Shares of electric vehicle maker Rivian Automotive (NASDAQ:RIVN) have been under pressure this year due to macro challenges and supply chain bottlenecks. Furthermore, RIVN stock was trending lower in Monday’s pre-market trading following the news that the company is voluntarily recalling almost all the vehicles (13,000 as per Reuters) it has delivered to customers due to a loose fastener. Rivian stated that the fastener connecting the steering knuckle and front upper control arm might not have been “sufficiently torqued.”

Amid a tough business environment, the news of the recall is definitely a setback for the company. For now, Wall Street analysts are cautiously optimistic about the stock due to near-term headwinds, even as the company’s long-term growth prospects look bright.

Rivian stock was down 8% in Monday’s pre-market trading and has plunged 67.3% so far this year.

On Track to Meet Full-Year Production Guidance

Prior to the news of the recall, Rivian announced its Q3 delivery and production update last week. The company produced 7,363 vehicles, up 67% from the second quarter. It delivered 6,584 vehicles in Q3, reflecting over a 47% increase compared to the preceding quarter. Rivian mainly pleased investors by reaffirming its full-year production guidance of 25,000 vehicles despite component shortages and supply-chain issues.

The U.S.-based EV maker currently manufactures the R1T pickup trucks, R1S SUVs, and electric delivery vans for Amazon (NASDAQ:AMZN) at its Normal, Illinois factory. Note that Amazon, which is also a major shareholder, placed an initial order of 100,000 electric delivery vans to be delivered by 2030. Rivian is ramping up the Normal Facility to its full installed capacity of 150,000 units to meet the robust demand for its vehicles. Rivian is also building its second factory in Georgia and is optimistic about launching its R2 vehicles at this facility in 2025.

However, higher input costs amid an inflationary environment and growth investments are weighing on the company’s bottom line.

Is Rivian Stock a Buy?

Following the Q3 update, Truist analyst Jordan Levy noted that while the Q3 production figure lagged estimates, the fact that the company reaffirmed its full-year target is the more vital news to focus on. Levy opines that Rivian’s production outlook reaffirmation provides “incremental comfort” in the company’s ability to sail through persistent supply-chain woes. In line with his optimism, Levy reiterated a Buy rating for Rivian stock with a price target of $65 (91.5% upside potential).

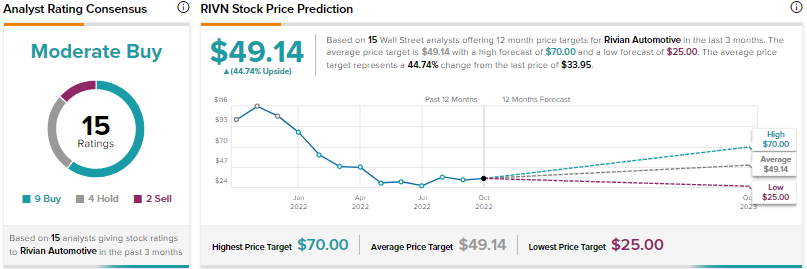

On TipRanks, Rivian scores a Moderate Buy consensus rating based on nine Buys, four Holds, and two Sells. The average Rivian stock price prediction of $49.14 implies 44.7% upside potential from current levels.

Conclusion: Near-Term Headwinds Could Continue to Weigh on Rivian

A tough macro backdrop, high costs, and an impending recession could continue to drag down Rivian stock. However, the company’s long-term prospects look strong given the robust demand for EVs and favorable policies in many countries to boost EV adoption.

On TipRanks Smart Score System, Rivian scores a 2 out of 10, which indicates the stock could likely underperform market averages.