Airline companies such as Delta Air Lines (NYSE:DAL), American Airlines (NASDAQ:AAL), and United Airlines (NASDAQ:UAL) benefitted from a strong recovery in air travel demand in 2022 and 2023. Moreover, the trend will likely sustain itself in 2024 as IATA (International Air Transport Association) sees improved revenue and profitability for airline companies. As these companies will benefit from an improved operating environment, TipRanks’ Stock Comparison tool shows that analysts favor DAL stock.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

But before we discuss analysts’ views on DAL stock, let’s look at IATA’s outlook for 2024.

IATA’s Outlook

IATA expects airline industry revenues to reach a historic high of $964 billion in 2024, reflecting a year-over-year increase of 7.6%. Further, the IATA expects revenues in 2024 to rise faster than expenses, thus boosting profitability.

The trade association projects the airline industry’s net profit to reach $25.7 billion in 2024, reflecting an improvement from $23.3 billion in 2023.

As the sector is expected to see improved revenue and profitability, let’s zoom in on analysts’ favorite airline stock.

What is the Prediction for Delta Stock?

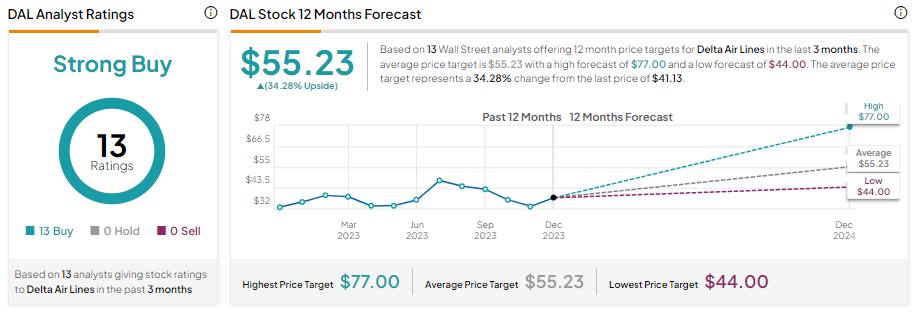

TipRanks’ Stock Comparison tool shows that Delta Air Lines is the only stock with a Strong Buy consensus rating and a perfect Smart Score of 10.

Analysts Favor DAL Stock

TD Cowen analyst Helane Becker expects revenue for airline companies to grow in 2024 but at a slower rate than the past two years. Moreover, Delta is Becker’s 2024 Best Idea. The analyst reiterated a Buy on DAL stock on December 21 with a price target of $49.

Moreover, Goldman Sachs analyst Catherine O’Brien maintained a Buy on DAL stock with a price target of $47 on December 13. The analyst expects Delta to benefit from accelerating growth in high-margin and less cyclical businesses, exposure to markets that are recovering, and a strong balance sheet.

Overall, 13 analysts cover Delta stock, and all recommend a Buy. While Delta stock has gained about 26% year-to-date, analysts’ average price target of $55.23 implies an upside potential of 34.28% over the next 12 months.

Bottom Line

Delta Airlines is expected to benefit from the continued strength in bookings across its global network. Further, its efforts to reduce debt and improve the balance sheet are positives. Thus, analysts maintain a Strong Buy consensus rating on DAL stock and see significant upside potential from current levels.