D-BOX Technologies Inc. (TSE: DBO), the small cap Canadian designer and manufacturer of entertainment haptic (motion) technology, greatly enhances the music and movie experience for millions each year. For close to 20 years, D-BOX has been giving audiences realistic experiences.

The company sparked investor interest in a major way with the debut of encoded D-BOX seats at the release of the Fast & Furious movie in 2009. Enhancing the total user experience for action packed adventure movies has maintained D-Box’s value for investors. Since then, D-Box has increased its music and cinema footprint, bringing its motion systems to over 700 screens throughout 40 countries.

The downside, although not necessarily related to D-Box’s financials, is the recent hacking ransomware attack suffered by the company at the close of business on July 12, 2021. Despite this, trading volume revolved around 299.96 over the past 30 days and investors earned 9.09% year to date on the stock. (See D-BOX stock chart on TipRanks)

Investors Increase Expectations

Investors have grown used to collaborations and other initiatives led by D-BOX. This was seen most explicitly in the recent agreement with SIMTAG BV, an innovator in developing and building simulators and accessories for Sim Racing, according to a company press release.

“During the fourth quarter, we are pleased to get the support from the investment community with the completion of $5.75M equity financing. D-BOX can accelerate its investments to maintain our technology and market leadership, support the recovery of commercial entertainment market and to execute our gaming, sim racing and home entertainment strategy,” stated David Montpetit, CFO of D-BOX Technologies.

It is important to note that the business model relies on cities and venues not being locked down, and not having a threat of impending restrictions due to COVID-19. That’s because currently, the company does not have significant product visibility in home theater systems and relies heavily on people enjoying themselves leisurely in public.

Meanwhile, the company is quietly becoming a leader in haptic technology, bringing technological breakthroughs and innovative solutions to the gaming industry, commercial training and simulation and home entertainment.

Investor View on D-Box

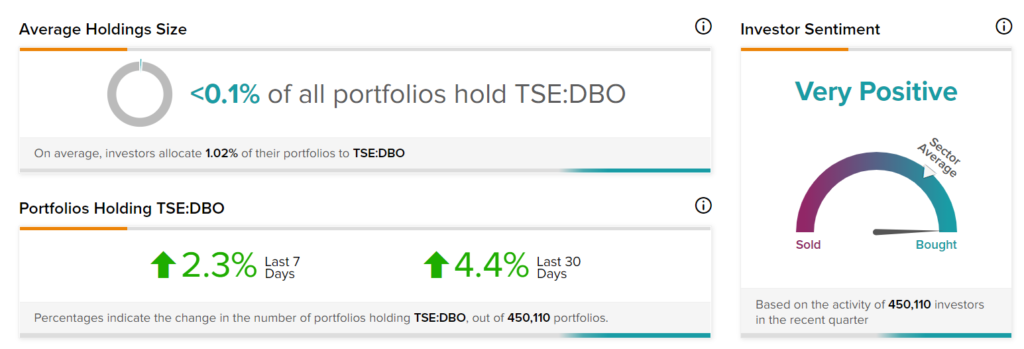

According to TipRanks’ Investor Sentiment Signal, D-Box has Very Positive Sentiment.

With a 52-week range peaking at C$0.27 and bottoming out at C$0.03, the stock last closed at C$0.11.

As of March 31, 2021 total revenues decreased to C$2.9 million, from C$6.6 million for the same period last year, as a result of the adverse impact of the COVID-19 pandemic.

Net loss was C$2.5 million compared to a net loss of C$3.1 million during the same period last year. Adjusted EBITDA* decreased to C$(1.6) million from C$7 thousand for the same period last year.

Bottom Line on D-Box

D-BOX Technologies first introduced its motion generating systems in 2001, and has carved out a secure investment path for thousands of investors since first going public. Furthermore, analysts have also been motivated by the enthusiasm of executive leadership.

D-BOX’s most recent marketed public offering issued 44,275,000 units at a price of $0.13 per unit. Shareholders were offered a common share purchase warrant allowing shareholders one share of D-BOX at an exercise price of $0.16 at any time until March 4, 2023. As investors continue to be rewarded by the small cap company, more will likely find new reasons to invest.

Disclosure: Lukas Brenowitz held no position in any of the stocks mentioned in this article at the time of publication.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.