According to CapitolTrades.com, Virginia Foxx, the U.S. representative for North Carolina’s 5th District, has recently bought shares of Duke Energy (NYSE:DUK) and Vector Group (NYSE:VGR). Meanwhile, Foxx sold Hess Corp. (NYSE:HES) stock.

Per the data, Foxx bought and sold these stocks at the end of December 2022. The buy transactions had a size range of 1-15K. Meanwhile, she sold HES in a size range of 50-100K.

Using TipRanks’ data, let’s check what’s on the horizon for DUK, VGR, and HES.

Is Duke Energy Stock a Good Buy Now?

Duke Energy is a leading energy holding company that operates through regulated electric utilities and natural gas units. The company’s decision to exit the capital-intensive Commercial Renewables business (with slow earnings growth) and the growing contribution from the regulated electric and gas operations augur well for growth.

On TipRanks, Duke stock has a Moderate Buy consensus rating, reflecting five Buy, seven Hold, and one Sell recommendations. However, analysts’ average price target of $104.15 is roughly in line with its closing price on January 5.

Our data shows hedge funds sold 248.2K DUK shares last quarter. Meanwhile, insiders sold DUK stock worth $85.5K. Overall, DUK stock has a Neutral Smart Score of four.

Is VGR Stock a Buy or Sell?

Vector Group is a holding company operating through Liggett Group, Vector Tobacco, and New Valley LLC. VGR stock has gained over 35% in three months, led by solid volumes in the tobacco segment. Its focus on driving volume, pricing, and market share bodes well for growth.

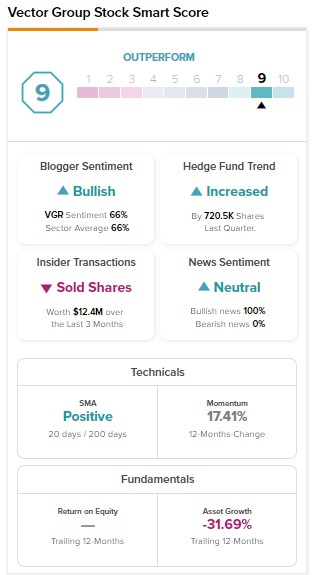

Along with Foxx, hedge funds have also acquired VGR stock. Hedge funds bought 720.5K VGR stock in the last three months. However, insiders sold VGR stock worth $12.4M. Nevertheless, VGR stock has an Outperform Smart Score of nine.

What’s the Prediction for Hess Stock?

Hess Corporation is engaged in the exploration and production of oil and natural gas. HES stock gained over 75% in one year, reflecting higher realized selling prices. Thanks to the favorable operating environment, HES expects to enhance its shareholders’ value through buybacks and higher dividends.

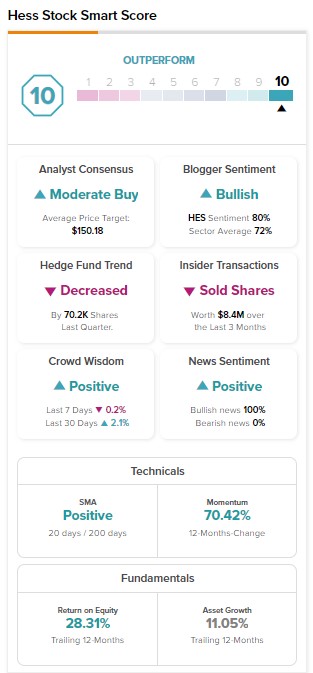

HES stock has a Moderate Buy consensus rating, reflecting eight Buy and three Hold recommendations. Meanwhile, analysts’ average price target of $150.18 implies 6.68% upside potential.

It’s worth highlighting that hedge funds and insiders capitalized on the increase in HES stock. Hedge funds sold 70.2K shares in three months. Meanwhile, insiders sold HES stock worth $8.4M. HES stock has a maximum Smart Score of “Perfect 10.”

Bottom Line

Retail investors might gain from closely monitoring politicians’ trade. In the meantime, retail investors could also use TipRanks’ Experts Center for their trades. According to TipRanks, VGR and HES stocks are likely to outperform the broader market averages. Meanwhile, Duke’s Smart Score of four implies that this stock could move in line with the broader market.