The Chinese electric vehicle market has been one to watch lately. Exemplified by its hometown equivalent of the Big Three—Xpeng (NYSE:XPEV), Li Auto (NASDAQ:LI), and Nio (NYSE:NIO)—it’s generated no shortage of interest as China looks to stake a claim on the next big thing in personal transportation. Recent delivery numbers have emerged for the trio, and the news isn’t that great.

All three companies lost ground not long after rolling out the latest delivery numbers. While each is up—and up substantially—against this time last year, the numbers presented aren’t great news. Xpeng delivered 9,578 vehicles for the month of August 2022. That was a 33% increase over the numbers seen in August 2021.

Nio had a slightly better August, coming in at 10,677 vehicles for an 8.16% jump against August 2021. Meanwhile, Li Auto delivered just 4,571 vehicles for the same period. Interestingly, Li didn’t offer a comparison against this time last year.

In the last 12 months, Xpeng shares are down by more than half. Last September, Xpeng came in at just under $41. Today, it’s down to around $18.

Li Auto, meanwhile, has lost about $3 of its share value since this time last year, going from about $31 to around $28. Finally, Nio had a similar fate to Xpeng, starting off last September at around $40 and dropping down to about $19.

Given the state of the Chinese market as a whole, and the Chinese electric vehicle market, in particular, I don’t much like where any of it is going. Thus, I’m bearish on all three companies. What happens to one is likely to happen to the others, to at least some degree, and there are very few bright spots coming out of China right now.

Stocks of XPEV, LI, and NIO are Unlikely to Outperform

Part of the Chinese automakers’ investor sentiment is readily available. Each currently has a Smart Score on TipRanks, and the news for some is much better than for others. None of the three, however, are faring well. Li Auto comes out the best right now, with a Smart Score of 6 out of 10. That’s the second-highest level of “neutral,” meaning it will likely perform in line with the broader market.

Nio, meanwhile, comes in next-best. It has a Smart Score of 4 out of 10, the lowest level of “neutral.” That makes it a bit more likely than not to lag the broader market.

Finally, Xpeng fares the worst of the trio. Xpeng has a Smart Score of 1 out of 10, the lowest possible score and the lowest level of “underperform.” That makes it one of the most likely stocks covered to lag the broader market.

Chinese EV Stocks Not That Great Compared to Global Competitors

As exciting as some of the numbers out of the Chinese electric vehicle market look, they don’t exactly hold up well when staging broader comparisons to the rest of the vehicle market. Start by taking a look at Tesla (NASDAQ:TSLA).

While August numbers for Tesla aren’t out yet, reports suggest that Tesla may be on track for a record quarter. Tesla shipping tracker VedaPrime reported a seventh ship’s worth of deliveries and “many thousands of Tesla” already arriving. In addition, the Giga Shanghai factory is set to record “record production,” other reports note.

It only gets worse when expanding to traditional automakers. Nio delivered a total of 10,677 vehicles for August. Ford (F), meanwhile, delivered 17,763 Ford Explorers. Just one car in Ford’s entire portfolio nearly doubled the best numbers for the entire Chinese electric vehicle industry.

That’s not good news for the Chinese market. Looking at the macroeconomic picture for China is even worse. A little over a month ago, bank runs were spreading like wildfire in China. Two local banks entered bankruptcy procedures just days ago.

Dragging things down further for China is the country’s real estate and housing market. One of the leading developers in China, Country Garden, reported a 96% drop in its first-half profits.

It describes the larger property market as being in “severe depression.” Throw in a growing number of Chinese citizens who now refuse to pay their mortgages, and the problem only worsens.

The Chinese real estate markets are sufficiently dangerous to prompt concerns for the entire global economy at this point.

While issues of Chinese banking and real estate are really only peripherally connected to the Chinese electric vehicle market, there is a connection nonetheless.

If Chinese citizens are having difficulties accessing their money from local banks, then how in the world will they buy an electric car? If Chinese citizens refuse to pay mortgages on properties that have yet to even be built, then again, why will they buy an electric car?

Are Chinese EV Stocks a Good Buy?

Turning to Wall Street, Xpeng has a Moderate Buy consensus rating. That’s based on six Buys and three Holds assigned in the past three months. The average Xpeng price target of $47.40 implies 165.1% upside potential. Analyst price targets range from a low of $22 per share to a high of $153 per share.

Meanwhile, analysts are more bullish on Li Auto, as it has a Strong Buy consensus rating. That’s based on nine Buys assigned in the past three months. The average Li Auto price target of $68.89 implies 153% upside potential. Analyst price targets range from a low of $39 to a high of $238.

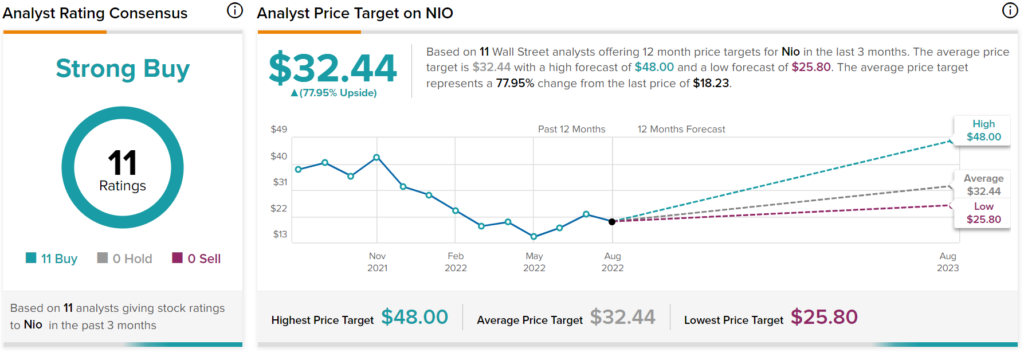

Lastly, Nio also has a Strong Buy consensus rating. All 11 analysts covering the stock have issued Buy ratings in the past three months. The average Nio price target of $32.44 implies 78% upside potential. Analyst price targets range from a low of $25.80 to a high of $48.

Conclusion: Great Prices, Bad Timing for Chinese EV Stocks

It’s easy to be tempted by the surprisingly low prices on Li Auto, Xpeng, and Nio. Upside potentials range from the nearly-double to the pushing-triple. Taking out a flier here may not prove a bad idea once it’s all said and done. The problem with these upside potentials, though, is that they depend at least somewhat on normalcy reasserting itself. These upside potentials were often established before multiple bank runs, mortgage protests, and before the Chinese locked down yet another city over COVID-19.

Just hours ago, China locked down the city of Chengdu, taking 21.2 million people’s lives off-line for a while. These are not people who will likely buy an electric car tomorrow.

That’s why I’m bearish on the Chinese electric vehicle market, including the shares of Nio, Li Auto, and Xpeng. All three are likely to be hit by the same conditions in the broader Chinese market. With a slew of competitors in the rest of the world’s markets, that’s going to leave the Chinese market leaning more on China, which is proving to have troubles of its own.