Deere (NYSE:DE) stock took a nasty fall yesterday, but was the sell-off warranted? I suggest it was senseless, and Deere stock looks ripe and ready for value hunters everywhere. All in all, I am bullish on DE stock and expect it to stage a fabulous comeback before the current quarter is over.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

While Deere sells a variety of equipment types, you probably recognize the company as a manufacturer of riding lawnmowers. Indeed, I’d say the Deere brand is practically synonymous with lawn care in the U.S.

Yet, somehow Deere stock ran out of gas on August 18. I strongly suspect that the market will crank it back up soon, as when we take a closer look at Deere, we’ll see that there’s nothing malfunctioning with this old American standby.

A Rough Day for Deere Stock

Losing over 5% in a single day might not be a big deal for some stocks, but it’s unusual for Deere stock to fall that far. The market was flat overall today, so clearly, there must have been a company-specific catalyst for the sell-off.

The culprit was Deere’s earnings report for the fiscal third quarter ending on July 30, 2023. Interestingly enough, though, Deere’s actual results were quite good. Moreover, the company’s forward guidance was fairly optimistic.

Here’s the rundown. Deere’s quarterly revenue increased 12.1% year-over-year to $15.8 billion, and the company’s equipment sales of $14.3 billion exceeded Wall Street’s call for $14.1 billion. Turning to the bottom-line results, Deere reported quarterly EPS of $10.20, easily beating the consensus estimate of $8.22.

Just to provide a basis of comparison, Deere only reported equipment sales of $13 billion and EPS of $6.16 in the year-earlier quarter. Hence, it’s difficult to find anything objectionable about Deere’s results.

Looking ahead to all of Fiscal Year 2023, Deere expects to earn net income in the range of $9.75 billion to $10 billion. The company’s previous guidance was for full-year net income of $9.25 billion to $9.5 billion. In other words, Deere is reasonably optimistic, so the company’s earnings guidance shouldn’t have prompted a sell-off in DE stock.

Making Sense of the Fear

This is starting to look like a terrific buying opportunity, wouldn’t you agree? However, it’s still important to figure out what caused Deere stock to drop today.

I had to do some digging to get a sense of what happened. After all, there was nothing in Deere’s beat-and-raise that should have caused stock traders to be fearful. What I found out is that investors are worried about agricultural original equipment manufacturers (OEMs) like Deere having too much inventory.

In other words, companies like Deere stocked up their inventory recently, and this could unfavorably tip the supply-demand balance later on. Thus, Baird analyst Mig Dobre is “moving to a more cautious stance on Ag OEMs.”

As I see it, this is a strange and ill-conceived reason for the sell-off in Deere stock. If investors see a problem with agricultural OEMs generally, shouldn’t this have been priced into the shares already? Why would they suddenly decide to punish Deere today? It’s bizarre, and stock traders should look into this situation, as there could be a prime buying opportunity here.

Is Deere Stock a Buy, According to Analysts?

On TipRanks, DE comes in as a Moderate Buy based on nine Buys and five Hold ratings assigned by analysts in the past three months. The average Deere stock price target is $450.77, implying 13.54% upside potential.

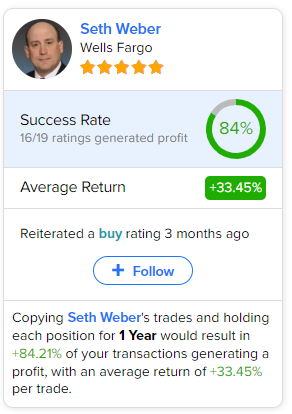

If you’re wondering which analyst you should follow if you want to buy and sell DE stock, the most profitable analyst covering the stock (on a one-year timeframe) is Seth Weber of Wells Fargo (NYSE:WFC), with an average return of 33.45% per rating and an 84% success rate. Click on the image below to learn more.

Conclusion: Should You Consider Deere Stock?

Yesterday was one of those “What the heck just happened?” moments. The stock market was basically flat, and Deere’s quarterly results and full-year outlook were perfectly acceptable, yet investors used an odd excuse to dump their Deere shares.

However, when the market is senseless, you can be sensible. Deere is an iconic American brand with staying power, and this won’t change anytime soon. Plus, it’s evident that Deere is able to sell equipment and turn a nice profit. Therefore, I’d say that anyone looking for good value should consider DE stock before the market potentially pulls it back above $400, which is where the stock really belongs, in my opinion.