Chewy (NYSE:CHWY) stock is falling today, even though the company posted decent revenue growth. Check Chewy’s profit margins, and you’ll see why investors dumping their shares. Overall, I’m neutral on CHWY stock and am not considering taking a long position until there’s more positive data available in the upcoming quarters.

Chewy is based in Florida and offers pet products online, including food, treats, medications, and other pet supplies. Certainly, Chewy is doing better than the notorious Pets.com, whose stock soared and then crashed during the dot-com bubble of the early 2000s.

However, the market is treating Chewy like Pets.com today, as CHWY stock is currently down over 11% for the day. As we’ll see, Chewy is profitable and posted top- and bottom-line Street beats. There’s a major problem, though, and in my opinion, this isn’t the right time to take a bite of Chewy stock.

Chewy’s “Solid” Quarterly Results

“We delivered solid results in Q2 across both topline and profitability,” Chewy CEO Sumit Singh proudly declared in the company’s second-quarter earnings report. To a certain extent, Singh’s company has earned the right to brag about its results.

Here’s the scoop. In the second quarter of 2023, Chewy’s revenue increased by 14.4% year-over-year to $2.78 billion, exceeding the consensus estimate by $20 million. Perhaps RBC Capital analyst Steven Shemesh and JPMorgan (NYSE:JPM) analyst Doug Anmuth had Chewy’s decent sales growth in mind when they recently issued Buy ratings on CHWY stock.

There’s a fair chance that Shemesh will end up revising his $44 price target on the stock, though, as it has lurched toward the $25 area on heavy trading volume today. I’d say that the $29 price target for Chewy stock issued by Piper Sandler analyst Peter Keith and the $31 forecast published by Wedbush analyst Seth Basham are more realistic now.

Turning to the bottom-line results, Chewy reported adjusted second-quarter EPS of $0.15, thereby surpassing the consensus earnings forecast by $0.06. So far, so good. Is it possible that Chewy’s quarterly results were really “solid,” as the company’s CEO seemed to suggest?

Chewy’s Main Problem in 2023

Before you make any investment decisions, it’s a great idea to read a company’s financial reports from top to bottom. If you only glance at the headline numbers, you might miss some important details.

Specifically, Chewy’s profit margins were already thin and appear to be getting even thinner. In Q2 2023, the company’s gross margin improved by 20 basis points year-over-year to 28.3%, but that’s not the full story. Unfortunately, Chewy’s net margin declined 20 basis points to 0.7%, reflecting the company’s higher operating expenses and an increase in promotional activity.

Going forward, investors should insist that Chewy’s management release an action plan to reduce the company’s expenditures. That way, Chewy’s decent revenue growth can hopefully translate to improved net margins.

Ultimately, the ability to generate sales isn’t Chewy’s primary problem. Unlike Pets.com in the year 2000, Chewy offers valid reasons for investors to believe that Chewy can drive substantial revenue. The company’s Autoship business has been particularly robust, so it’s fine for Chewy to continue focusing on that.

Looking ahead, Chewy anticipates full-year 2023 revenue in the range of $11.15 billion to $11.35 billion. Whether the company will parlay its sales into higher net margins is another story entirely.

Is Chewy Stock a Buy, According to Analysts?

On TipRanks, CHWY comes in as a Moderate Buy based on 13 Buys, five Holds, and one Sell rating assigned by analysts in the past three months. The average Chewy stock price target is $43.61, implying 80.2% upside potential.

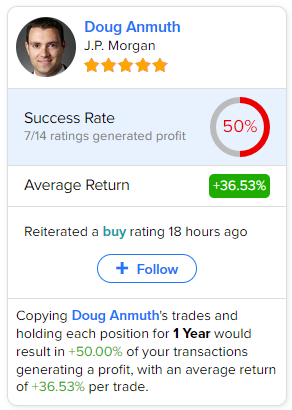

If you’re wondering which analyst you should follow if you want to buy and sell CHWY stock, the most profitable analyst covering the stock (on a one-year timeframe) is Doug Anmuth of JPMorgan (NYSE:JPM), with an average return of 36.53% per rating and a 50% success rate. Click on the image below to learn more.

Conclusion: Should You Consider Chewy Stock?

Chewy probably won’t fail like Pets.com, but don’t just focus on the company’s sales. Keep an eye on Chewy’s net margins, as they’re alarmingly thin in 2023 so far.

Today’s sell-off in CHWY stock was harsh but possibly justified. I don’t think that investors should consider an investment in Chewy yet. Instead, I will be keeping tabs on Chewy’s financials and hoping that the company’s management announces a specific action plan to cut costs soon.