Cisco Systems stock (NASDAQ:CSCO) has recorded solid gains recently, gaining more than 26% in the past year. The networking equipment giant has been posting solid financial results. At the same time, the industry’s outlook remains very optimistic, especially following the ongoing AI boom, as hyper-scalers around the world are already utilizing the company’s core networking technology to sustain their operations.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

With Cisco’s earnings growth projections appearing quite strong and shares still trading at a reasonable valuation despite the recent rally, I am bullish on the stock.

Compelling Growth Catalysts Power Continued Success

Cisco Systems is poised for continued success, capitalizing on numerous compelling growth catalysts. The relentless surge in demand for cutting-edge network devices, robust cybersecurity solutions, state-of-the-art Internet of Things (IoT) technology, and the latest artificial intelligence (AI) advancements have positioned Cisco at the forefront of this evolving landscape.

Despite its status as a mature company, Cisco’s stronghold remains unyielding as it continues redefining connectivity technologies and spearheading innovation. Its relentless commitment to pushing boundaries solidifies its dominance and fuels a robust growth trajectory.

The company’s most recent results once against showcased Cisco’s capitalization on these tailwinds. For its fiscal Q3 results, total revenues came in at $14.6 billion, up 14% year-over-year. This included Product revenues of $11.1 billion, up 17%, and Service revenue of $3.5 billion, up 3% compared to last year.

Specifically, in terms of Product revenue, Cisco’s Secure Agile Networks, its largest business segment, demonstrated remarkable growth of 29%. Moreover, switching revenues experienced robust double-digit growth, driven by the strong performance of Cisco’s Catalyst 9000, Meraki, and Nexus 9000 offerings in both campus and data center switching.

In line with Cisco’s commitment to shaping the future of the Internet, the “Internet for the Future” category witnessed a 5% increase, primarily attributed to the remarkable growth of the company’s core routing products, particularly the Cisco 8000 offering.

Also, Cisco’s total Software revenue reached an impressive $4.3 billion, marking an 18% increase. This included Software Subscription revenue, which experienced a commendable 17% growth. Clearly, Cisco’s products and services benefit across the board from the current landscape in the tech and communications sectors.

Profitability-wise, Services’ adjusted gross margin landed at 67.3%, down 160 basis points year-over-year. However, this decline was offset by the adjusted gross margin from Product, which landed at 64.5%, up 40 basis points year-over-year.

The year-over-year increase in Product gross margin was driven by favorable pricing and sales mix, which demonstrates the strong demand for Cisco’s connectivity solutions. Also, adjusted earnings per share grew by 15% to $1.00, further aided by Cisco’s ongoing stock buybacks.

Future Growth Drivers

Moving forward, Cisco is poised to reap the rewards of several robust growth drivers and internal advancements. These catalysts can be consolidated into three groups.

First and foremost, Cisco’s relentless pursuit of increased subscriptions and recurring revenue continues to yield impressive results. As stated earlier, the company achieved a remarkable 18% growth rate in Software revenues, with subscription-based revenue accounting for an impressive 82% of total Software revenue at the close of the quarter.

This shift towards subscription models not only ensures excellent cash-flow visibility but also establishes a solid foundation for Cisco as Software revenues progressively form a larger portion of its overall revenue stream.

Secondly, the burgeoning field of security presents an immense opportunity for Cisco. The company’s management anticipates unveiling groundbreaking innovations in the upcoming quarters, building upon its robust Cisco Security Cloud strategy.

Areas such as end-to-end security, which experienced modest 2% revenue growth in Q3, hold significant potential for acceleration. Given the impressive strides made thus far, management remains exceedingly optimistic about Cisco’s prospects in this rapidly-expanding market.

Finally, the exponential rise of generative AI is poised to revolutionize industries worldwide, and Cisco is well-positioned to leverage this trend. The company’s core networking technology already empowers leading AI models employed by global hyper-scalers such as Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) and Microsoft (NASDAQ:MSFT), granting Cisco a noteworthy “first-mover advantage” in this domain.

Moreover, Cisco has swiftly capitalized on generative AI capabilities within its own product portfolio, which holds the potential to expedite innovation. While this aspect remains somewhat speculative, it underscores Cisco’s ability to pursue avenues for growth in an ever-evolving world.

Is CSCO Stock a Buy, According to Analysts?

Turning to Wall Street, Cisco Systems has a Moderate Buy consensus rating based on five Buys and 11 Hold ratings assigned in the past three months. At $55.75, the average Cisco Systems stock price target implies 7.6% upside potential.

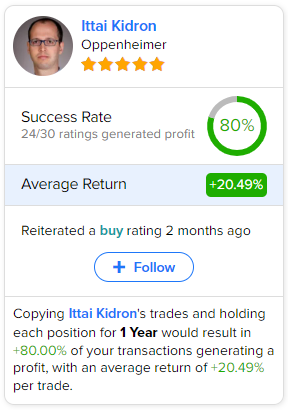

If you’re wondering which analyst you should follow if you want to buy and sell CSCO stock, the most profitable analyst covering the stock (on a one-year timeframe) is Ittai Kidron from Oppenheimer, with an average return of 20.49% per rating and an 80% success rate.

Final Thoughts

Cisco continues to demonstrate its strength and resilience in the evolving tech landscape. The company is well-positioned for continued success with solid financial results and a positive industry outlook. Cisco’s focus on growth catalysts such as cutting-edge network devices, cybersecurity solutions, IoT technology, and AI advancements solidifies its dominance and fuels its robust growth trajectory.

As the firm capitalizes on subscription-based revenue, expands its presence in the security market, and leverages generative AI, it should remain at the forefront of innovation, ensuring a promising future.

In the meantime, based on the company’s year-to-date performance and management’s strong Q4 guidance, consensus estimates for Fiscal 2023 point to earnings per share of about $3.81. Besides implying solid year-over-year growth of 13.3%, this figure also implies that shares of Cisco are currently trading at a forward P/E of just 13.4.

This multiple is notably lower than the S&P 500’s (SPX), which is relatively strange given that the company is growing in the double-digits and enjoying several tailwinds ahead. Hence, there could be further upside for shares of Cisco moving forward, despite their extended rally over the past year.