Shares of Disney (NYSE:DIS) have shown signs of life in recent months, thanks partly to the broad market’s rally since mid-October. Undoubtedly, it’s not just broader market strength that could help Disney stock outpace the S&P 500 going into the new year. Activist investor Nelson Peltz is back. And this time, he could take things to the next level, nominating himself and Disney’s former CFO to the board. As a long-time Disney shareholder, I welcome as much change as possible.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Though long-time CEO Bob Iger seeks to turn the tides in his latest tenure, I think Disney needs a clean slate, with a new manager and a successor that’s perhaps not of Iger’s choosing. Nothing against Iger, but he hasn’t had much to show for his time at Disney in recent years. As Peltz hopes to spark change again, I think it’s hard to be anything but bullish. Not while shares are close to multi-year depths, with expectations that have been drastically reduced.

Disney Stock: Great Assets and Modest Valuation

At the end of the day, Disney has magnificent assets. And though it may not be able to unlock the full power of its brands over the medium term, I believe it’s a mistake to discount them. As the media industry consolidates, with Warner Bros. Discovery (NASDAQ:WBD) potentially in the running to merge (yes, once again!) with fellow media kingpin Paramount (NASDAQ:PARA), we could easily hear of more takeover speculation when it comes to Disney.

While Disney is a relative behemoth in the space, with its $168.4 billion market cap at writing, I view its assets as potentially worth more in the hands of another firm with deep pockets and an appetite for dominating the video-streaming market.

Indeed, Apple (NASDAQ:AAPL) immediately comes to mind when thinking of a firm large enough and capable enough to make a Disney acquisition work. Apple TV+ is an intriguing streaming platform, but one that needs a boost to catch up with the top dogs in the streaming scene. Whether it’s Disney or a much smaller firm, I view an acquisition or partnership as a missing piece of the puzzle for taking Apple TV+ to the next level.

Recently, Vivek Couto of Media Partners Asia sat down in an interview conducted by CNBC, remarking on how he believes Disney’s entertainment assets would be attractive through the eyes of a prospective acquirer. I couldn’t agree more. Disney is not a bite-sized media company by any stretch of the imagination. That said, it does offer plenty of bang for the buck after enduring its painful multi-year funk.

Disney stock also looks incredibly cheap right now, with shares going for 1.89 times price-to-sales (P/S) and 1.7 times price-to-book (P/B), both of which are well below DIS stock’s five-year historical averages of 3.4 times and 2.7 times, respectively.

Significant Changes Could be Key to Ending Multi-Year Slump

During the October trough, Disney stock touched lows not seen in almost a decade. That’s some severe underperformance minting Disney stock as one of the Dow Jones Industrial Average’s biggest dogs over the last 10 years. Indeed, the media and entertainment industry has grown a heck of a lot tougher over the past years. The pandemic made a tough situation that much more dire when Disney was doing its best to adapt with its Disney+ streaming service launch. However, more than two years after pandemic lockdowns, I don’t think you can point the finger at external issues any longer.

Disney needs to try something different and be the master of its own fate, even in the face of profound industry headwinds. Whether Disney needs new blood (at the CEO’s office and on the board) remains to be seen. Regardless, one can’t imagine there’s a lot to lose after 10 years of weak returns relative to the market averages.

As we move into 2024, I do think a new hope (pardon the Star Wars reference) could be in store for the House of Mouse. Whether that entails Peltz making big changes at the upper levels of management or pushing for more drastic changes at the operating level, I do think more Peltz is a good thing for Disney stock. Though Disney has been trimming away at costs while looking to pivot its Disney+ streaming service toward profitability, it’s clear more is needed to get the long-time laggard rallying again.

As Peltz returns with his proxy battle over at Disney, I do view Disney stock as one of the most compelling deep-value options in the media scene, even if it’s less clear what Peltz plans to push if he does have his way. I’d be more confident in Disney’s turnaround prospects if Peltz gets the board seats he seeks. Ultimately, I view more activism in a troubled firm as a major plus, especially for a firm battling succession issues and hefty expenditures from left, right, and center.

On the front of succession, Disney may be getting closer to finding a suitable replacement for the long haul as Morgan Stanley (NYSE:MS) legend James Gormon looks to help find Disney the right person for the job. The sooner Disney solves its succession issues, the sooner I believe the stock can get moving higher again.

Wall Street’s Take on DIS Stock

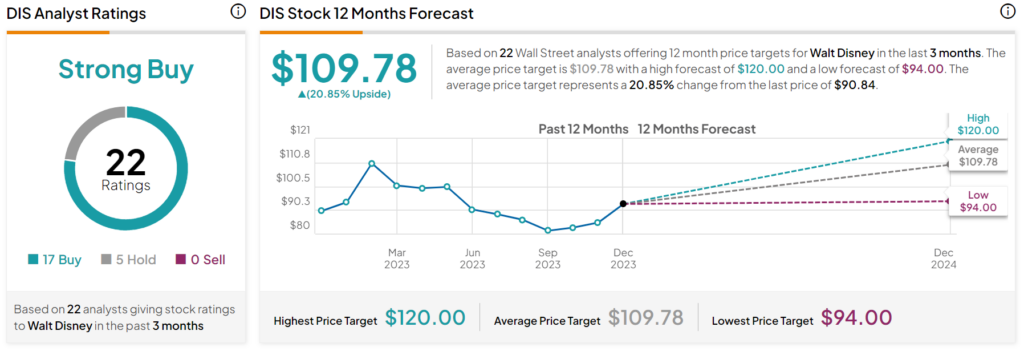

On TipRanks, DIS stock comes in as a Strong Buy. Out of 22 analyst ratings, there are 17 Buys and five Hold recommendations. The average DIS stock price target is $109.78, implying an upside potential of 20.9%. Analyst price targets range from a low of $94.00 per share to a high of $120.00 per share.

Takeaway: Disney Looks like a Great Comeback Play for 2024

Disney stock is looking like a great comeback play for 2024, as Nelson Peltz looks to make a bigger mark while James Gormon assists the firm in ironing out its succession wrinkles. Things are looking up for Disney, even as the media landscape moves into what’s likely to be yet another challenging year.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue