Citigroup (NYSE:C) released a note last week stating that it expects the stock market to be picky over the next few quarters. Therefore, a portfolio drift into quality and momentum stocks would be investors’ best course of action. Three stocks that fit this description are Amazon (NASDAQ:AMZN), JPMorgan (NYSE:JPM), and Domino’s Pizza (NYSE:DPZ).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to Citi’s published note, there’s a growing risk of a global recession, meaning “earnings expectations become the more important toggle from here.”

Citi’s base argument is that investors should allocate capital toward high-quality stocks or assets that are popular among investors. In the investment bank’s view, quality and momentum-segmented securities could bypass a recession, keeping investors’ stock portfolios afloat during periods of systemic turbulence.

What are Quality and Momentum Factors?

Citigroup’s mention of “quality and momentum” pertains to market segments more commonly known as factors. In practice, professional portfolio managers divide the stock market into an array of segments by identifying stock ‘DNAs.’ Common segments include growth, value, quality, momentum, and high dividend yield.

The quality factor groups stocks that exhibit high profitability, robust balance sheets, sound liquidity ratios, and dynamic income statements. Thus, there should be no surprise that these stocks are often non-cyclical, which is why Citi’s research team strongly recommends them.

On the other hand, momentum stocks are popular stocks that tend to outperform the market because of their large and loyal investor bases. Consequently, Citi’s reference to momentum stocks seems suitable in today’s stock market climate as they typically experience anomalous market outperformance. Cumulatively, Citi’s recommendation makes sense.

Amazon

Its more than 25% year-to-date drawdown means Amazon’s one of the most oversold technology stocks on the market. However, things are looking up for Amazon after delivering promising second-quarter earnings results, which garnered the attention of leading Wall Street analysts.

Michael Pachter of Wedbush recently commented on Amazon’s interlinkages with the broader economy, stating that “despite inflationary pressures, a tight labor environment, and suboptimal fixed cost leverage, Amazon delivered strong second-quarter results that benefited from elevated levels of consumer demand and better optimization of its fulfillment Network.”

Pachter added, “Longer-term, Amazon should benefit from steady margin expansion driven by the rapid growth of its cloud and advertisement businesses.”

Furthermore, global advertising has slowed as small to medium-sized enterprises brace for a recession. However, Benchmark Company’s Daniel Kurnos says Amazon’s an outlier in the advertising space. According to Kurnos: “What will likely surprise investors was the ongoing strength of Amazon’s advertising unit, which set another record in the quarter and is showing no signs of slowing,”

Amazon’s cumulative 5-year CAGR (compound annual growth rate) of 26.48% conveys its ability to scale throughout economic cycles, categorizing it as a high-quality stock.

Lastly, Amazon’s website traffic is on the up, recovering from a mid-year slump. Could this lead to a surge in top-line revenue? If conversion rates follow along, it definitely would.

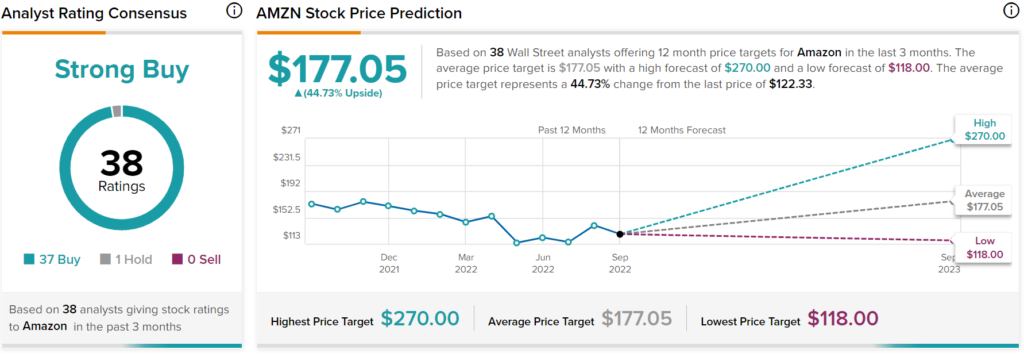

Is Amazon a Buy, Hold, or Sell?

Turning to Wall Street, Amazon earns a Strong Buy consensus rating based on 37 Buys and one Hold assigned in the past three months. AMZN stock’s average price target of $177.05 implies 44.7% upside potential.

JPMorgan Chase & Co.

Banking stocks are a considerable risk, with inflation at a multi-decade high. However, on the flip side, investors have an opportunity to lock in deep value and high dividend yields. JPMorgan passed its Basel III stress test with flying colors earlier this year, meaning its risk-weighted asset allocation is on par. The bank’s Total Capital Ratio of 15.6% exceeds the regulatory threshold of 8%, indicating that JPMorgan invests its capital with optimal efficiency.

Furthermore, JPMorgan’s CEO Jamie Dimon believes the bank’s prospects are bright as enterprises and individual consumers are in better shape than most believe. Dimon states, “They [enterprises & individuals] are spending money. They have more income. Jobs are plentiful. They’re spending 10% more than last year, almost 30% plus more than pre-COVID. Businesses, you talk to them, they’re in good shape. They’re doing fine.”

Whether Dimon’s argument holds true or not is debatable. However, one thing’s for sure, JPMorgan’s key financial metrics are in phenomenal shape. For example, the bank’s return on common equity roams at 14.68%, approximately 27.33% higher than the sector median. Moreover, with cash from operations of $132.53 billion, the question beckons whether JPMorgan could be too big to fail.

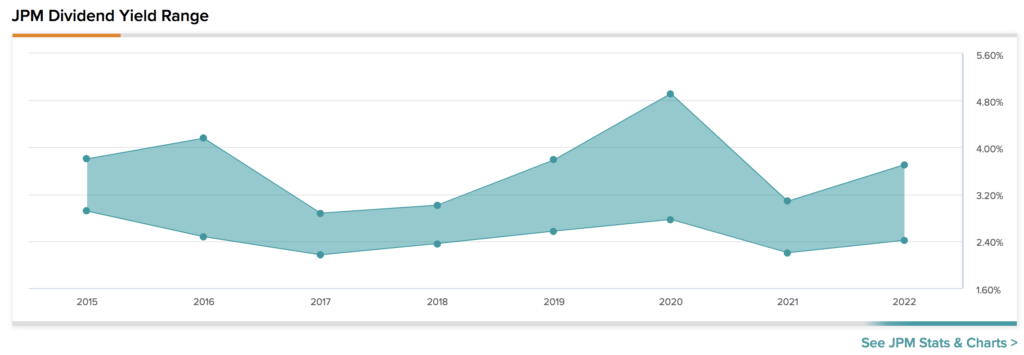

An income-generating investment vantage point suggests JPMorgan is a “best-in-class” total return play. JPM stock’s dividend yield of 3.42% is accommodated by a dividend coverage ratio of 2.77x, implying that JPMorgan’s dividends are both lucrative and sustainable.

Based on numerous key influencing variables, JPMorgan fully deserves its quality stock status, placing it within the realms of potential market outperformers.

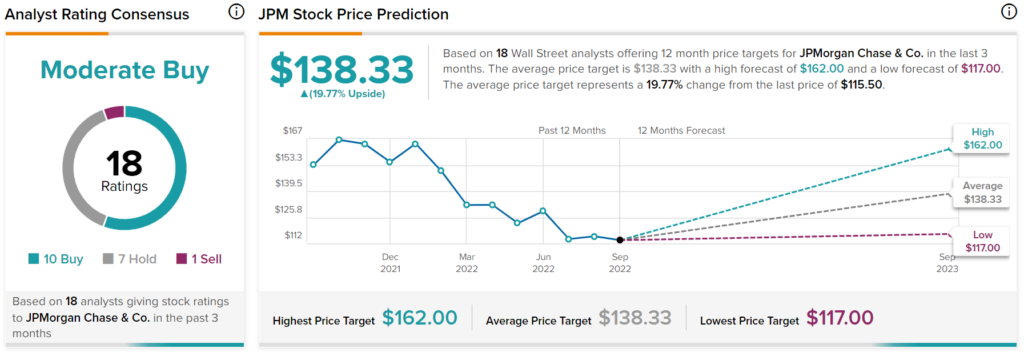

Is JPM a Good Stock to Buy?

Turning to Wall Street, JPMorgan earns a Moderate Buy consensus rating based on 10 Buys, seven Sells, and one Hold. JPM stock’s average price target of $138.33 implies 19.8% upside potential.

Domino’s Pizza

Domino’s Pizza is a former Bill Ackman favorite and widely touted as a potential market-beater. As a consumer staples company, Domino’s Pizza is generally expected to exhibit low levels of earnings volatility. Moreover, the company owns approximately 42% of the “major pizza chain” market in the U.S., meaning its pricing power could see it outperform the broader industry.

Adding to Domino’s Pizza’s stock appeal is its blistering return on total capital of 40.97%. This doesn’t only convey its ability to repay equity investors but also suggests that its general capital payback profile is sound, preventing principal-agent conflicts from occurring.

Furthermore, Domino’s is a firm favorite among global hedge fund managers. According to TipRanks’ 13-F tracker, hedge funds added 79.3 thousand net Domino’s Pizza shares in the previous financial quarter.

Is DPZ Stock a Good Buy?

Turning to Wall Street, Domino’s Pizza earns a Moderate Buy consensus rating based on seven Buys, six Holds, and nine Sells. DPZ stock’s average price target of $427.77 implies 26.5% upside potential.

Takeaway – AMZN, JPM, and DPZ Stocks are Potential Outliers

The three stocks covered in this article align with Citigroup’s quality and momentum narrative. Amazon, JPMorgan, and Domino’s all exhibit robust profitability ratios and total return metrics, conveying sustainable future returns. Thus, they can be considered potential outliers going forward.