The International Diabetes Federation estimated that about 537 million adults were living with diabetes in 2021, and the number is estimated to rise to 783 million by 2045.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Health officials have also been warning of the increased risk of complications that people with diabetes are likely to face if they get infected with COVID-19. Amid these scenarios, continuous glucose monitoring devices or CGMs are gaining relevance.

Using the TipRanks stock comparison tool, let’s compare two prominent companies in the CGM space—Dexcom and Abbott Laboratories.

Dexcom (NASDAQ: DXCM)

Dexcom’s innovative technology has helped it emerge as one of the leading players in the CGM devices market, with its revenue growing from $573 million in 2016 to $2.45 billion in 2021.

This growth has largely been fueled by strong momentum in the adoption of the company’s G6 CGM system in recent years.

Dexcom generated about 84% of its overall revenue last year from the disposable sensor and other products, while reusable hardware accounted for the remaining 16%.

With an expanding customer base, the company expects to generate an increasing proportion of its top line from the recurring sales of its disposable sensors.

Last month, Dexcom reported an adjusted EPS of $0.68 for the fourth quarter of 2021, which reflected a year-over-year decline of over 25% and lagged analysts’ estimate of $0.85.

Fourth-quarter revenue of $698 million reflected an increase of 23% from the prior-year quarter, and exceeded analysts’ expectation of about $696.5 million.

The company’s forecast for 2022 revenue in the range of $2.82 billion to $2.94 billion is lower than the Street’s estimate of $2.96 billion.

Recently, Dexcom’s G7 CGM received the CE Mark (Conformité Européenne) for use in patients in Europe aged two and older.

The company stated that it expects to launch G7 in Europe in the “next several weeks.”

Reacting to this development, BTIG analyst Marie Thibault stated, “We think improved accuracy, smaller footprint, and faster warmup times (30 minutes), among other improvements, will allow Dexcom to compete more effectively, especially in the Type 2 market.”

Dexcom submitted the G7 for approval to the U.S. FDA (Food and Drug Administration) in the fourth quarter of 2021. While the company did not provide a timeline for the anticipated FDA approval, Thibault feels that a mid-2022 clearance is a “reasonable” timeline.

The analyst reiterated a Buy rating and kept the price target for Dexcom stock unchanged at $535 (14.8% upside potential).

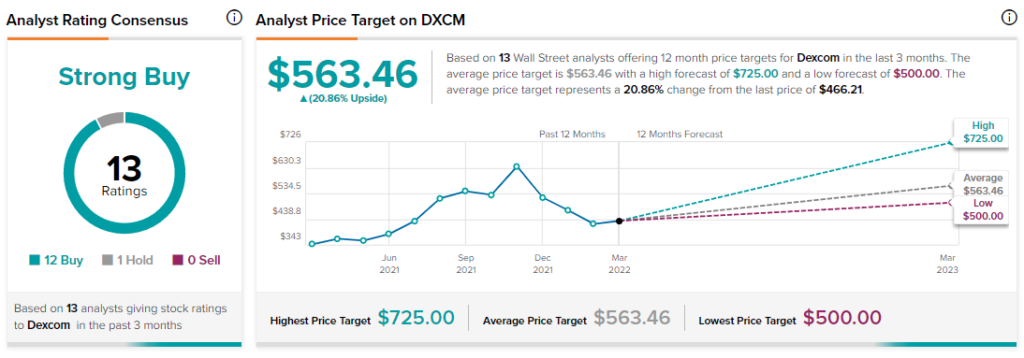

Dexcom scores a Strong Buy consensus rating, based on 12 Buys and one Hold. The average Dexcom price target of $563.46 implies 20.9% upside potential to current levels.

Abbott Laboratories (NYSE: ABT)

Abbott is a diversified healthcare giant offering an extensive range of healthcare products. The company’s business is comprised of four key segments: Established Pharmaceuticals, Diagnostics, Nutritional Products, and Medical Devices.

While the pandemic-induced restrictions hurt Abbott’s Medical Devices division by causing a delay or cancellation of elective and non-essential medical procedures last year, the company’s Diagnostics division benefited from the demand for several COVID-19 diagnostic tests.

Abbott’s COVID-19 testing products, including BinaxNOW, Panbio, and ID NOW, contributed sales of $2.3 billion in the fourth quarter of 2021 as the Omicron variant spread rapidly. Overall, the company reported fourth-quarter sales of $11.5 billion, up 7.2% year-over-year.

In 2021, Abbott’s COVID-19 testing products contributed sales of $7.7 billion. However, uncertainty associated with the pandemic makes it difficult for the company to predict full-year demand for the tests this year.

The company’s guidance issued in January indicated that it expects COVID-19 testing sales of $2.5 billion to occur early in the year.

Aside from COVID-19 tests, Abbott has also been in focus due to the rapid growth in its FreeStyle Libre CGM systems. Excluding the impact of currency fluctuations, FreeStyle Libre sales grew about 37% to $3.7 billion in 2021.

The Libre platform has 4 million users, which is expected to increase further as the company aims to expand Libre 3 into additional international markets, like the U.K. and France.

Abbott has been promoting its Libre system as a more affordable option than CGMs offered by rivals like Dexcom.

Overall, continued innovation and a strong product portfolio addressing diversified healthcare needs are expected to drive Abbott’s growth over the long term.

Furthermore, Abbott has now earned the status of a Dividend King, a term used for companies that have raised their dividends for at least 50 consecutive years. The stock offers a forward dividend yield of 1.5%.

Recently, Bank of America analyst Travis Steed reinstated coverage of Abbott with a Buy rating and a price target of $140 (14.3% upside potential).

Steed’s bullish stance is backed by the company’s sustainable top-quartile organic growth profile, robust pipeline, strong balance sheet with COVID testing profits, and a diversified business model.

The Street is optimistic about Abbott stock, with a Strong Buy consensus rating based on eight Buys and one Hold. The average Abbott price target of $143.22 implies 17% upside potential to current levels.

Conclusion

Amid intense stock market volatility, both Abbott and Dexcom stocks are in the red so far this year. However, Wall Street analysts continue to have a bullish stance about the growth prospects of both companies.

Abbott has a diversified portfolio, and a robust product pipeline across several lucrative healthcare areas.

Based on the upside potential though, Dexcom stock seems to be a better pick.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure