Per CapitolTrades.com, John Curtis, the U.S. representative for Utah’s 3rd congressional district, has recently bought shares of Advanced Micro Devices (NASDAQ:AMD). Meanwhile, Congressman Curtis sold shares of Bank of America (NYSE:BAC) and JPMorgan Chase & Co. (NYSE:JPM).

Per the data, Curtis bought and sold these stocks on December 20, 2022. Meanwhile, these transactions had a size range of $1-$15K.

Let’s leverage TipRanks’ data to find out what’s in the offing for AMD, BAC, and JPM.

What is the Future of AMD Stock?

Shares of chipmaker AMD have dropped over 48% in one year, reflecting inventory issues and softness in demand due to the negative impact of inflation and high-interest rates on consumer spending. Given the continued weakness in PC shipments and pricing pressure, AMD stock could continue to face challenges in the short term.

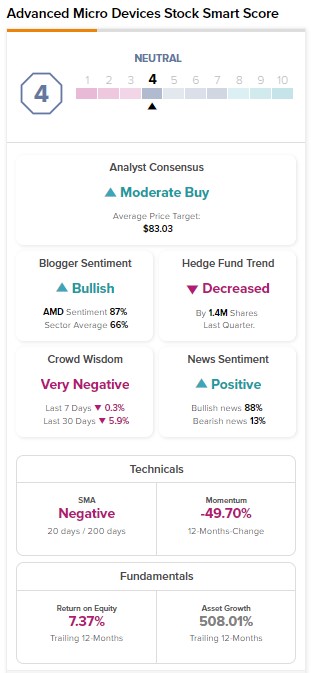

However, most Wall Street analysts maintain a bullish stance on AMD stock. It has received 17 Buy and six Hold recommendations for a Moderate Buy consensus rating. KeyBanc analyst John Vinh reduced his price target on AMD stock to $80 from $85. The analyst expects weakness in most end markets, primarily in automotive and industrials, to remain a short-term drag. However, Vinh believes AMD is well-positioned to weather the near-term challenges. He maintains a Buy rating.

On TipRanks, AMD’s price target of $83.03 implies 17.27% upside potential.

While analysts are cautiously optimistic about this large-cap stock, Hedge Funds sold 1.4M shares of AMD last quarter. Overall, AMD’s Smart Score of four implies a Neutral outlook.

Is Bank of America a Buy, Sell, or Hold?

Bank of America stock sports a Moderate Buy consensus rating on TipRanks. The banking giant has seven Buys and five Holds. Further, analysts’ average price target of $40.63 implies 17.87% upside potential.

Deutsche Bank analyst Matt O’Connor recently downgraded BAC stock to Hold and cut his price target to $36 from $45. O’Connor expects a weak macro environment will lead to an increase in reserves and hurt earnings. Further, he sees downside risk from the valuation perspective in the event of a recession.

While O’Connor sees challenges ahead, hedge funds have been accumulating BAC stock. In the last three months, hedge funds bought 14.6M shares of BAC. Bank of America’s stock carries an Outperform Smart Score of nine.

Is JPM a Buy or Sell?

On TipRanks, JPM stock commands a Moderate Buy consensus rating based on nine Buys and five Holds. These analysts’ average price target of $147.86 implies 6% upside potential.

Similar to BAC, O’Connor downgraded JPM stock, citing challenges ahead. The analyst highlighted the “ongoing macro risks” and “weakening bank fundamentals” as reasons for the rating downgrade.

Our data shows that hedge funds have reduced their exposure to JPM stock. They sold 778.4K shares of JPM last quarter. Overall, JPM stock has a Neutral Smart Score of seven.

Bottom Line

It could prove advantageous for retail investors to follow politicians’ trades closely. Also, investors can use TipRanks’ Experts Center to make informed buying and selling calls. As for AMD, BAC, and JPM, the near-term macro headwinds could pose challenges and limit the upside.