Love them or hate them, by now, you’re almost certainly aware of Crocs (NASDAQ:CROX). The company’s namesake colorful plastic clogs have become ubiquitous over the past few years. Shares of Crocs are down nearly 40% from their 52-week high, but there is a lot to like about the company, and this short-term weakness could end up being a buying opportunity for long-term investors. Shares of Crocs look cheap, and Wall Street analysts forecast ~60% upside ahead. Therefore, I’m bullish on CROX stock.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Why the Sell-Off?

The primary culprit for the decline in CROX’s share price is the slowing revenue growth that the company reported for the second quarter. However, it’s not as if this is a company in decline. Revenue grew by 11.2% year-over-year and surpassed the $1 billion dollar mark, setting a company-record $1.07 billion for the quarter.

This would usually be cause for celebration, but investors didn’t like the fact that this revenue growth represented a slowdown from the scorching 34% year-over-year revenue growth that Crocs posted during the previous quarter.

While growth has slowed year-over-year, CROX still reported record revenue, and the company’s long-term revenue growth trajectory has been up and to the right for a long time, so this seems more like a blip on the radar than a cause for long-term concern.

The market also didn’t like the fact that the midpoint of management’s revenue guidance for the third quarter came in at $3.11, which was one cent below Wall Street’s consensus EPS estimate of $3.12. Similarly, the midpoint for its quarterly revenue guidance of $1.02 billion was a hair below Wall Street’s consensus revenue projection of $1.06 billion.

These seem like pretty minor differences in what was a strong quarter overall, and it’s important to note that management actually raised its full-year guidance for revenue and earnings per share.

The market isn’t always rational, and investors can overreact to results that are slightly below their expectations, but this can create buying opportunities that allow patient long-term investors to accumulate shares of quality companies at a discount.

A Success Story

It’s important to take a step back from the most recent quarter and look at the big picture. The Colorado-based company’s ascent has been somewhat under the radar, but Crocs has quietly done a remarkable job of establishing itself as a strong consumer brand and a true American success story.

How popular have Crocs become? The company’s Adult Classic Clog is the number one selling men’s shoe on Amazon (NASDAQ:AMZN). Note that this isn’t just for sandals or clogs — it is the best-selling shoe across all men’s footwear on the site, beating plenty of more heralded brands for this accolade.

Want to know the second-best-selling shoe on the list? It’s the Wally Sox loafer from HEYDUDE — a footwear company that Crocs acquired in 2022. Also, HEYDUDE has three additional sneakers in Amazon’s top 10, while Crocs’ Adult Bistro clog, which is geared towards restaurant and hospitality workers, clocks in at number 10 on the list.

And it’s not just Amazon where Crocs is dominating. In China, which is a high priority for the company, Crocs was number one in sales on Douyin and number two in casual footwear sales on Tmall during the Mid-Season festival.

Furthermore, not only is Crocs profitable, but it also sports one of the highest gross margins among footwear companies. Believe it or not, its gross margin of 54.9% trumps that of Nike (NYSE:NKE), which stands at 43.5%. Its strong gross margin indicates that Crocs enjoys strong demand and that customers are happy to pay a premium for its product.

Also, Crocs has plenty of potential for more growth ahead. HEYDUDE should continue to grow as it taps into Crocs’ distribution channel and gains visibility with new consumers. During the quarter, HEYDUDE’s direct-to-consumer (DTC) revenue grew by 30% on a constant-currency basis, while its digital revenue grew by 37%.

Crocs is even successfully expanding into adjacent markets like sandals, a sensible market for the company to target given the similarities between sandals and clogs. Sandals were a $310 million business for the company in 2022, and management projects this to grow into a $400 million business this year.

International markets like Asia also represent a major opportunity for the company, and Crocs is making good progress on this front. Revenue in Asia has grown at a 30% compound annual growth rate (CAGR) in recent years, and the company said that its revenue from China grew by triple digits year-over-year during the second quarter.

Compelling Valuation

Despite its success in growing a ubiquitous consumer brand and the long growth runway ahead, shares of Crocs are surprisingly cheap. Shares of the company trade at under 9x earnings and just over 7x forward earnings when looking out to Fiscal 2024. This is a steep discount to the broader market, as the S&P 500 (SPX) trades for just under 20x earnings.

Crocs stock is also cheap based on its PEG ratio of just under 0.9. Popularized by legendary investor Peter Lynch, the PEG ratio, or price/earnings to growth ratio, seeks to account for a stock’s earnings growth when valuing it by dividing its price-to-earnings multiple by its annual earnings growth rate. Investors generally view a stock with a PEG ratio of under 1.0 as undervalued, so Crocs looks attractive using this metric.

Crocs management also seems to know that the stock is cheap, as the company bought back 1.24 million worth of shares during the quarter and continued buybacks into July.

Is CROX Stock a Buy, According to Analysts?

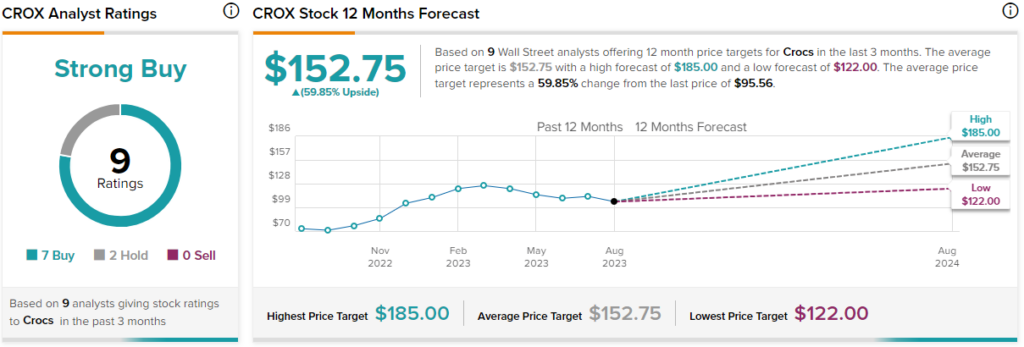

Turning to Wall Street, CROX earns a Strong Buy consensus rating based on seven Buys, two Holds, and no Sell ratings assigned in the past three months. The average CROX stock price target of $152.75 implies 59.85% upside potential for the next 12 months.

Investor Takeaway

The recent sell-off seems like an overreaction, and Crocs looks attractive, trading at under 9x earnings. Crocs has established itself as a strong brand that resonates with consumers, and its dominant position on Amazon, where Crocs and HEYDUDE occupy plenty of prime real estate on the list of best-selling men’s footwear, are testament to this. The company also has plenty of avenues for further growth ahead.

It’s hard to find stocks where analysts see 60% upside potential nowadays, but Crocs is one of them.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue