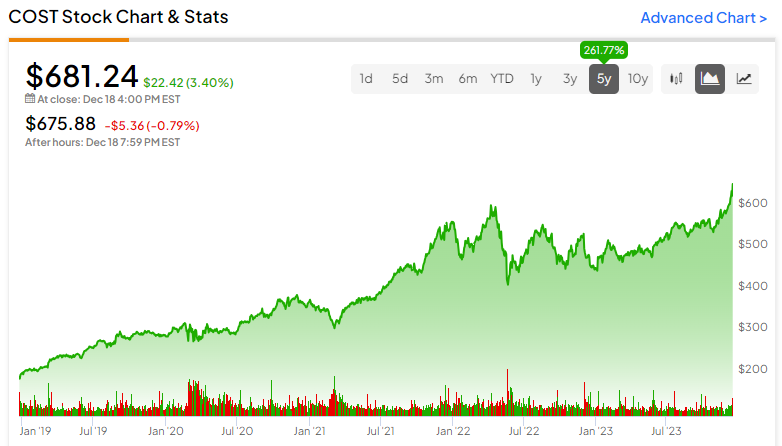

Costco (NASDAQ:COST) stock has been on a tear in late 2023, but don’t get too greedy now. I am neutral on COST stock and feel that it should cool down before the next leg up. Sure, Costco is a rock-solid business, and the consumer is resilient, but the market already knows this and has priced its optimism into the shares.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Costco is known as big-box retail store chain where people buy a wide variety of products in bulk for a good price. Shoppers may have bought groceries, home goods, or even gold bars (I’m actually not kidding about that) at Costco.

While Costco’s growth prospects for 2024 look good, COST stock just went vertical recently. It would take a lot of positive data points to convince contrarian investors to buy Costco shares now. So, let’s see if there’s a convincing bullish argument to be made here.

Costco’s Earnings Beat and Special Dividend

Just in time for the holiday shopping season, Costco gave its loyal investors some extra special gifts. When I say “special,” I mean it literally, as Costco announced a special dividend of $15 per common share.

This type of dividend doesn’t occur every quarter. In fact, Costco’s previous special dividend was for $10 per share, and it was announced in late 2020. Bear in mind that Costco’s new $15-per-share dividend is in addition to the company’s regular dividend; regarding that, Costco’s forward annual dividend yield is 0.6%.

The special dividend is a nice bonus, but perhaps more important in the long run is Costco’s performance as a business. On that topic, Costco delivered a notable earnings beat for the first quarter of Fiscal Year 2024.

Starting with the top line, Costco generated $56.717 billion in net sales versus $53.437 billion in the year-earlier quarter. Hence, Costco demonstrated moderate revenue growth with a quarterly result that was roughly in line with Wall Street’s expectations.

Here’s where it really gets good. For Q1 of FY2024, Costco reported net income of $3.58 per share, which is much better than the $3.07 from the year-earlier quarter. Additionally, this earnings result beat the consensus estimate of $3.41 per share.

You may be surprised to learn how Costco made so much money. Remember how I said Costco is selling gold bars now? Believe it or not, the company generated $100 million from selling those gold bars in Q1 FY2024. Also, Costco sold four million pies during the Thanksgiving weekend. When shoppers like something, they really like it.

Generally speaking, it was a strong quarter for Costco, and there’s evidence that the U.S. consumer is in a buying mood. Remarkably, Costco’s quarterly same-store sales increased by 3.8% year-over-year, while the company’s e-commerce same-store sales grew by 6.3%.

Costco Gets a Slew of Positive Ratings

Given the aforementioned quarterly results, it’s understandable that analysts are raising their price targets on Costco stock. It’s actually getting hard to keep track of all the praise that analysts are heaping on Costco nowadays.

I’ll start with Laura Champine of Loop Capital Markets, who reiterated her Buy rating on Costco stock and assigned it a $710 price target. TheFly also mentioned that UBS analyst Michael Lasser gave a Buy rating to Costco shares.

Next, BMO Capital upgraded COST stock from $612 to $700 while maintaining an Outperform rating on it. The BMO Capital analysts praised Costco’s “solid” quarterly results and “uniquely positioned” business model, and I certainly can’t argue with that.

Other analysts who issued Buy ratings on Costco stock were TD Cowen analyst Oliver Chen and Stifel Nicolaus’s Mark Astrachan, as well as Dean Rosenblum of Bernstein. Reportedly, Rosenblum was impressed with Costco’s sales growth and strategic expansion plans.

Finally, I should mention that overall, analysts are looking forward to Costco’s likely imminent membership fee increase. It’s not great news for the company’s customers, but evidently, analysts are pleased with the idea of Costco’s loyal customers coughing up more money for their memberships.

Is Costco Stock a Buy, According to Analysts?

On TipRanks, COST comes in as a Moderate Buy based on 20 Buys and seven Hold ratings assigned by analysts in the past three months. The average Costco stock price target is $656.86, implying 3.6% downside potential.

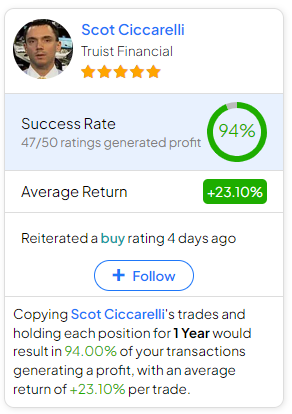

If you’re wondering which analyst you should follow if you want to buy and sell COST stock, the most accurate analyst covering the stock (on a one-year timeframe) is Scot Ciccarelli of Truist Financial, with an average return of 23.1% per rating and a 94% success rate. Click on the image below to learn more.

Conclusion: Should You Consider Costco Stock?

As we’ve discovered, there’s no shortage of Buy ratings for Costco. As long as the American consumer is resilient, there’s room for Costco to grow and deliver strong results.

Here’s where it gets tricky, though. Contrarians might be alarmed by the recent parabolic rally in Costco’s share price. That’s understandable, so I like the idea of letting COST stock pull back 10% or even 20% before considering a long position. Just like you might look for bargains at Costco, you can choose to wait until there’s a share price reduction before making an investment.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue