Beverage giant Coca-Cola (NYSE:KO) has fared better than the broader market so far. The company is often considered recession-resistant as the demand for its products is not significantly impacted by an economic downturn. Coca-Cola’s Q3 results and upgraded guidance reflect the company’s pricing power and the resilience of its business model. Moreover, the company’s consistent dividends make it an attractive pick.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Coca-Cola’s Guidance Reflects Resilience

Coca-Cola’s Q3 revenue grew 10% to $11.1 billion (organic revenue growth of 16%), while adjusted EPS increased 7% to $0.69. The company’s ability to hike prices, given its strong brand name and the demand for its beverages, has helped it pass on the increased costs to consumers to some extent.

Coca-Cola raised its full-year outlook despite considerable currency headwinds and higher costs. It now expects organic revenue growth in the range of 14% to 15% and adjusted EPS growth of 6% to 7%.

Coca-Cola, a dividend king, has raised its dividends for 60 consecutive years. With an annual dividend of $1.76 per share, Coca-Cola’s dividend yield stands at 2.92%. The company’s free cash flow declined 14% year-over-year in the first nine months of 2022, reflecting the impact of working capital benefits in the prior year and higher annual incentives that were paid in Q1 2022. Nonetheless, at $7.3 billion, free cash flow was still strong at Q3-end. Coca-Cola expects to generate free cash flow of about $10.5 billion in 2022.

Meanwhile, Coca-Cola continues to innovate products based on evolving consumer needs. The company’s innovations contributed over 25% to incremental gross profit so far this year. Notably, 55% of the year-to-date innovations were outside of the carbonated beverage category, keeping in view the growing aversion to soda beverages. Coca-Cola is focused on developing no or low-sugar options to cater to health-conscious consumers.

Coca-Cola is also expanding into emerging categories, like ready-to-drink alcoholic beverages. It has teamed up with Molson Coors (TAP) to launch Topo Chico Spirited, a line of spirit-based, ready-to-drink cocktails, in 2023. The two companies launched Simply Spiked Lemonade in the U.S. earlier this year and Topo Chico Hard Seltzer in 2021. Also, Coca-Cola recently launched Fresca Mixed in the U.S. in partnership with Constellation Brands (STZ).

Will KO Stock Go Up?

Following the Q3 print, J.P. Morgan analyst Andrea Faria Teixeira stated, “Demand trends remain resilient and demonstrate the attractiveness of KO’s brand equity and resilient categories in the face of macro uncertainty.”

Teixeira slightly increased the price target for Coca-Cola stock to $64 from $63 and reiterated a Buy rating.

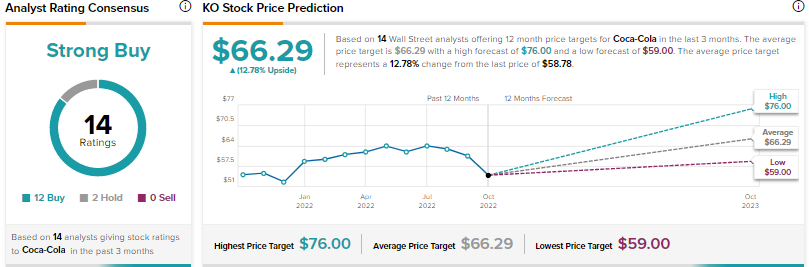

Overall, Wall Street has a Strong Buy consensus rating on KO stock based on 12 Buys and two Holds. The average Coca-Cola stock price target of $66.29 implies 12.8% upside potential. Shares are down by just 1% year-to-date.

Conclusion

Coca-Cola’s pricing power, strong fundamentals, attractive dividend yield, and solid demand for its products make it an attractive pick during these uncertain times.

As per TipRanks’ Smart Score System, Coca-Cola earns a nine out of 10, which indicates that the stock could outperform market averages over the long term.