Investors had plenty of positives to savior in Carnival’s (CCL) latest quarterly update.

On the back of strong travel demand and an increase in cruise prices, the cruise line company generated record revenue of $5.4 billion in its fiscal fourth quarter (November quarter), amounting to a 40.6% year-over-year increase while beating the Street’s call by $120 million.

At the bottom-line, in what represented its most slender loss since the pandemic, adj. EPS of -$0.07 improved on the loss of $0.85 per share in the year-ago period while trumping analyst expectations by $0.06.

The company also brought its debt balance down by $4.6 billion from the heights seen in 1Q23 and saw out the fiscal year with $5.4 billion of liquidity.

On another positive note, although Carnival acknowledged potential headwinds to the travel sector due to geopolitical instability, inflation, and increased fuel costs, the company anticipates growth of over 30% in EBITDA for 2024 compared to the previous year. Additionally, it foresees a doubling of EBITDA in Q1 vs. the same quarter a year ago.

The report added more sheen to an exceptional performance for the stock in 2023 – the shares are up by a mighty 135%.

Moving forward, Deutsche Bank’s Chris Woronka thinks the bull case is driven by two major points. One being the potential for double-digit yield growth (2026E vs. 2024E) and the other being “further de-leveraging opportunities” making room for upside revisions to EPS.

However, Woronka sees two noteworthy rebuttals to the bullish argument. “The first is that the recent string of upward revisions to buy-side expectations is now likely closer to encountering a wall; that’s based on an opinion that the 2024 book of business is still benefiting from pent-up demand (i.e, one year behind resort hotels in the post-Covid recovery) and thus pricing gains may be nearing a top,” the analyst explained. “The second is that, in 2019, return of capital (both dividends and buybacks) were a critical piece of the CCL story but are not all that close to returning based on the level of de-leveraging still to go.”

As such, Woronka maintains a Hold rating although his price target rises from $14 to $18. However, that figure still represents downside of 5% from current levels. (To watch Woronka’s track record, click here)

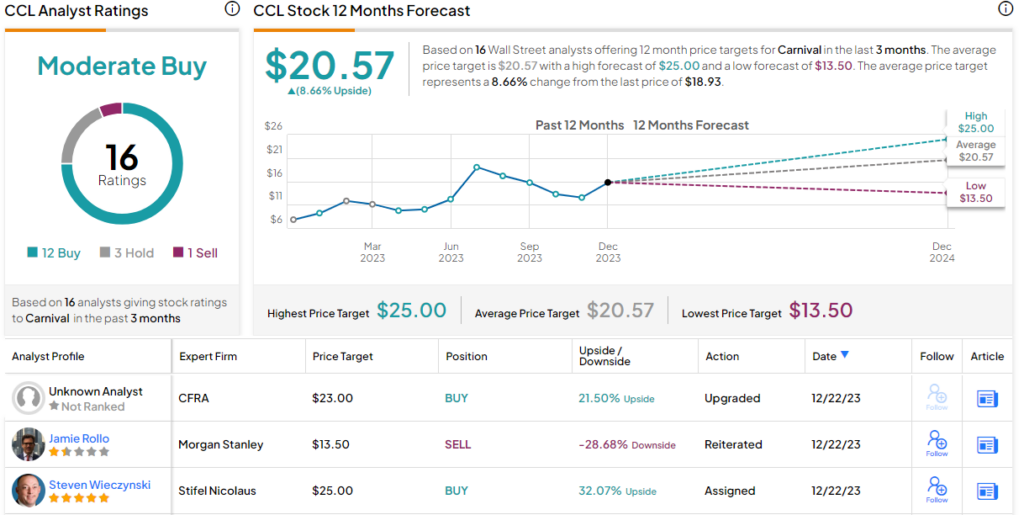

Amongst Woronka’s colleagues, 2 others join him on the sidelines, and with an additional 12 Buys and 1 Sell, the stock receives a Moderate Buy consensus rating. Over the coming year, shares are expected to climb 8.5% higher, considering the average target clocks in at $20.57. (See Carnival stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.