It’s been a little over a year since Robert Iger returned at the helm to transform Walt Disney (NYSE:DIS). As Iger led the transformation, what stood out were the cost-saving initiatives. These initiatives have provided a buffer for its earnings and cash flows. Nevertheless, potential investors should take caution, as suggested by the consensus rating from analysts.

Iger emphasized during the Q4 conference call that Disney’s comprehensive restructuring plan has led to significant efficiencies. As a result, the entertainment giant is poised to realize around $7.5 billion in cost reductions, surpassing its earlier target by approximately $2 billion.

He emphasized the significance of Disney’s revamped operating structure, particularly in the streaming business. His new strategies in marketing, pricing, and programming have contributed to an enhancement in the operating results of the combined streaming businesses by approximately $1.4 billion from fiscal 2022 to fiscal 2023. Additionally, Iger expressed confidence that Disney’s streaming business is on track to achieve profitability in the fourth quarter of fiscal 2024.

With this backdrop, let’s look at the Street’s forecast for DIS stock.

Is Disney Stock a Sell or Buy?

Analysts are cautiously optimistic about DIS stock. However, during a recent town hall meeting, Iger announced that the company is ready to rebuild its business following a year of restructuring.

A key emphasis is on streamlining operations within the ESPN and entertainment segments, which should be viewed positively. Additionally, the company is set to unveil a direct-to-consumer version of ESPN in 2025. What’s noteworthy is Disney’s commitment to invest $60 billion in the parks and resorts business, with Iger expressing confidence in this segment’s significant growth potential.

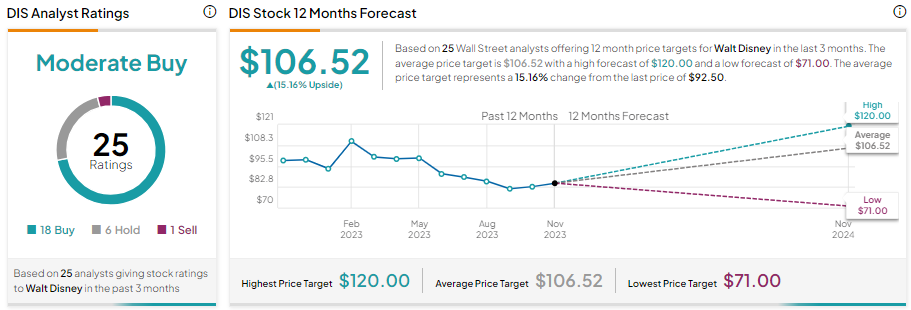

With 18 Buy, six Hold, and one Sell recommendations, Walt Disney stock has a Moderate Buy consensus rating. Further, analysts’ average DIS stock price target of $106.52 implies 15.16% upside potential from current levels.

Bottom Line

Disney’s focus on generating significant cost savings and streamlining operations will enable it to deliver profitable growth in the coming years. Further, large capital allocations in high-growth parks and resort businesses support its bull case. However, challenges in the linear TV segment due to the ongoing shift towards connected TVs remain a concern, as reflected through analysts’ Moderate Buy consensus rating.