Deere (NYSE:DE) stock was under considerable pressure last week, thanks in part to a pick-up in recession jitters. Despite the wave of negativity that sent shares down more than 10% last week, I continue to view the farming equipment maker as a deep-value play with heavily-discounted long-term growth prospects. I am bullish and may add to my position on the latest dip.

At writing, Deere stock is down around 16% from its all-time high of $448.40 hit back in December 2022. It’s been a steep slide, but let’s not forget that Deere stock has been on a hot run since bottoming last summer. Often, fast and furious gains set the stage for equally swift losses.

Regarding its long-term growth prospects, not a lot has changed between now and when the stock was flirting with new highs. Still, it’s always wise to proceed with caution when it comes to a seller of big-ticket discretionary goods, even if a low price-to-earnings (P/E) multiple beckons you in with promises of deep value.

Deere Stock: The Fine Line Between Deep Value and a Trap

After last week’s beat-down, Deere stock has a 13.7 times trailing P/E ratio. Undoubtedly, investors should be skeptical of companies that boast P/E multiples well below the market average. Typically, low P/Es accompany serious issues and may indicate a value trap. Still, when it comes to Deere, I do think the value to be had in the name is real. However, the company faces prominent headwinds over the year ahead.

The road behind Deere looks far smoother than the one that looks to be ahead. And while recession headwinds could prove more severe, I’m not yet ready to throw in the towel on a well-run company in an industry with legs strong enough not to be broken by the coming recession.

Still, you have to give the shorts credit for their timing. Specifically, research firm Hedgeye made a well-timed call when it rang the alarm bell on the industrial more than two weeks ago when shares were well above the $400 mark.

Deere, which was touted by Hedgeye as one of its top short ideas in the industrial space, has delivered for the bears in record time, at least so far. Hedgeye’s short case was pretty sound: too much optimism in a “deep cyclical” in the face of numerous headwinds and a stage set for the “end of the pandemic-era order boom.”

Undoubtedly, high-interest rates and the pandemic-driven boom are coming to a conclusion, and a lot of demand has been pulled forward in the last few years. Nevertheless, whether or not this year’s slate of headwinds means the beginning of the end for Deere’s run, though, remains to be seen.

Deere Stock May Still Have Legs

As well-timed as Hedgeye’s call was (it deserves a round of applause), I think the shorts would be wise to book their profits as the path of least resistance could remain up. Despite the recession-fear-induced dip, Deere stock may still have legs over the long run.

The company’s long-term growth profile is still sound. Most notably, Deere stands to benefit from secular tailwinds, including the automation of farming. Such tailwinds tend to work their magic over many years, though, and macro headwinds could easily cause investors to lose sight of the longer-term opportunities at hand.

Fortunately, Deere has done a fine job of controlling what it can. The company has also cut costs without taking away from its innovative pace. It’s this innovative pace that should keep demand robust in the market’s next upcycle. In addition, a recession doesn’t necessarily mean “game over” for the farming industry.

Remarkably, crop prices are holding their own. Just have a look at the Invesco DB Agriculture Fund ETF (NYSEARCA:DBA) — my preferred gauge of crop prices — which is up more than 50% over the past three years. While many farmers have made the most of high crop prices to update their fleets in recent years, I still think many have yet to reinvest their windfalls in new gear. With productivity-enhancing tech on the latest models of Deere equipment, I do think demand could be more resilient in the face of the next downturn.

Is Deere Stock a Buy, According to Analysts?

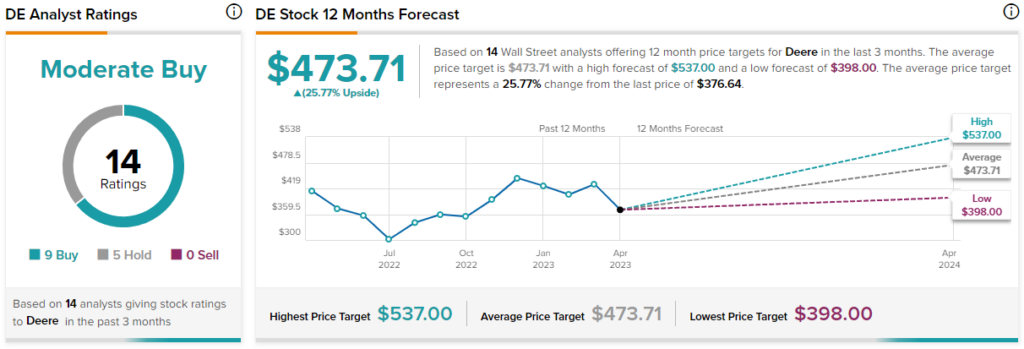

Turning to Wall Street, DE stock comes in as a Moderate Buy. Out of 15 analyst ratings, there are nine Buys and six Holds. The average Deere stock price target is $471.67, implying an upside of 25.8%. Analyst price targets range from a low of $398.00 per share to a high of $537.00 per share.

The Bottom Line on Deere Stock

Deere stock hasn’t been performing well recently. At this juncture, we’re likely a few months away from encountering a recession, and it’s the industrials that tend to have dreadful track records when the economy gradually begins to fold.

That said, a recession has been on the market’s radar for many months (even a full year) now. I think Deere stock’s current valuation already reflects the macro pain to come.

The farming-equipment kingpin already trades at a discount to its machinery peer group on a trailing P/E and price-to-sales (P/S) standpoint (13.7x P/E and 2.0x P/S versus the 16.1x and 3.9x industry averages) and compared to its own five-year historical average (20.8x P/E and 2.3x P/S).

As Deere rolls into harder times, with relatively low expectations in place, I think the stage could be set for outperformance, not underperformance. In such a scenario, I believe the shorts would be wise to run for cover.