Beverage stocks may not be as exciting as AI stocks, but they can provide resilient returns through harsh economic conditions. Better yet, their performances could be less tied to the fate of the broader Nasdaq 100 (NDX), which may be overdue for a slight dip going into year-end. Wall Street seems to view the following trio of drink stocks — CELH, KO, MNST — in high regard, with Strong Buys rewarded by the analyst community.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

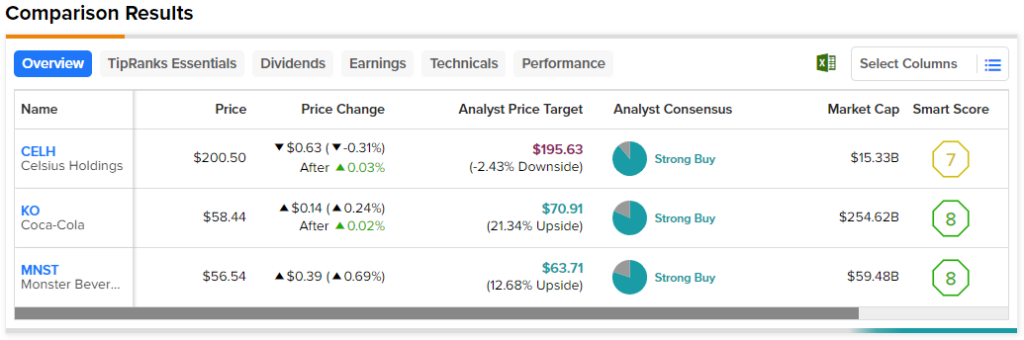

Therefore, let’s use TipRanks’ Comparison Tool to compare how analysts view the following three drink stocks and what to expect for the year ahead.

Celsius Holdings (NASDAQ:CELH)

Up first, we have the most exciting beverage stock of the batch. Celsius Holdings is a relative newcomer and lightweight (a mere $15.3 billion market cap) to the fizzy drink scene. Still, its recent surge in popularity among young people is difficult to ignore. Further, there’s ample runway for growth as the firm looks to earn more in a massive market that could be ripe for disruption.

Year-to-date, Celsius stock has nearly doubled. Indeed, the chart suggests Celsius is an AI company and not a beverage maker. Though Celsius differentiates itself as a more health-conscious option in the energy drink market, only time will tell if the firm can sustain such a sky-high premium to the peer group as market waters look to get rougher. Undoubtedly, should the firm keep expanding its reach to disrupt incumbent beverage makers, there’s a good chance the good times could keep on coming.

Though I’ve not tried a Celsius drink personally, I must say I’m impressed by the triple-digit growth rate (revenues soared 111.6% in its quarter ended June 2023), which could stay elevated as long as the product remains relevant among younger consumers. What is less impressive, however, is the valuation.

The stock looks priced for perfection, priced at 82.4 times forward price-to-earnings (P/E), well higher than the non-alcoholic beverage industry average of 21.4 times.

Due to the rich multiple and a bold, bearish recent call from Maxim (a firm that recently called the top in CELH shares due to overvaluation concerns), I’m inclined to be neutral on the stock for now. That said, I’m always open to switching my stance should a pullback strike in the near future. Ultimately, Celsius is one of the market’s fastest growth stories, and it’s not even an AI play!

Aside from Maxim, most analysts remain very upbeat about the growth story and think more gains are in the cards.

What is the Price Target for CELH Stock?

Celsius Holdings is a Strong Buy, with eight Buys and one Hold. The average CELH stock price target of $195.63 implies 2.4% downside, however.

Coca-Cola (NYSE:KO)

If extremely high growth and valuation multiples aren’t your cup of tea, perhaps a classic beverage firm like Coca-Cola is worth consideration. The stock stands out as a better value play in the non-alcoholic drink scene (relative to CELH), with a trailing P/E of just 24.1 times. Along with a 3.1% dividend yield, it’s hard for value seekers to go wrong with KO stock, even as recession odds continue to retreat.

The stock may not have done much over the past year (shares slipped by 1%), but the beverage maker has potential growth drivers, like AI-created flavors, that could help it break out of its funk. AI-made drinks may seem a tad gimmicky, but I still think many people will likely want to try and buy them. As the old-school firm looks to bring marketing and beverage innovation into the new age, it’s hard not to be bullish.

Even if the mysterious “futuristic” AI Coke doesn’t hit the spot for consumers, I believe dabbling in AI is a brilliant marketing decision. At the end of the day, Coca-Cola is a legendary brand built on the back of magnificent marketing.

In the latest (second) quarter, KO delivered strong results while demonstrating great pricing power, with average selling prices rising by 10%. Looking ahead, the future looks bright as new colas garner interest from young consumers. Recession or not, analysts think KO seems poised to do well for the year ahead.

What is the Price Target for KO Stock?

Analysts are drinking some Coca-Cola, giving the stock a Strong Buy comprised of nine Buys and one Hold. The average KO stock price target of $71.60 implies 22.5% upside potential.

Monster Beverage (NASDAQ:MNST)

Monster Beverage is fresh off a strong past year of gains, with shares up 27% over the span. While hot competitors like Celsius could erode Monster’s dominance, most analysts remain remarkably upbeat on MNST. For instance, HSBC analyst Carlos Laboy praised the stock for its labels to target more female consumers in America (most Monster fans are men).

Potential “growth catalysts” highlighted by Mr. Laboy could help Monster offset competition pressures. With a 41.3 times trailing P/E multiple, Monster’s valuation lies in a comfortable middle zone between the higher-growth Celsius and the long-time stalwart Coca-Cola. All considered, I’m staying bullish alongside the Wall Street crowd. Monster stock still has legs, but it will be interesting to see how the battle with Celsius pans out over the coming years.

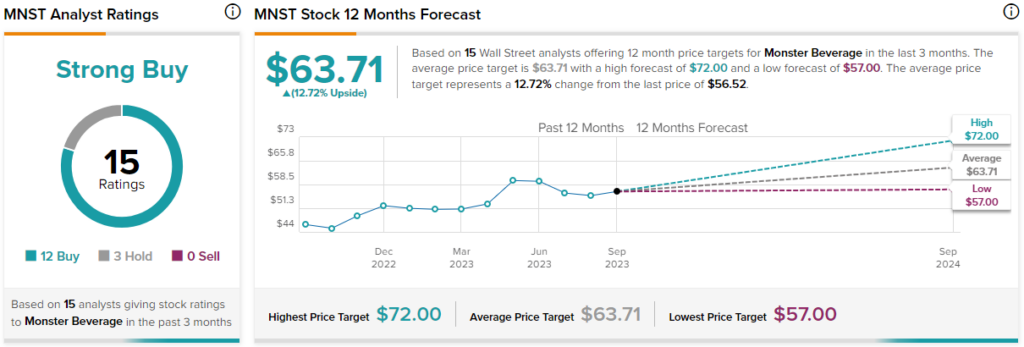

What is the Price Target for MNST Stock?

Monster is a Strong Buy, with 12 Buys and three Holds. The average MNST stock price target of $63.71 implies 12.7% upside potential.

Conclusion

Drink stocks are a great place to score defensive growth as a potential recession and rising interest rates look to weigh on market sentiment. Of the trio of stocks in this piece, analysts expect the most upside from KO stock.