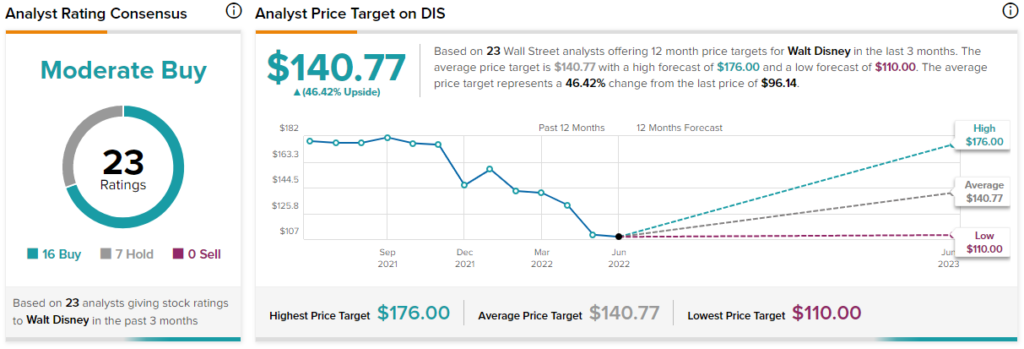

Turning to Wall Street, DIS stock comes in as a Moderate Buy. Out of 24 analyst ratings, there are 17 Buy recommendations and seven Hold recommendations.

The average Disney price target is $140.77, implying 46.4% upside potential. Analyst price targets range from a low of $110.00 per share to a high of $229.00 per share.

The Bottom Line on Disney Stock

Disney isn’t just a film and amusement parks company anymore. It’s an entertainment company that’s willing to explore new media.

As Chapek looks to explore new technologies to enhance the experience while potential second-half catalysts kick in for the parks, I think it’ll be hard to stop a Disney stock turnaround in the second half of this year.