Restaurant chain Darden Restaurants (NYSE:DRI) is on deck to release its first quarter of fiscal 2023 before the market opens on Thursday, September 22. Numerous upsides, like a focus on customer experience combined with a strong labor market, are likely to have aided the company’s quarterly performance, despite higher cost pressures.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Ahead of the print, the Street has pegged its estimates for earnings per share at $1.56, which is about 11% lower than the prior-year fiscal Q1 figure. Revenue expectations stand at $2.47 billion, a 7% year-over-year increase.

Factors That Are Likely to Have Influenced Q1 Results

At a time when consumers dig for flexible digital communication in almost everything, Darden’s focus on enhancing its digital platform is paying off. The platform offers online ordering, mobile monitoring, and payment systems. The company is also working on building an elaborate customer relationship management program. These customer-facing efforts are likely to have pulled in more customers in the first quarter, and hence, more revenues.

Moreover, operations streamlining, optimal staffing, and quality-enhancing efforts are also likely to have aided business efficiency in the quarter.

Also, consumers became more at ease with the pandemic situation during the first quarter, which is likely to have garnered more footfall to Darden’s restaurants, namely, Olive Garden, Fine Dining, and LongHorn Steakhouse.

Elevated labor costs and high commodity prices are likely to have weighed on Q1 margins. Moreover, supply-chain constraints are also expected to have limited the company’s ability to procure certain raw materials.

Raymond James analyst Brian Vaccaro is optimistic about DRI ahead of its Q1 results. He believes that, in the face of recessionary concerns and high-interest rates, demand for U.S. restaurants continues to be resilient.

Website Traffic Looks Positive

With so much emphasis on enhancing its digital platform and improving its content, it makes sense to have a look at what the trends of Darden’s website traffic are.

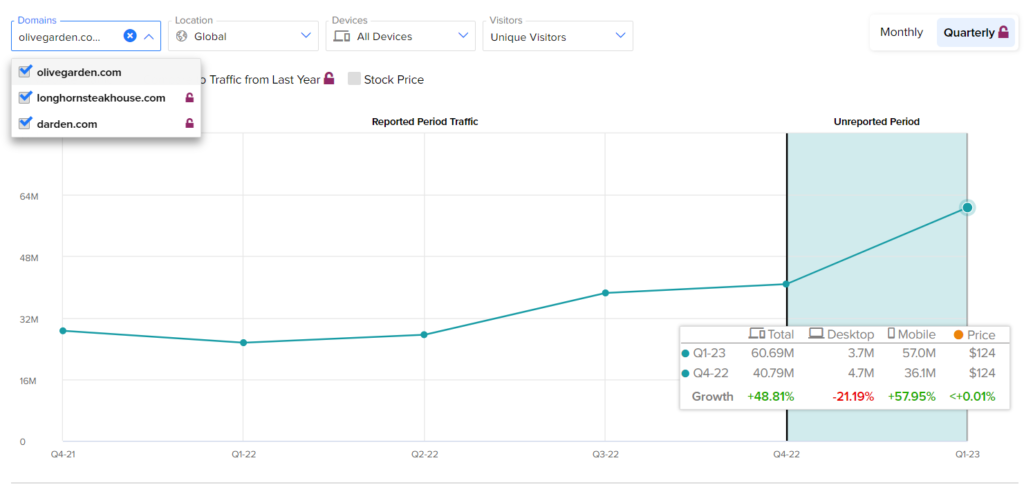

TipRanks’ website traffic tool shows that in Q1, cumulative unique visitors to Darden’s websites, namely darden.com, longhornsteakhouse.com, and olivegarden.com, increased 48.81% sequentially.

Compared to the prior-year quarter, website visits were up almost 138%, which is impressive.

Going by the trends, it appears that Darden’s efforts to enhance the digital experience of existing and potential customers have paid off in Q1. This may also have driven more online sales.

Is DRI a Good Stock to Buy?

Wall Street is cautiously optimistic about Darden, with a Moderate Buy rating based on 13 Buys and six Holds. DRI’s stock price prediction shows a 7% upside potential, with the average price target standing at $141.61.

Bottom Line: This May Be a Good Time to Scoop Up DRI Shares

Founded in 1968, Darden has seen many ups and downs and survived several market cycles. Moreover, the efforts to retain existing customers and pull in new customers are expected to have helped the company drive sales in Q1. These trends are also expected to help the company hold its ground if the economy slips into a recession. Streamlined operations, optimal labor, improved digital communication platforms, and strong demand from the upper middle class segments of society are expected to drive the business forward.

At the time of writing, DRI stock trades at 17.9x trailing earnings, which is lower than the average price-to-earnings ratio of the broader U.S. restaurant industry, which is more than 20x. This might also be a sign to consider DRI for your portfolio.