ChargePoint Holdings (CHPT) is scheduled to release its results for the second quarter of Fiscal 2023 (ending July 30) on August 30, after the market closes. ChargePoint offers networked electric vehicle (EV) charging systems and cloud-based software, and related services to residential and commercial customers as well as fleet operators.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

CHPT stock has lost 23.1% so far this year. However, a slew of good news on the EV front has helped boost the stock by 6.3% in the past week.

A Look at ChargePoint’s Q2 Expectations

The Street expects ChargePoint to post a diluted loss of $0.20 per share in Q2, better than its comparative prior-year’s loss of $0.29 per share. Meanwhile, revenue is pegged at $103.03 million, representing a massive year-over-year jump of 83.6%.

On the other hand, ChargePoint forecasted Q2 FY23 revenue in the range of $96-$106 million. It expects full-year FY23 revenue between $450-$500 million.

In its Q1 FY23 results, ChargePoint’s President and CEO, Pasquale Romano noted that persistent supply chain constraints had marred the company’s performance. Moreover, rising costs decreased its adjusted gross margin by 600 basis points to 17%.

Notably, in Q2, supply chain issues and escalated costs could continue to impact ChargePoint’s results to a certain extent.

However, these macroeconomic headwinds are expected to soften in the second half of the year. This will boost ChargePoint’s margins and production capabilities going forward. This viewpoint is backed by the company’s full-year adjusted gross margin outlook in the range of 22% to 26%, which reflects an improvement compared to the Q1 gross margin.

Well Positioned for Long-Term Growth

Notably, ChargePoint also remains one of the biggest beneficiaries of the Inflation Reduction Act (IRA) passed recently. America’s clean and green energy initiatives have gained a much-needed boost from the IRA. Both EV manufacturers and EV charging infrastructure companies, like ChargePoint, will be well awarded when consumers avail the credits under the Act to buy more EVs.

Furthermore, ChargePoint is also venturing into advertising through a partnership with Ara Labs Inc. and Destination Media Inc. Ara Labs is a digital display company, while Destination Media produces video ads at fuel pumps and retail outlets. ChargePoint intends to create an advertising network by installing advertising screens across the U.S. to earn an extra buck. In the long run, this venture will likely add decent dollars to ChargePoint’s revenue stream.

Is CHPT a Buy Now?

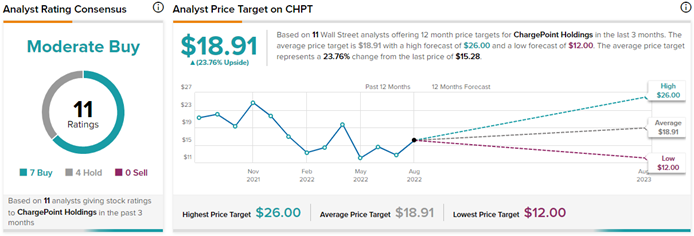

Wall Street analysts are cautiously optimistic about CHPT stock. On TipRanks, CHPT stock has a Moderate Buy consensus rating based on seven Buys versus four Holds. The average ChargePoint Holdings price target of $18.91 implies 23.8% upside potential to current levels.

Similarly, retail investors are being cautious about CHPT stock. TipRanks’ Stock Investors tool shows that investor sentiment is currently Negative on ChargePoint Holdings, with 1.1% of portfolios tracked by TipRanks decreasing their exposure to CHPT stock over the past 30 days.

Parting Thoughts

ChargePoint is one of the favored stocks within the EV charging infrastructure segment. However, supply chain issues and higher costs are posing a challenge to its margins. In the long run, ChargePoint may be able to manage its costs once these headwinds soften. Also, the company’s performance will be bolstered by the impetus of the IRA. All in all, short-term challenges persist but the long-term outlook for ChargePoint remains rosy.