It’s not just the tech stocks that can grow at an impressive pace over time. Within the beverage scene, there are a handful of compelling companies that are more than able to quench investors’ thirst for growth. And unlike the high-flying tech firms, growth to be had in the beverage plays may not be so quick to fade should the economy further tilt into a slowdown. That’s the beauty of consumer staples companies.

At the end of the day, beverage companies are better equipped to deal with times of economic hardship than most growth firms. Therefore, in this piece, we’ll use TipRanks’ Comparison Tool to check in with three analyst-favored beverage stocks that may just be able to give your portfolio a jolt.

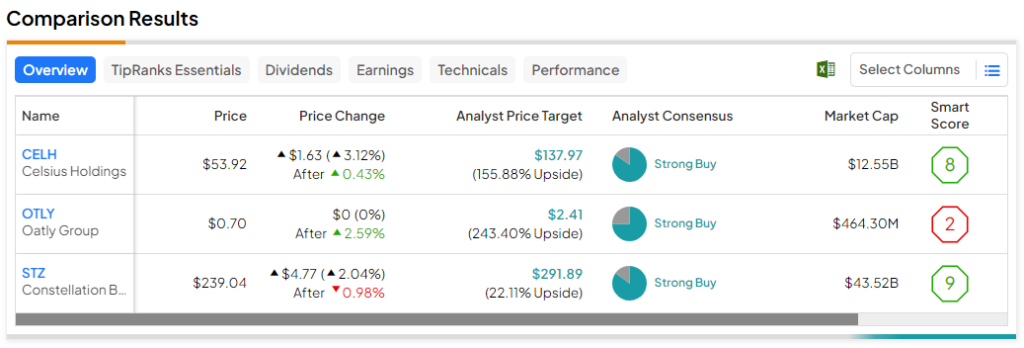

Celsius Holdings (NASDAQ:CELH)

Celsius Holdings has been one of the hottest stocks over the past five years, surging by quadruple-digit percentage points over that time frame. Indeed, it’s quite surprising to see a drink stock keeping up with the likes of the tech industry’s biggest winners. Unlike many tech high flyers, Celsius competes in a market that’s pretty easy to understand. The beverage space is where legendary investor Warren Buffett made a great deal from his old-time Coca-Cola (NYSE:KO) investment.

Though Coke remains the king of the sugary cola space, a new corner of the beverage market has really taken off in recent years — healthy energy drinks. It’s a market where Celsius has really shined. And though it’s always a dangerous game to chase top performers, many analysts still view plenty of market share for Celsius to take. That alone makes me bullish on Celsius as it looks to justify its high price of admission to the world.

Despite the massive gains posted in recent years, Celsius remains a relatively small fish ($12.55 billion market cap) in an ocean where the tide is in its favor. The stock is down around 23% from its all-time high, near $70 per share, but the turbulence isn’t giving analysts pause.

Celsius stock recently won a new bull over at Jefferies. Analyst Kaumil Gajrawala thinks Celsius is more than just a hot, new drink; he views it as a lifestyle brand with mass appeal. He’s absolutely right, in my opinion.

The company doesn’t just have a great product and room to run; it has what it takes to be an industry disruptor that can nudge consumers to reach for a Celsius beverage over alternatives at the convenience store. In that regard, the sugary soda plays — think Coke — may have a moat that could be challenged as Celsius moves in on the relatively untapped international markets like Canada and Europe.

Celsius has the formula for even greater growth. And with that, shares rightfully deserve to trade at a lofty premium (58.14 times forward price-to-earnings (P/E)) to the peer group.

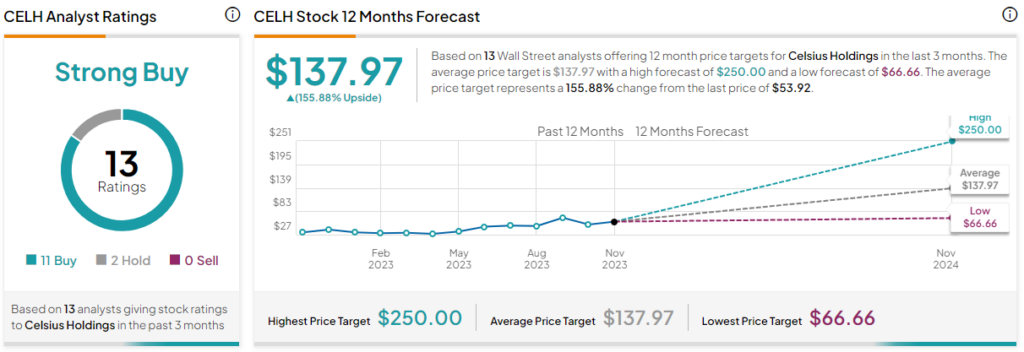

What is the Price Target for CELH Stock?

Celsius is a Strong Buy, according to analysts, with 11 Buys and two Holds assigned in the past three months. The average CELH stock price target of $137.97 implies 155.9% upside potential from here.

Oatly (NASDAQ:OTLY)

Swedish oat milk maker Oatly has been a massive dud for investors, now down over 97% from its peak hit shortly after its much-followed IPO. Indeed, I was quite shocked to learn the stock now trades at $0.70 per share, just over two years after it went live on the Nasdaq exchange.

Undoubtedly, the IPO price was unreasonably expensive, given that oat milk is essentially a commodity. In the years following the IPO, a lot has gone wrong for the firm. Sales have been sagging domestically, and management has been forced to trim away at guidance. It doesn’t help that Oatly hasn’t been able to squeeze out a profit. Add haze over the Asian market into the equation (where Oatly also does business), and you can’t really fault analysts for cutting estimates on the company in recent quarters.

So, what is there to be bullish about? Other than the dirt-cheap valuation and the catchy brand, not a heck of a lot. That said, even a battered and bruised stock can be a great purchase if you pay a low enough price! The growth potential in Asia, I believe, is the one reason to give the stock the benefit of the doubt as it sinks into the abyss. I’m bullish, but I do acknowledge the speculative nature of the stock at below a buck per share.

At writing, OTLY stock trades at 0.79 times price-to-book (P/B) and 0.78 times price-to-sales (P/S). Only time will tell if the company can recover from a horrid year. If management can’t jolt growth and make progress on the margin front, Oatly may very well be a value trap. However, if it can, the stock could have serious upside potential. However, its high potential comes at the cost of equally elevated risks as the company hovers on the fine line between being a value trap and a “return-to-growth” story.

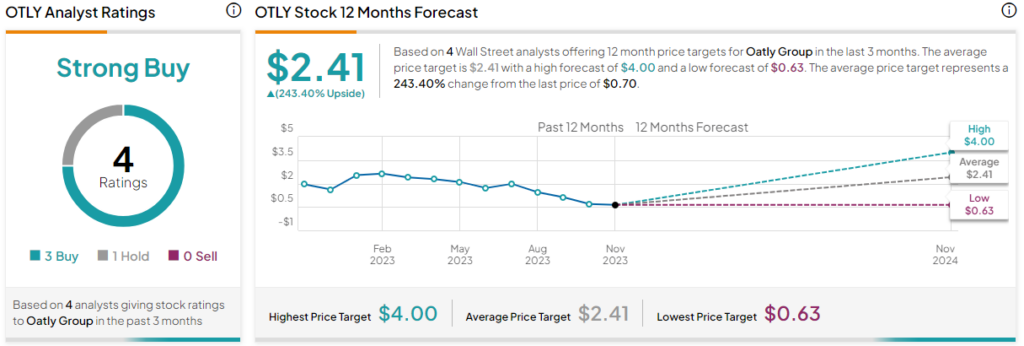

What is the Price Target for OTLY Stock?

Oatly’s a Strong Buy, according to analysts, with three Buys and one Hold. The average OTLY price target of $2.41 entails 243.4% upside.

Constellation Brands (NYSE:STZ)

Constellation Brands is an alcohol company that’s been growing sales at a steady mid-single-digit rate over the last few years. Shares have been a less turbulent ride than Celsius or Oatly. Regardless, the firm has growth drivers it can pull to keep the slow and steady ascent going strong. Premium beer (think Modelo Extra and Especial) has been a strong point for the company.

Only time will tell how long the momentum in high-end beers will go on. I think it could be a strong suit for the firm as its Wine and Spirits division looks to bounce back from a sluggish quarter.

For now, I’m staying bullish on the firm while it trades at 28 times trailing P/E, a slight premium to the wineries & distilleries industry average of 24.1 times. Given Constellation’s robust beer portfolio and the relatively defensive nature of alcoholic beverages, the stock still looks enticing going into year’s end.

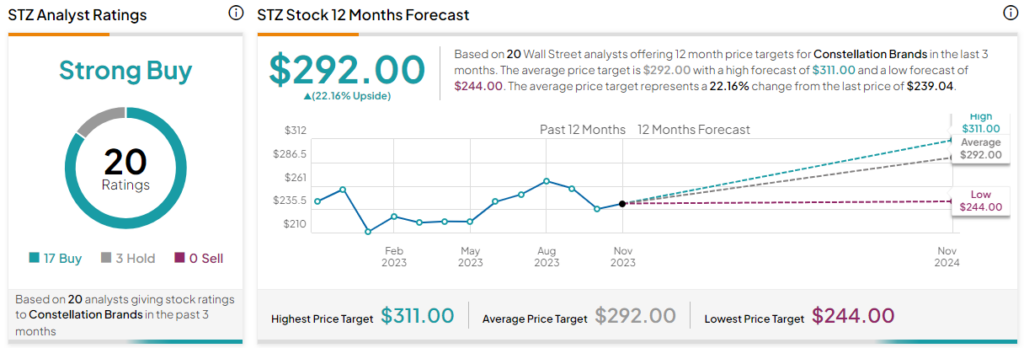

What is the Price Target for STZ Stock?

Constellation’s a Strong Buy, according to analysts, with 17 Buys and three Holds. The average STZ price target of $292.00 implies 22.2% upside potential.

The Takeaway

Beverage stocks are worth a sip if you’re looking for robust growth in a potential recession year. Whether you seek hyper-growth, a growth reacceleration, or slow and steady growth, the following trio of drink stocks looks intriguing. Of the trio, analysts expect the most upside from OTLY stock — high risk, high reward.