The semiconductor sector is home to several recent high-flyers. Continuing on the previous decade’s trend, Nvidia and AMD have both generated massive returns for investors, while tech supplier Entegris and even mobile chip giant Qualcomm are among those to have surged this year. Overall, the industry’s key index, The SOX (The PHLX Semiconductor Sector Index) has outperformed the market in 2020 by posting gains of 18%, considerably more than the S&P 500’s 4% year-to-date uptick.

Driven by COVID-19 tailwinds, 2020 has seen boosted demand for data center and cloud-based applications – all powered by chipmakers’ tech.

However, one of the sector’s less hyped stocks, Micron (MU), has been unable to ride the gravy train.

Roesnblatt Securities analyst Hans Mosesmann – a longtime Micron bull – has argued the market is underestimating this large cap’s potential. With the upcoming 5G cycle kicking into gear, Mosesmann expects Micron to start closing the gap on its outperforming brethren.

But now there’s a slight change to Mosesmann’s tune, as the full effect of COVID-19 comes into play.

Mosesmann is worried he might have been overestimating the economy’s post pandemic recovery, and the concern has now resulted in a slight change to his overall Micron estimates.

Mosesmann changed his outlook for Micron by pulling FY21 EPS estimates down from $10.20 to $10.

The 5-star analyst said, “COVID-19 clearly impacted the timing and the trajectory of the up-cycle. It did not, in our opinion, drive us into another down-cycle which would require a collapse in most, if not all, key memory end markets. Note, we are not adjusting estimates on new or sudden weaker overall bit demand and/or price dynamics. We see current market conditions to prevail through the November quarter, for example. We had simply modeled an aggressive recovery that, while possible, is too optimistic at this stage of COVID-19 uncertainty.”

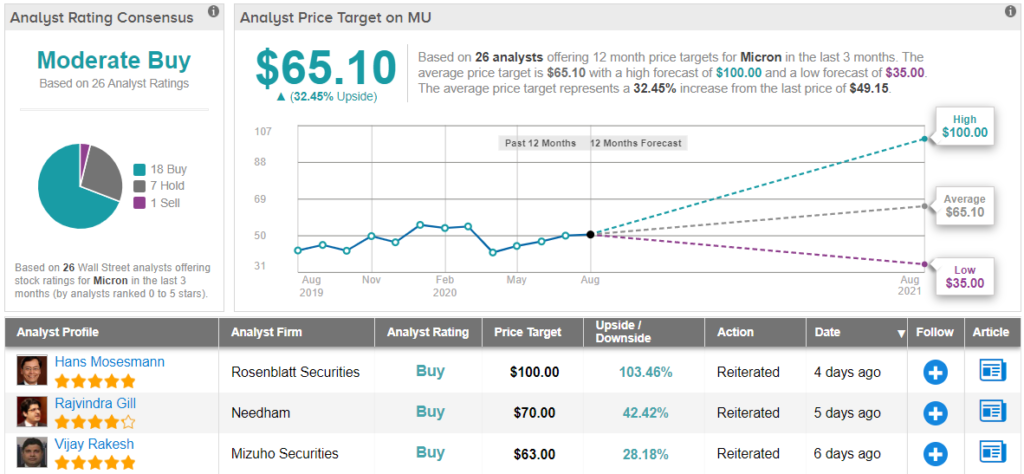

The slight reduction, however, hasn’t affected Mosesmann’s Buy rating or $100 price target. Mosesmann still believes Micron is undervalued as there’s still plenty of upside from current levels – $105%, as it happens. (To watch Mosesmann’s track record, click here)

While not anticipating such mercurial upside, the rest of the Street remains on Micron’s side. 18 Buys, 7 Holds and 1 Sell add up to a Moderate Buy consensus rating. The average price target hits $65.10 and implies possible upside of 32.5% in the year ahead. (See Micron stock-price forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.