Carvana (CVNA) has seen its share price more than double from its lows in June. Since it seems that the company only has the ability to destroy value from an operations standpoint, there isn’t any fundamental catalyst to justify this rally. Therefore, investors should at least be aware of this before trying to ride the momentum.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Carvana Continues to Dilute Shareholders and Increase Bankruptcy Risk

Carvana isn’t a profitable company. In the last 12 months, Carvana’s free cash flow was -$2.7 billion – a staggering cash burn. In order to sustain this, it has to borrow a significant amount of debt and sell shares through equity raises. The former increases bankruptcy risk, while the latter dilutes shareholders.

In the last quarter, long-term debt ballooned from $3.04 billion to $6.3 billion. Indeed, when calculating the Altman Z-Score for Carvana, which measures bankruptcy risk, it has been steadily trending down and now sits at a score of 2. This puts it in the ‘grey zone,’ meaning that CVNA is close to the ‘distressed zone.’ This zone is reached when the score falls below 1.81. This clearly demonstrates that management has been increasing the risk to shareholders.

Furthermore, Carvana also raised $1.2 billion in equity financing. For reference, its share count rose from 90.1 million in Q1 to 101.5 million in Q2. This equates to a dilution of approximately 12.7%. Since the company is not expected to become profitable anytime soon, it’s likely that more value destruction will occur from an operating standpoint.

Investor Sentiment is Currently High

Despite the negative fundamentals, the sentiment among TipRanks investors is currently very positive. Out of the 553,246 portfolios tracked by TipRanks, 0.3% hold CVNA. In addition, the average portfolio weighting allocated towards CVNA among those who do have a position is 2.97%. This suggests that investors of the company are somewhat confident about its future.

In addition, in the last 30 days, 3.5% of those holding the stock increased their positions. As a result, the stock’s sentiment is above the sector average, as demonstrated in the following image:

Is CVNA Stock a Buy?

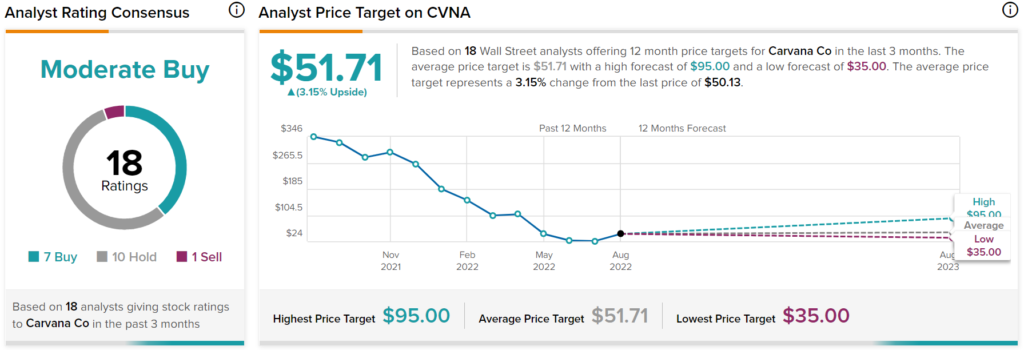

Carvana has a Moderate Buy consensus rating based on seven Buys, 10 Holds, and one Sell assigned in the past three months. The average CVNA price target of $51.71 implies 3.2% upside potential.

Takeaway – Know What You are Investing In

What makes the stock market interesting is that anything can happen. A stock like Carvana is fundamentally terrible, as its operations bleed money, and it relies on outside capital to stay in business. However, the share price has seen a strong rally as of late. Therefore, if you plan on riding CVNA’s momentum, just remember that it doesn’t deserve to reach its all-time high.