The struggles of the EV industry have been well-documented in 2023, with the difficult macro backdrop and waning demand combining to depress sentiment. That has also bled over to the industry’s providers of ancillary services. For instance, shares of EV charging network operator ChargePoint (NYSE:CHPT) have lost 76% of value throughout the year.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

A big chunk of that loss came in the wake of the company’s mid-November preliminary announcement of the third quarter of fiscal 2024 results (October quarter) when ChargePoint said revenue for the quarter will come in between $108 to $113 million, compared to prior expectations of $150 to $165 million.

So, by the time the company released the full Q3 statement last week, investors had already digested the worst of it. Still, revenue came in below the mid-point of the new guide, hitting $110.28 million, representing a 12% year-over-year decline while also missing the Street’s call by $8.3 million. Segment-wise, networked charging systems revenue fell by 24% y/y to $73.9 million while subscriptions revenue improved by 41% compared to the same period a year ago to reach $30.6 million. At the other end of the equation, EPS of -$0.43 fell short of the consensus estimate by $0.12.

With a new management team at the helm, the company refrained from offering a guide for F4Q it reiterated its intention to turn adjusted EBITDA positive by the end of FY25 (CY24).

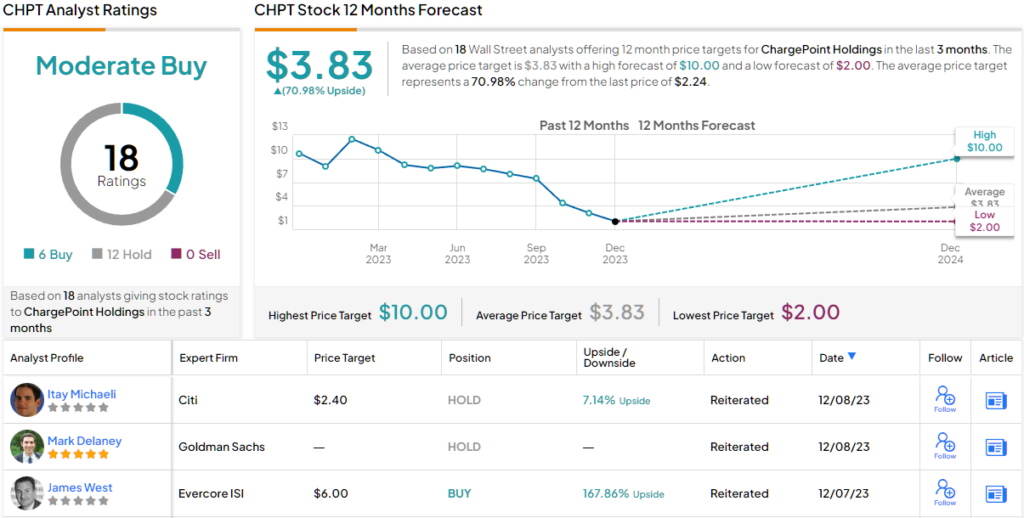

Moving forward, given L2 corporate charging is a “high margin business,” Goldman Sachs analyst Mark Delaney thinks it will be important to keep an eye on enterprise demand. Another issue to monitor will be the extent Tesla “expands its efforts providing white label EV charging hardware (which would be incremental competition for ChargePoint).”

On balance, for now, there’s no change to Delaney’s overall stance. “While we believe that ChargePoint can participate in the growth of the charging industry as EV adoption rises driven by its broad-based product set and asset-light business model, we believe that competition and mix shift could limit margin improvement,” the 5-star analyst said. “We also believe that the stock could be range-bound until investors gain more visibility into the longer-term earnings and FCF of the business.”

Accordingly, Delaney maintained a Neutral rating on CHPT shares along with a $2.50 price target, suggesting the stock has ~12% upside over the coming year. (To watch Delaney’s track record, click here)

On the other hand, the Street’s average target is a more exuberant $3.83, implying shares will appreciate by 71% in the year ahead. All in all, based on a mix of 6 Buys and 12 Holds, the analyst consensus rates the stock a Moderate Buy. (See CHPT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.