Berkshire Hathaway’s (NYSE:BRK.B) most recent 13F filing for Q2 2023 revealed three new purchases of homebuilder stocks. Warren Buffett bought D.R. Horton (NYSE:DHI), NVR (NYSE:NVR), and Lennar (NYSE:LEN), with D.R. Horton being the most significant new position at 0.21% of Berkshire’s assets. In this article, I’ll review D.R. Horton’s Fiscal Q3-2023 results and discuss why I believe it makes sense to follow in Buffett’s footsteps. I am bullish on DHI stock.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

D.R. Horton Q3-2023 Results

D.R. Horton reported 10.7% year-over-year revenue growth in Q3 of Fiscal 2023, an acceleration compared to the 4.7% year-to-date growth rate. However, despite a smaller share count (down 3.1% from the prior-year period), earnings per share were weaker, 16.5% lower from Q3 2022 to $3.90/share. The silver lining is that the decrease was smaller than the 20.8% drop to $9.39/share in the first nine months of the year.

The lower profits in Q3 were entirely the result of a slump in homebuilding pre-tax income, down 25.1% year-over-year, which was only partially compensated by 39.8% growth in the company’s smaller business divisions (Financial Services, Forestar (residential lot development) and Rental).

Balance Sheet Strength, Dividends, and Buybacks

D.R. Horton runs a very conservative balance sheet, which was further strengthened over the past year. Its net-debt-to-total-capital ratio (which shows what percentage of the capital employed in the business is funded by debt as opposed to equity) improved to 11.2% in Q3 2023 from 19.3% in the prior-year period.

As a result, on top of strengthening its balance sheet, the company says that it’s on track to allocate $340 million this year in dividends at its current rate, with the main avenue for shareholder remuneration being share buybacks, anticipated at $1.1 billion in 2023.

Q4 2023 and Full-Year Outlook

For the last quarter of the year, D.R. Horton expects the following:

- Revenue of about $9.9 billion, up 3.1% year-over-year.

- Home sales gross margin of about 23.75% (down versus the prior year but in line with the 21.6% to 23.9% range observed so far in 2023).

Essentially, compared to the Q3-2023 results outlined above, the company expects a material slowdown in revenue growth but stable margins.

For the full year 2023, D.R. Horton expects:

- Revenue of about $34.9 billion, up 4.2% year-over-year.

- Cash provided by operations to be greater than $3 billion (2022: $1.9 billion).

Relative to the outlook communicated in Q2 2023, the company boosted its revenue outlook on the back of stronger results in both homebuilding and rental divisions.

Mortgage Market Outlook

30-year fixed mortgage rates in the U.S. currently stand at the highest levels observed this century, at about 7% to 7.5%. This is due to the rapid rise in interest rates from the Federal Reserve. Despite high rates, house prices in the U.S., tracked by the Case-Shiller index, recovered from the downturn observed in the latter part of 2022 and are now flat from the prior-year period.

Furthermore, relief for the housing market is widely expected to come in 2024 and 2025. The Federal Reserve projects the Federal Funds Rate to be 5.6% at the end of 2023, 4.6% in 2024, and 3.4% in 2025. The futures market is currently pricing in a ~40% probability that the Federal Reserve will raise rates to 5.50%-5.75% in its three remaining meetings of 2023, with the first rate cut most likely in May 2024.

As a result, the current strain on margins experienced by D.R. Horton is likely to gradually diminish in the next two years, although a return to the stellar results of 2022 is unlikely.

Is DHI Stock a Buy, According to Analysts?

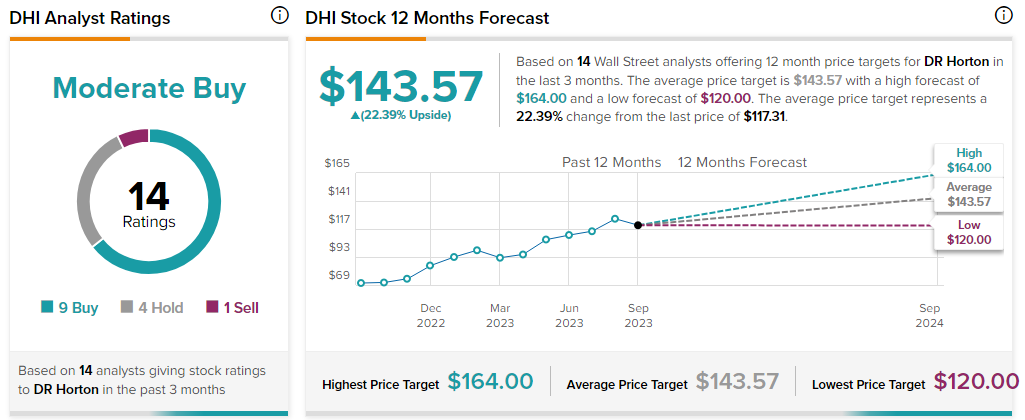

Turning to Wall Street, D.R. Horton earns a Moderate Buy consensus rating based on nine Buys, four Holds, and one Sell rating. Additionally, D.R. Horton stock’s average price target is $143.57, implying 22.39% upside potential.

The Takeaway

Warren Buffett is clearly betting on a turnaround in D.R. Horton’s fortunes. After a stellar 2022, the company is experiencing margin weakness and falling profits in 2023. With lower interest rates widely expected in 2024 and 2025, D.R. Horton is likely to benefit from increased activity in the housing market. Should the downturn prove more persistent, the company’s fortress balance sheet and conservative payout policy should help it weather the storm.

As a result, I agree with Berkshire’s assessment that the stock is a Buy, given the risk-reward profile of the company.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue