Colgate-Palmolive Company (CL) is a global manufacturer and marketer of consumer products, focusing on personal and home care. A wide product line creates a sustainable future path for Colgate, as hundreds of millions of consumers around the world are using the company’s products in their everyday lives.

In this analysis, the company’s stock performance, financials, valuation, and defensive resiliency are examined. I am neutral on the stock.

Recent Stock Performance

After a quick run-up at the beginning of 2021, Colgate’s stock retreated and proceeded to trade flat for the better part of the year. Caught in the middle of a major market pullback, after another run-up at the end of 2021, the stock recorded some losses.

CL has retreated 14% from its all-time high levels. Colgate-Palmolive trades at a ~$62 billion market cap and pays a 2.6% dividend yield.

Financial Performance and Valuation

One of the things that hold many investors back from committing to Colgate is a record of relatively stagnant top and bottom-line growth. Revenue has stayed flat over the course of the last decade, slightly increasing from $17.1 billion in 2012 to $17.4 billion in 2021.

Net income has also been relatively flat, marginally contracting from $2.5 billion in 2012 to $2.2 billion in 2021. Cash flow generation has also stayed consistent yet flat over the last 10 years, with cash from operations ranging between $3.0-3.7 billion.

That said, analysts expect revenue growth to pick up in the next few years, projecting $19.3 billion in revenue by the end of 2024. Net income is also expected to increase at an 8.8% CAGR over the next three years.

Profitability-wise, Colgate has a proven track record of beating sector average metrics, recording a very generous 59.6% gross margin and a 12.4% net margin. These metrics can be compared to the consumer staples sector’s 31% gross margin and 4.4% net margin.

Colgate is a clear winner in terms of profitability, especially when considering the efficiency improvement requirement it takes for a company that is barely growing its sales to maintain such margins.

On the balance sheet side, the company is unlikely to face any short-term liquidity struggles, with a current ratio of 1.1. Long-term debt levels of $7.2 billion are also relatively low, although this figure has increased over the past 10 years. The company’s cash & equivalents balance appears low at $832 million, given the consistent cash flow generation the company exhibits.

Turning to valuation metrics, Colgate trades at a 23x non-GAAP P/E ratio and a 3.6x P/S ratio, both higher than the sector’s ~20x and 1.4x average multiples. Coupled with a 16x EV/EBITDA multiple, it is safe to say that Colgate trades a little overvalued at current price levels.

Dividends and Buybacks

Colgate-Palmolive has been a prime choice for dividend investors for many years, and for a good reason. It offers a 2.6% dividend yield that is higher compared to the current 1.4% S&P 500 dividend yield and slightly higher than the average yield across the consumer staples sector of 2.3%. What carries more weight, however, when it comes to CL’s incomes distributions, is consistency.

The company has been growing its dividend for 17 consecutive years, at 10 and five-year CAGRs of 4.5% and 3%, respectively. Colgate carries a relatively safe 56% payout ratio as its dividend payments are generally considered safe.

Dividend payments aren’t the only way the company tries to reward investors while further increasing its appeal. The company has been slowly yet consistently reducing the number of shares outstanding, increasing shareholders’ stake in the business. Buybacks are expected to pick up pace as, on March 10, Colgate announced a $5 billion stock repurchase program.

Defensive Nature

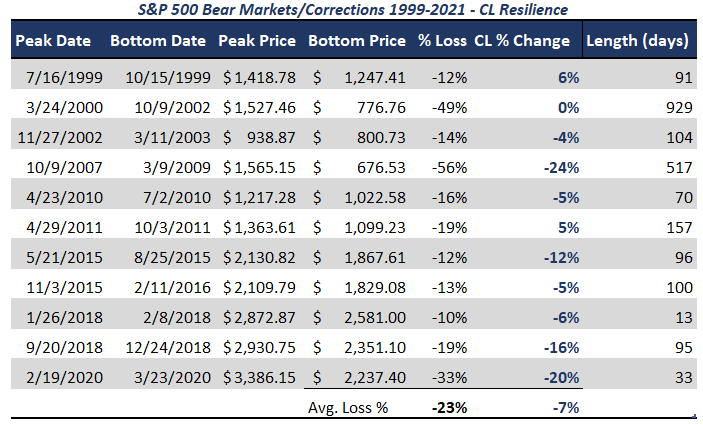

Often referred to as a more conservative sector, it should go without saying that exposure towards consumer staples, while missing on some bull-market gains, should minimize losses during bear markets and corrections. Focusing on the past 20-year period, the stock’s performance through S&P 500 bear markets and corrections is examined in the table below.

As it is clearly shown, Colgate backs up its defensive attributes throughout the duration of this analysis. As the market averages a -23% drawdown, CL only averages -7%.

In fact, over the same time span, the stock faced only two bear markets, with its worst performance being a -24% return, whereas the S&P 500 saw losses beyond -30% three times. What the evidence suggests is that Colgate-Palmolive stock can provide investors with some serious downside protection.

Wall Street’s Take

Turning to Wall Street, Colgate has a Hold consensus rating, based on three Buys, eight Holds, and one Sell assigned in the last three months.

The average Colgate-Palmolive price target is $86.50, implying 17.6% upside potential from current price levels, with a high forecast of $95.00 and a low forecast of $76.00.

Conclusion

After all things are considered, Colgate offers a proven defensive choice for investors to consider in case that lasting bear market is ahead. However, given the current valuation as well as stagnant revenue and net income growth, the company needs to record some more forward progress before analysts and investors fully commit.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure