Crypto miner CleanSpark (NASDAQ:CLSK) has seen its shares skyrocket nearly 142% over the past six months with its toline surging from $39.3 million in 2021 to $131.5 million in 2022.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Notably, the price gains come in sync with a nearly 82.4% rise in Bitcoin (BTC-USD) over the past six months. Furthermore, CLSK mined 1,624 BTC during the quarter ended June 2023 marking a 170% jump in its BTC holdings QoQ. The company currently has a fleet of 68,678 BTC miners with a hash rate of 6.7 EH/S.

Recently, CLSK also acquired two turnkey BTC mining facilities in Georgia. The facilities are anticipated to host more than 6,000 Antminers (S19 XPs and S19J Pro+s) and add nearly 1 EH/s to the company’s hash rate.

The strategic move means CLSK remains on track to reach its goal of achieving 16 EH/s by the end of 2023. Moreover, CLSK continues to expand its fleet with total machine purchases of ~77,500 since February this year. Impressively, the company nearly tripled its hash rate last year and is executing a balanced capital approach, selling some of the Bitcoins it mines to reinvest for growth.

Clearly, the strategy is paying off and recently, CleanSpark’s CFO, Gary A. Vecchiarelli commented, “We continue to make use of opportunities created by current market conditions to prepare for next year’s Bitcoin halving.”

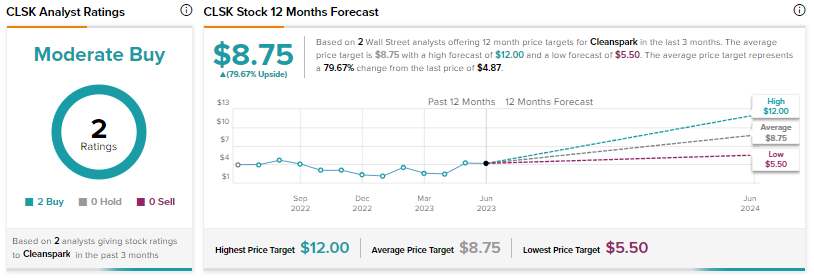

The Street is already eyeing further gains in the stock with the consensus price target of $8.75 pointing to a hefty 79.67% potential upside. Overall, the consensus rating on CLSA remains a Moderate Buy.

Read full Disclosure