What could be better than a company with improving quarterly results and consistent dividend payments? CVS Health (NYSE:CVS) stock could provide healthy returns to its loyal shareholders over the coming quarters. Moreover, I am bullish on the stock because the company’s cost-cutting efforts should boost CVS’s bottom line.

CVS Health operates a chain of retail pharmacies and is also a one-stop shop for cosmetics and other various products for the home. The company pays a juicy 3.3% annual dividend yield, which is double the sector average dividend yield of around 1.5%.

Of course, you shouldn’t buy a stock just because the company pays a nice dividend — though that’s certainly a nice bonus. It’s also important to learn as much as you can about the company. In the case of CVS, I’m sure you’ll find that the company’s recently reported sales growth is just what the doctor ordered.

CVS Cuts Jobs, but That’s Not Necessarily a Bad Thing

During these challenging economic times, CVS’s management undoubtedly had to make some tough choices. Cutting the dividend was one possible way to save money for the company, but CVS chose not to do that.

Instead, CVS is reducing its expenses by cutting around 5,000 jobs, according to The Wall Street Journal. This, CEO Karen Lynch stated in a staff memo, will help CVS to “be at the forefront of a once-in-a-generation transformation in health care.”

Plus, the majority of jobs affected are corporate positions at CVS; the company doesn’t expect customer-oriented roles to be affected during this round of layoffs. So, this should make CVS’s workforce reduction seem less unpleasant.

Along with the layoffs, CVS is reportedly trimming its travel expenses and focusing on productivity measures in order to cushion the company’s margins. All in all, I’d say it’s a smart move for CVS to execute this plan to reduce its expenditures.

Revenue Growth is CVS’s Prescription for Success

What’s the remedy for a tough economy? Cutting costs is part of the formula, but CVS can’t succeed in the long run without sales growth. So, did the company deliver in Q2?

Indeed, CVS delivered $88.9 billion in second-quarter revenue, up 10.3% year-over-year. Thus, there’s no need to worry anymore that CVS can’t grow its sales in a post-COVID-19 world (i.e., without having COVID-19 vaccines as a major part of the company’s business model).

By the way, the consensus estimate for revenue was $86.41 billion, so CVS posted a top-line beat. Turning to the bottom line, CVS delivered another beat, with adjusted earnings of $2.21 per share versus Wall Street’s call for $2.12 per share. Therefore, we can forgive CVS if the company’s earnings declined by 12.6% year-over-year.

Additionally, CVS confirmed its full-year 2023 adjusted EPS guidance range of $8.50 to $8.70. If the company earned $2.21 per share in Q2, then there’s no reason (unless there’s an economic recession) why CVS couldn’t achieve EPS of $8.50 to $8.70 for the full year.

Finally, I should point out that CVS stock is still down year-to-date. This looks like a buy-the-dip opportunity, as investors should sooner or later come to appreciate CVS’s improving results and delicious dividend yield.

Is CVS Stock a Buy, According to Analysts?

Turning to Wall Street, CVS Health stock comes in as a Strong Buy based on 13 Buys and four Hold ratings. Further, the average CVS Health stock price target is $93.24, implying 22% upside potential.

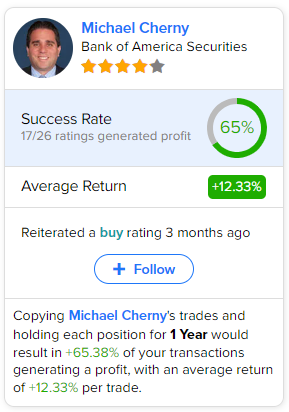

If you’re wondering which analyst you should follow if you want to buy and sell CVS stock, the most profitable analyst covering the stock (on a one-year timeframe) is Michael Cherny of Bank of America (NYSE:BAC) Securities, with an average return of 12.33% per rating. Click on the image below to learn more.

Conclusion: Should You Consider CVS Stock?

Analysts are generally optimistic about CVS stock, and it’s evident that CVS Health has a sensible cost-cutting plan in place. It’s baffling, I’d say, that the stock isn’t higher than it currently is.

Hence, investors can definitely consider CVS stock for a buy-and-hold position right now. While they’re waiting for the share price to return to its peak (which I wholeheartedly believe will happen sooner or later), investors can collect dividend distributions from CVS every three months — not a bad strategy, you must admit.