Since hitting bottom last October, the S&P 500 has bounced back strongly – in fact, it’s up approximately 27% from that trough. A rally of that magnitude meets the definition of a bull market, and some economists are saying we’re experiencing just that.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Among the bulls is Cathie Wood, who believes that a big shift is taking place. “The market is starting to look to the other side of the interest rate increase and they’re starting to look at inflation which is crumbling,” she noted. The Fed will have to adjust to the leading indicators of inflation “coming down rapidly” and then we’ll be “on the other side of the horror show we went through.”

Wood has not been shy about loading up the truck with names she believes in, both in difficult and better times. During the second quarter, through her ARK Investment Management firm, she bought more shares of two stocks that are currently trading under $10.

In fact, it’s not only Wood who favors these names. Using the TipRanks database, we found that both are also rated as ‘Strong Buys’ by the analyst consensus. Let’s take a closer look.

Markforged Holding (MKFG)

For our first Cathie Wood-backed name, we’ll turn to Markforged, a disruptor in the additive manufacturing industry – basically, the industrial production term for 3D printing.

Founded in 2013, the company has revolutionized the world of industrial-grade 3D printing by introducing composite and metal 3D printers. Markforged’s unique approach combines traditional 3D printing techniques with continuous fiber reinforcement that enables the production of robust and high-strength parts for a wide range of applications.

By using materials such as carbon fiber, fiberglass, and metal powders, the printers can fabricate components that are significantly stronger and more durable than those created with conventional plastic-based 3D printers. This has made Markforged a partner of choice for industries like aerospace, automotive, engineering, and manufacturing, where the demand for lightweight, strong, and complex parts is critical for success.

After generating record hardware revenue in 4Q22, Markforged notched record consumables and services revenue in Q1, and that helped sales reach $24.09 million, amounting to a 10.2% year-over-year increase and beating the Street’s call by $1.17 million in the quarter. The company also beat Q1 consensus estimates by ~8% on the adj. gross margin front, recording adj. gross margin of 49.4%, a 190bp sequential increase in what is seasonally the weakest quarter of the year. For the full year, the company stuck to its guide for revenue in the range between $101-110 million and a 47-49% adj. gross margin.

Cathie Wood is clearly showing her confidence here, snapping up 2,681,498 MKFG shares in Q2 through Ark Invest. The firm’s total holdings now stand at 21,246,648 shares, currently worth over $24 million.

It’s a purchase that most likely gets the thumbs up from Berenberg analyst Jared Maymon, who highlights the stock’s appealing valuation.

“We believe Markforged offers a differentiated set of hardware, consumables, and software,” Maymon said. “Consequently, we believe the company is capable of outpacing market growth consistently in the outyears while offering industry-leading gross margins. As a result, we believe Markforged will be an alpha-generative investment and is a high-probability acquisition target for key peers, assuming its valuation remains subdued.”

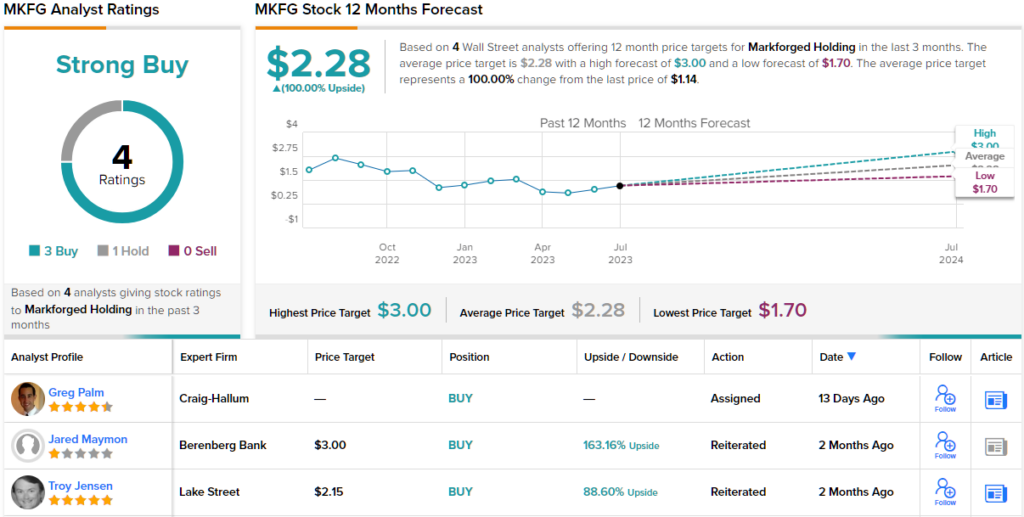

These comments underpin Maymon’s Buy rating while his $3 price target makes room for 12-month returns of a very healthy 163%. (To watch Maymon’s track record, click here)

Overall, Wall Street tends to agree with the bull. The 4 recent analyst reviews include 3 Buys and 1 Hold, for a Strong Buy consensus rating. The shares are currently trading for $1.14 and are expected to double in value over the coming year, considering the average target stands at $2.28. (See MKFG stock forecast)

Rocket Lab USA (RKLB)

For an ardent enthusiast of innovation like Cathie Wood, exploring opportunities in the space industry becomes a logical step, and that’s where the small-cap satellite launch company, Rocket Lab, comes into the picture. Notably, during Q2, Wood increased her stake in RKLB, buying 638,440 shares, and bringing Ark Invest’s ownership to 3,829,323 shares, currently valued at over $28 million.

Rocket Lab is known for its innovative Electron rocket, a lightweight and cost-effective launch vehicle capable of deploying payloads of up to 300 kilograms to low Earth orbit. The company is also constructing its own reusable rocket, the Neutron, taking the good fight to SpaceX’s Falcon 9. Rocket Lab is targeting a launch price of $50 million and with its debut slated for next year.

Earlier this month, the company launched its 39th Electron mission from Launch Complex 1 in New Zealand, deploying seven satellites into orbit, belonging to three customers: NASA, SFL, and Spire. This achievement comes after the company successfully executed three launches during the second quarter, per its guide, and brings the total number of successful missions for the year to seven.

Meanwhile the company is seeing some healthy growth. In the most recently reported quarter, for 1Q23, revenues increased by 35% to $54.89 million, beating the analysts’ forecast by $2.04 million. EPS of -$0.10 met Street expectations. Rocket Lab also recorded a 73% increase in gross profit, while growth of 23% for its selling, general, and administrative expenses – not as much as the revenue uptick – offers promise that margins will further improve, and the company can eventually turn a profit.

These improvements are evident to Stifel analyst Erik Rasmussen, who sees the stock benefiting from an improved balance sheet. “We remain encouraged by the company’s recent results, speed of execution, and scale of the business, which should get the company closer to profitability (the company is targeting Adj. EBITDA in 2H24, but depends on Neutron) and be a positive catalyst for the stock,” the 5-star analyst wrote. “Our thesis remains intact and continue to see RKLB as a true end-to-end space company that is scaling its business, while improving its market position.”

Accordingly, Rasmussen has a Buy rating on RKLB shares, backed with an $11 price target. The implication for investors? Potential upside of ~50% from current levels. (To watch Rasmussen’s track record, click here)

Overall, it’s clear that Wall Street likes what it sees here. The stock has 4 recent analyst reviews, and they all agree to Buy, making the Strong Buy consensus unanimous. The stock is selling for $7.33, and its $11.13 average price target suggests that it has room to grow ~51% in the year ahead. (See RKLB stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.