2023 turned out to be a terrific year for stocks, as the stock market did shockingly well in an environment of rising interest rates and worries about an economic downturn. The S&P 500 and the NASDAQ indexes have both posted solid gains, of 17% and 33%, respectively.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

While stocks are surging towards their highest levels, it doesn’t mean investors have lost their chance to hop on the bandwagon. According to banking giant Deutsche Bank, there’s still plenty of room for them to get in on the action.

Against this background, let’s take a look at Deutsche Bank’s quarterly Fresh Money List, the recently updated compilation of the DB analysts’ ‘top ideas’ for the coming year. The investment bank started this list in 2017, and since then these picks have posted consistent outperformance when compared to the S&P 500. The index has gained 124% over the past 6 years; the Deutsche Bank Fresh Money List has gained 167%. This remarkable track record makes the Deutsche Bank picks an enticing selection to explore.

Using the TipRanks database, we’ve pulled up details on three of the stocks that the bank’s analysts have tapped as Buys. All have solid upside potential ahead of them – with one anticipated to generate returns of 160% in the coming months. In fact, Deutsche Bank is not the only firm singing these stocks’ praises. According to TipRanks, they are all rated as Strong Buys by the Street’s analysts.

SeaWorld Entertainment (SEAS)

In the world of theme park entertainment and zoological organizations, SeaWorld stands out. The Florida-based company, which has been in operation for nearly 60 years, operates a chain of parks, featuring live animal attractions with dolphins, orcas, and sea lions, as well as the more traditional theme park fare of roller coasters, splashdowns, and other thrill rides. The company operates 12 destinations in key local markets around the US.

In addition to operating theme park destinations, SeaWorld is also active in the rescue and rehabilitation of marine and aquatic animals. The company has rescued more than 40,000 animals in the last 50 years, and has built up a zoological collection which it showcases at its parks and uses as ambassadors to promote animal husbandry and rescue efforts.

SeaWorld reported its first quarter ’23 results earlier this year, and showed both important gains and an equally important miss. On the positive side, the company’s total revenue came to $293.3 million, a Q1 record that reflected 8.4% year-over-year growth – and came in almost $12 million ahead of the forecasts. On the negative side of the ledger, a net loss per diluted share of 26 cents, was 9 cents deeper than had been anticipated.

Digging down, some operational highlights show that SeaWorld’s Q1, its slowest quarter of the year, had a measure of success. The company’s admission per capita figure was up 9.4% y/y, reaching $48.51, and the total revenue per capita grew 9.2% y/y, reaching $86.84. Both figures, like the revenue total, were Q1 records for SeaWorld.

Among the bulls is Deutsche Bank analyst Chris Woronka who sees SeaWorld holding a sound niche, and looks forward to seeing the company’s performance during its traditionally busy summer season.

Woronka believes that the stock is priced low relative to near-peers, and writes, “We believe SEAS is well positioned to deliver steady free cash flow in a fairly wide range of macroeconomic environments and believe the company’s recent margin gains are more durable than perhaps initially thought. The current valuation reflects an unreasonable (in our view) disconnect versus several other travel/leisure subsector verticals, including cruise lines and select areas of gaming and lodging. SEAS maintains a strong balance sheet with limited – and predictable – capital needs, and we believe management will continue to opportunistically return capital to shareholders (historically this has been done via share repurchases).”

Woroka’s comments on SeaWorld back up his Buy rating for the stock, and his $84 price target implies a sound 53% upside in the next 12 months. (To watch Woroka’s track record, click here)

Overall, SeaWorld’s Strong Buy consensus rating rests on 6 recent analyst reviews, including a 5 to 1 split of Buys over Hold. The shares are trading for $55.10 and have an average target of $75.80, suggesting a one-year potential gain of ~37%. (See SeaWorld stock forecast)

Planet Labs (PL)

We live in the Space Age, and even though manned space flight has been confined to low Earth orbit (LEO) for the last 50 years, governmental and international space agencies – and, increasingly, private ventures – are still challenging the ‘Final Frontier.’ Taken together, they have launched constellations of satellites around our planet, sent unmanned probes out to the farthest reaches of our solar system, and even sent robotic vehicles and a robot helicopter drone to Mars, our nearest neighbor.

Planet Labs uses space tech to develop high-resolution, real-time Earth observation, bringing space travel technology to bear on our own world. The company operates a fleet of 200 Earth imaging satellites, the largest such private fleet in existence, and collects detailed images of the Earth’s entire surface every day. Planet Labs has been using this database of satellite images to change the ways that public and private actors use such data. The company’s sets of imagery and data deliver daily insights on Earth’s surface changes, giving decision makers fresh data on mapping, forestry, agriculture, and other industries.

In the first quarter of fiscal year 2024, Planet Labs achieved a top line of $52.7 million, falling just slightly below the forecast by $212,000. The firm’s EPS was a loss, of 7 cents per share by non-GAAP measures – although it did beat the estimates by 3 cents per share.

The bigger problem with Planet Labs’ financial release was less the results than the guidance. The company is predicting revenue between $53 million and $55 million for fiscal 2Q24 – but the consensus had been looking for $60 million.

Shares in PL dropped sharply after the fiscal Q1 earnings release. The stock fell by 30%, and it has still not recovered. For Deutsche Bank analyst Edison Yu, this adds up to a stock that is undervalued, representing an affordable buy for investors now.

“Planet Labs’ stock has been under pressure following macro headwinds hurting its commercial business outlook. This presents an attractive buying opportunity in our view, considering PL’s data analytics platform is unique in the space sector and we expect growth/margin to improve materially in 2H… We believe the importance of Earth Observation as a critical strategic capability is highly underappreciated. Nearly every major country is developing or expanding capabilities in this area and we expect Planet to be a big beneficiary of this trend,” Yu opined.

To this end, Yu rates PL shares a Buy, while his $5 price target indicates his belief in a 47% upside potential going into the next 12 months. (To watch Yu’s track record, click here)

Overall, tech and space travel are exciting, and Planet Labs has picked up 11 recent analyst reviews, including 10 Buys and 1 Hold – for a Strong Buy consensus rating. The $6.41 average price target and $3.40 current share price combine for ~89% one-year upside potential. (See PL stock forecast)

Warner Bros. Discovery (WBD)

Last but not least is Warner Bros. Discovery, an entertainment conglomerate and mass media company based in New York City. It stands as the modern incarnation of the renowned Warner Bros., which, during animation’s Golden Age, brought us the beloved Looney Tunes. Warner Bros. Discovery emerged as a public entity in April of last year through the merger of TimeWarner, a spin-off from AT&T, and Discovery, Inc. This newly formed entity, with a market capitalization of $32 billion, has a significant presence across a wide range of entertainment channels.

WBD’s assets are legion, and include the Warner Bros. Pictures and Television Groups; DC Studios; DC Entertainment, the publisher DC Comics; HBO and CNN; and the cable channels that were formerly under the rubric of the Discovery Channel – and that’s just a sample of the list. The combined company offers viewers everything from superhero movies to food and cooking programming to the latest sports to news and even gaming. With its diverse portfolio of both entertainment and non-fiction, the company is a leader in global media and content distribution.

The global appetite for entertainment is huge, and WBD saw revenues in its 1Q23, the last reported, of $10.7 billion. This was up 238% year-over-year (we should note that the year-ago Q1 was the company’s first report in the WBD incarnation, and was still impacted by the company launch), but came in over $65 million below the forecast. The EPS, a 44-cent loss by GAAP measures, was also worse than expected, missing the forecast by 23 cents per share.

These results were described as ‘disappointing,’ and reflected both increased competition as the internet and social media continue to expand the universe of content offerings, and the impact of secular decline trends among the legacy media generally.

Nevertheless, for analyst Bryan Kraft, who covers the stock for Deutsche Bank, WBD presents an opportunity. The share price has fallen steadily in the 15 months that it has been trading, while the company’s content portfolio remains a powerful asset – and that combination is highly attractive, in Kraft’s view.

“We believe Warner Bros. Discovery offers an attractive risk/reward given its low valuation, industry leading general entertainment content portfolio, progress toward DTC scale and improving DTC EBITDA, strong FCF growth outlook, and clear path to deleveraging the balance sheet,” Kraft opined.

Based on the above, Kraft puts a Buy rating on WBD, along with a price target of $35. Taking that target forward, the analyst sees a powerful 160% upside lying ahead for these shares. (To watch Kraft’s track record, click here)

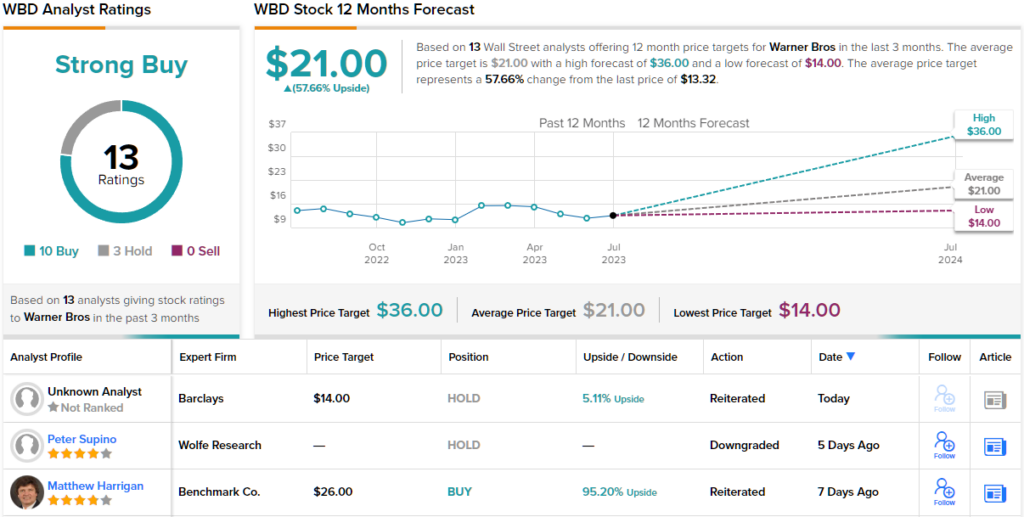

Like the other stocks on this list, Warner Bros. Discovery has a Strong Buy from the analyst consensus. The stock’s rating is based on 13 recent reviews, with a breakdown of 10 Buys and 3 Holds. The average target price here is $21, which points toward ~58% upside from the current trading price of $13.30. (See WBD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.