Some patterns have emerged since the COVID pandemic has faded more and more into the rear-view mirror, and one that investors are noticing is the outdoor leisure sector. Stores specializing in outdoor consumer goods – supplies for camping, athletic and leisure activities, sports, and hunting and fishing – saw strength during the pandemic, when solitary and small-group outdoor activities were at a premium.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

That strength has, in many ways, continued through today. The lockdown policies, thankfully, are done with – but many of us found again that outdoor leisure was fun, and consumer spending in recent quarters has prioritized sporting goods as an essential. The result has been a solid floor of support for outdoor and sporting goods retail stocks.

This is a view supported by Truist analyst Joseph Civello, who writes, “In our view, the pandemic drove many consumers to develop a greater enthusiasm for the outdoors and a stronger desire to live active/healthy lifestyles. Further, we saw an acceleration of ongoing casualization trends, especially towards athleisure. We believe these will remain sticky tailwinds for the industry for years to come…”

Civello goes on to recommend two sporting goods stocks that are showing clear advantages for investors. We’ve used the TipRanks platform to pull up the details on them and it seems like the rest of the Street agrees with Civello – both are rated as Strong Buys by the analyst consensus; here they are, along with Civello’s comments.

Don’t miss

- Tech Stocks Have More Room to Run, According to Bank of America — Here Are 2 Names to Watch

- ‘Riding the Clean Energy Wave’: This Analyst Suggests 2 Stocks to Play the Renewable Energy Transition

- Billionaire Steve Cohen Goes Big on These 2 ‘Strong Buy’ Stocks — Here’s Why You Should Follow

Academy Sports and Outdoors (ASO)

First up is Academy Sports, a retail firm that’s been in the sporting goods business since 1938. That’s a long time – and Academy has used it to build a network of 270 stores across 18 states. Over the next several years, the Texas-based company plans to continue its expansion with an additional 120 to 140 retail locations.

Academy’s product lines offer everything that outdoor enthusiasts could want or need, including all-weather outdoor apparel and other gear, athletic shoes and other footwear, fishing equipment, hunting and shooting gear and accessories, even off-road wheeled vehicles and indoor game room accoutrements. The company splits its categories into gear for men, women, and kids, and boasts that there is something to be found for everyone, with the chief product being ‘fun for all.’

We’ll see Academy’s results for fiscal 3Q23 on November 30, before the trading floors open, but for now we can look back at the last quarterly report for an idea of where the company stands. In fiscal 2Q23, which ended on July 29, Academy reported revenue of $1.58 billion. This was down 6% year-over-year, but met Street expectations. The company’s quarterly bottom line was $2.09 per share by non-GAAP measures, 8% below the year-ago figure – but 9 cents ahead of the forecast.

For Truist’s Civello, this retailer offers a sound base for investors to rely on, with a strong customer relationship and reliable revenues and earnings. The analyst writes, “Academy is a favorite sporting goods retailer for the middle-class that has meaningfully transformed its shopping experience/operations over the past 4 years. In our view, its regionally tailored assortments & ‘good/better/best’ value orientation resonate well with consumers that have become much more engaged in sports/outdoor activities and value conscious.”

“Academy’s industry-leading unit economics and robust expansion opps underpin our forecasted HSD revenue CAGR through FY25E. Although macro/category-specific pressures remain NT headwinds, we believe its valuation (6.5x FTM EPS) limits downside risks,” he went on to add.

Looking forward, Civello opens his coverage of this stock at a Buy, and his $57 price target implies a one-year gain of 18%.

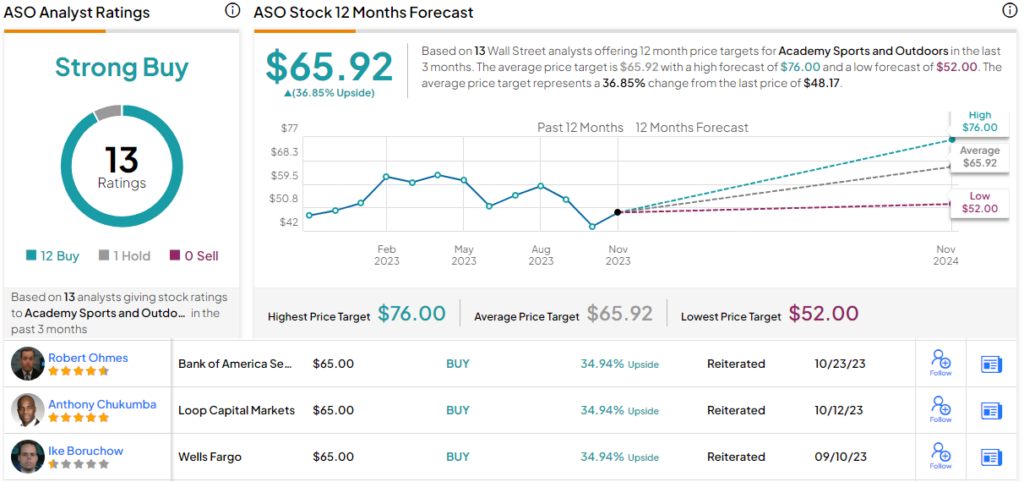

Overall, ASO shares have a Strong Buy consensus rating, based on 13 analyst reviews with a decisive 12 to 1 split favoring Buys over Holds. The stock’s $48.17 selling price and $65.92 average price target combine to suggest a 37% increase in the wings for the coming year. (See Academy Sports and Outdoors’ stock forecast.)

Deckers Brands (DECK)

Next on our list, Deckers Brands, is a footwear company, offering multiple lines of outdoor, athletic, and leisure shoes and other footwear. The firm got its start in 1973 selling mainly flip-flops, and today includes such well-known brands as UGG and Koolaburra, Teva and HOKA. Deckers sells its products in more than 50 countries around the world, and its outlet network includes specialty stores, department stores, online commerce, and company-owned retail stores. Deckers’ success as an outdoor and athletic footwear and lifestyle company has brought it a loyal customer base that spans the globe.

A strong base in a popular niche is a recipe for retail success, and that in turn has brought investor interest, so that DECK shares are up more than 61% so far this year. The stock saw a strong surge at the end of October, when the company released its fiscal 2Q24 earnings report.

That report beat the analyst expectations all down the line. Revenue came in at $1.09 billion, a company quarterly record, was up 24% y/y, and beat the forecast by $129.33 million. The company’s diluted EPS, the non-GAAP measure, was $6.82; this compared favorably to the $3.80 reported in the year-ago period and was $2.40 better than had been anticipated.

Two metrics in particular stand out in the quarterly report. The company’s premium footwear brand HOKA showed a 27.3% y/y sales increase, generating $424 million in revenue, and the direct-to-consumer online sales were up 38.8% y/y, to $331.7 million. We should also note here that Deckers’ fiscal Q2 ends on September 30 and covers the summer months; it is typically the company’s best performing quarter of the year.

For Truist, this all adds up to a sound investment choice. Civello describes the company as ‘well positioned,’ and writes, “We believe Deckers is an attractive LT growth story driven by the strength of HOKA’s premier positioning in performance running and reignited brand affinity for UGG. Further, we expect the company to maintain its robust Direct-to-Consumer (DTC) growth momentum, which we think continues to drive stronger customer relationships and offers a built-in upside margin lever.”

Quantifying his stance, the analyst gives DECK a Buy rating with a $735 price target to point toward a 17% upside potential in the next 12 months.

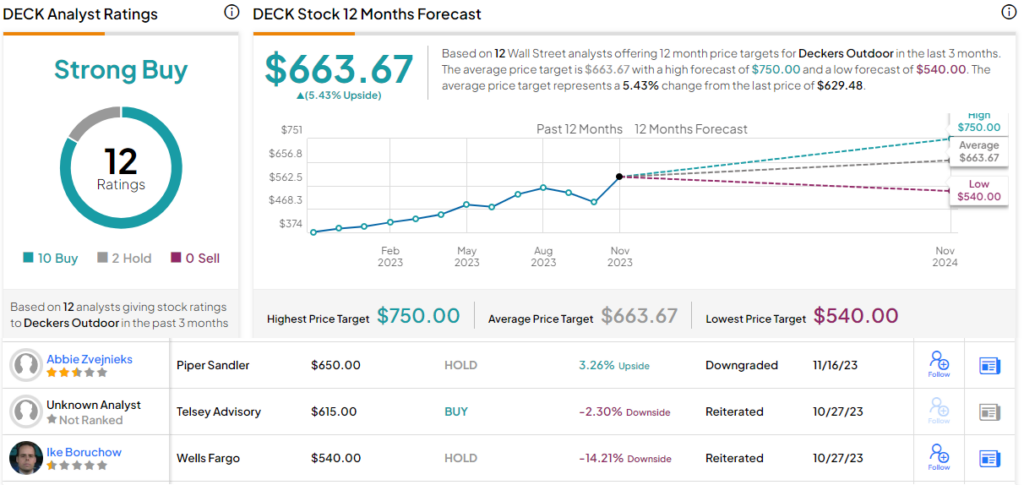

The analyst consensus here is also upbeat. The stock has a Strong Buy consensus rating, based on 12 recent reviews which include 10 Buys to 2 Holds. That said, the $663.67 average price target implies a modest one-year gain of 5.5% from the current $629.48 share price. (See Deckers Brands’ stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.