I am bullish on Coinbase (COIN), a cryptocurrency exchange platform, because of how well rounded and innovative this company is.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The Coinbase Wallet is a digital currency wallet that allows users to store, send and receive Bitcoin (BTC-USD). It also offers an API for developers to build applications that use the Coinbase API.

In the last few months, due to the wider sell-off in the tech sector, COIN is not performing too well. In addition, after a red-hot 2021, cryptos have not done too well this year. Therefore, investors are hesitant when pouring their capital into a company with exposure to this area.

Coinbase is a relatively low-risk entry point for crypto investing, as it’s not very volatile. The company has delivered on financial targets, with revenue and earnings growing by triple digits.

Coinbase & Bitcoin Fortunes Are Intertwined

Coinbase will be successful if the greater cryptocurrency world is healthy.

Crypto prices have been in a downward spiral since the start of the year, so investors are starting to focus on other investment opportunities. Many people are shifting their focus towards investing in dividend stocks and retirement funds.

However, after a few months, we finally see that Bitcoin is beginning to recover from its downtrend.

One factor that has helped is the Russia-Ukraine crisis. This turmoil in the Russian economy has made cryptos a more attractive investment opportunity. As the Ruble continues to fall, you will see a corresponding increase in interest in cryptos as an investment option.

In addition, President Joe Biden’s latest decree involves a regulatory authority to be put in place that will govern the cryptocurrency market and consider a government-issued central bank digital currency.

In short, there is hope the cryptocurrency market is becoming increasingly similar to the stock market. This explains why it’s so closely related to global factors like Russia’s war in Ukraine.

The volatility of Bitcoin has been noted for a long time now. In fact, when the original cryptocurrency set a record in April last year, it abruptly lost around half that value by mid-July.

However, this volatility should not overshadow the upcoming potential for Bitcoin and COIN. In the short run, Bitcoin and other cryptos will rise because of the geopolitical issues in Eastern Europe.

Coinbase’s Growth, Partnerships

The future of cryptocurrencies still holds a lot of volatility, and experts say it’s something long-term crypto investors will need to continue to deal with.

That’s why it’s best to evaluate COIN by looking at its operations and partnerships.

In terms of financials, everything appears to be rock solid. Over the last quarter, Coinbase saw revenue and earnings beats that impressed investors and analysts alike. Coinbase showed strong growth, taking a 300% increase in net income year-over-year, and a 327% increase in revenues.

Surprisingly, the stock fell sharply after reporting the earnings because of the outlook. Analysts projected earnings of $1.55 per share and $1.69 billion in revenue in the first quarter of 2022. However, Coinbase issued muted guidance.

The difference in Subscriptions and Services revenues between the last quarter and this current one indicates that Coinbase is set to shrink substantially in terms of revenues during Q1 2022 compared to Q4 2021.

It’s difficult to tell where Coinbase expects MTUs to land in the future. However, the company forecasts Average Transaction Revenue Per User to drop to “pre-2021 levels.”

However, it is important to note that the company should outperform its guidance substantially because this quarter has seen volumes surge because of the factors mentioned above.

Apart from this, the company announced on October 12 that it’s launching a peer-to-peer marketplace, which will allow users to participate in the minting, collecting, and trading of NFTs or non-fungible tokens.

Meanwhile, Meta’s (FB) new digital wallet, Novi, will process transactions using Coinbase.

Hence, this means that COIN is looking toward the future and making its revenue more stable by investing in different sectors.

Wall Street’s Take

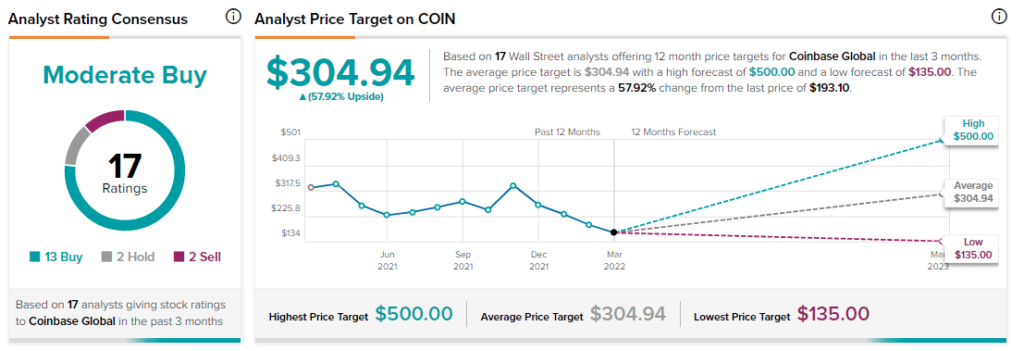

According to Wall Street analysts, the sentiment is quite bullish on Coinbase. The company has received a Moderate Buy consensus rating based on 13 Buy ratings, two Holds, and two Sells assigned over the past three months.

At $304.94, the average Coinbase price target implies 57.9% upside potential over the next 12 months.

Bottom Line

It’s crucial one remembers not to ignore the potential of higher-risk investments such as COIN.

Coinbase’s importance in the crypto ecosystem grows as Bitcoin, and other cryptocurrencies gain mainstream adoption.

We also want to remind you that Coinbase is not dependent on any single cryptocurrency. Additionally, the company is looking to expand its offerings, and services to diversify its revenue mix.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.