A lot of attention has been focused on the recent election, but some of the more mundane market trends are still in play. Among these is the seasonal vacation season, now getting into full swing.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Cruise stocks, in particular, have been charting an impressive course, and Truist analyst Patrick Scholes has taken notice.

“Given the impressive performance of the cruise stocks over the past three months, compared to the S&P 500, we go into our conversations and ‘big data’ analysis with the mindset of trying to find something concerning that could derail the party,” Scholes noted. “If there is one concern for the stocks in the near-term it is possible the cruise companies may come out on the conservative side to begin the year with when they provide 2025 earnings guides at 4Q earnings.”

“That said,” the analyst added, “should they start with conservatism, and these companies have a track record of (rightfully) doing so, based on our conversations and data analysis we see a continuation of quarterly beats & raises as the year progresses as opposed to a materially-above consensus guide to start the year.”

Against this backdrop, Scholes has taken a closer look at both Carnival Corporation (NYSE:CCL) and Norwegian Cruise Line (NYSE:NCLH), two industry heavyweights, ultimately identifying which cruise stock offers the most compelling buying opportunity as peak season approaches. Let’s take a closer look.

Carnival Corporation

We’ll start with one of the cruise industry’s largest companies, Carnival Corporation. The company boasts a market cap of nearly $32 billion, making it the second-largest player in the industry (Royal Caribbean is larger). The company operates through a number of brands, offering cruise experiences around the world. The leading brand, Carnival Cruise Lines, is an American brand, operating more than 20 ships out of 14 US home ports. The company also owns and operates the leading German cruise brand, AIDA, and the Italian Costa brand; together, these have some two dozen ships between them. Prominent among Carnival’s brands is the fabled Cunard name, one of the industry’s most venerable lines, which currently operates the Queen Mary 2, the Queen Elizabeth, the Queen Victoria, and the Queen Anne.

Whatever their brand, Carnival’s ships are easily recognizable on the seas, as they sail under distinctive liveries. The eponymous Carnival Cruise Line sports a unique funnel design, shaped like a whale’s tail and painted in the company’s red, white, and blue colors, while the Cunarders sail with black hulls and contrasting white superstructures. For passengers, the look is part of the experience.

For the company, the look and the experience draw in customers – but savings can be found in the engine rooms. Earlier this year, Carnival Corporation announced a major upgrade across its entire fleet to improve energy efficiency and reduce fuel consumption in its ships. The company is implementing this plan across all nine of its brands and expects to realize savings of 5% to 10% in fuel costs per ship.

That can only help the bottom line and the company’s total debt position. Carnival is carrying over $28 billion in debt, including debt left over from the period of COVID-related closures, but recent strong revenue and earnings numbers have allowed the company to pursue an aggressive payment plan. Since the start of 2023, Carnival prepaid as much as $7.3 billion in debt; its Q3 debt payments came to $625 million.

The company can do that with confidence because it’s been outperforming expectations recently. The fiscal 3Q24 report, the last released, showed a top line of $7.9 billion, up more than 15% year-over-year and some $80 million better than had been forecast. The non-GAAP EPS, reported as $1.27, was 12 cents better than expectations. We’ll see later this month how Carnival’s fiscal 4Q24 turned out, but for now, we should note that the company’s stock is up an impressive 81% since early August.

In his coverage of Carnival Corporation, Truist’s Scholes notes that the company faces stiff competition and that its leading position leaves it little room for further sales improvement. He writes of the cruise operator, “While we continue to envision rising tides lifting all boats, we often hear from travel executives that MSC, a ‘value priced’ brand that has been described as a ‘disruptor’ in this segment of the cruise market, continues to target Carnival’s customers on price… We note that MSC has been advertising very heavily as it continues to break into the North American market. Additionally, while we look favorably on CCL’s upcoming Celebration Key, as CCL’s annual sales are approx. 175% greater than NCLH’s and 55% more than RCL’s, we do not see this additional amenity moving the earnings needle as much as it would for a smaller company.”

For Scholes, this all adds up to a Hold rating on the stock, although his price target of $29 implies a one-year upside of 14%. (To watch Scholes’ track record, click here)

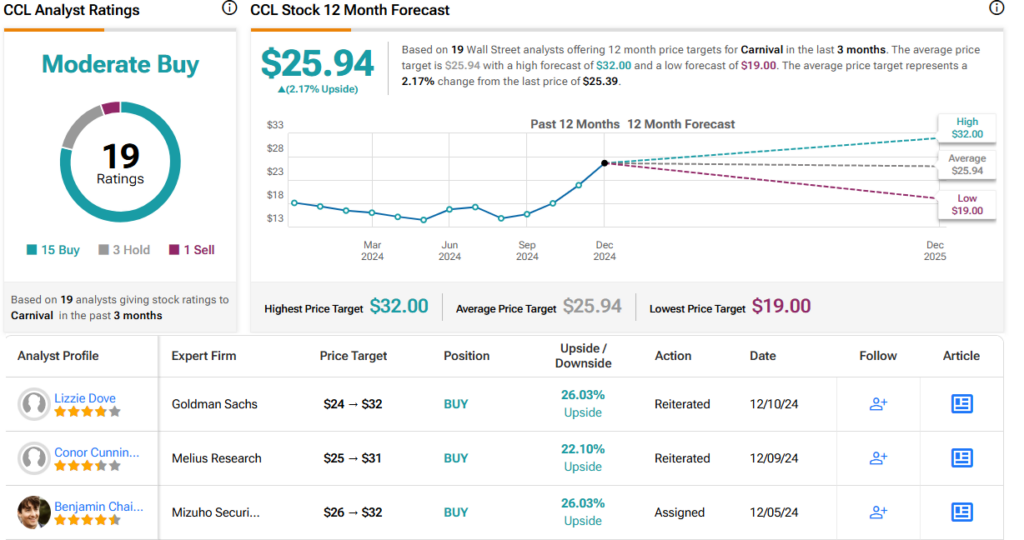

Overall, this stock gets a Moderate Buy consensus rating from the Street’s analysts, based on 19 recent reviews that include 15 to Buy, 3 to Hold, and 1 to Sell. The shares are priced at $25.39, and the average price target of $25.94 suggests the shares will stay rangebound for the time being. (See CCL stock forecast)

Norwegian Cruise Line

The second stock we’re looking at here, Norwegian Cruise Line Holdings, is the fourth-ranked cruise company in the global market, with a market cap of nearly $11.5 billion. The company, like Carnival Corporation above, operates as a holding firm, and its active cruise operations are conducted through three brands. These are Norwegian Cruise Lines, Oceania Cruises, and Regent. Together, Norwegian’s brands have 32 ships on the seas, employ over 41,000 people, and boast over 66,000 passenger berths. The company’s destinations include two luxury-level private islands.

Norwegian is working to expand and modernize its facilities and operations and currently has 13 ships on order, with deliveries expected from 2025 through 2036. These deliveries will bring with them some 41,000 passenger berths.

We can note here that, last year, Norwegian served approximately 2.7 million guests and generated total revenues of $8.55 billion. Looking ahead, the company expects that it will see more than $9 billion in revenue for 2024 and carry some 2.9 million guests aboard its ships. The company has raised its full-year 2024 guidance several times this year based on actual performance metrics.

In 3Q24, the last period reported, Norwegian’s total quarterly revenue came to $2.8 billion – a company record, up almost 11% year-over-year and $40 million ahead of the estimates. The bottom-line EPS, reported in non-GAAP figures, came to 99 cents – a nickel better than had been forecast and up from 76 cents in the prior-year period. NCLH shares have been on an excellent run recently, adding 75% since bottoming out in mid-August.

In his look at Norwegian, analyst Scholes takes a deep dive into the company’s plans for both cost efficiencies and expansions – and he likes what he sees. Scholes says of Norwegian’s efforts and potential: “We really like NCLH’s opportunity for ‘self-help’ with their $300M in annual cost savings and opportunity… to better monetize Great Stirrup Cay we are of the view that NCLH is on track to at least meet the (implied) revenue portion of their 2026 guidance provided at their recent investor day… We are of the belief that NCLH will not be spending $150m for just a pier without some sort of future plan to upgrade the ‘upsell’ offerings (the “other” in “onboard and other”) on the island and should NCLH make a more granular announcement about upgrading the island, we would expect this to be a positive to the stock at time of announcement, though actual monetization from the upgrade would still be several years away.”

These comments support the analyst’s Buy rating, and his price target, set at $35, indicates room for 35% share growth in the coming year.

The Moderate Buy consensus on NCLH shares is derived from 15 recent analyst reviews that include an even split of 7 Buys and 7 Holds, plus 1 Sell. The shares are currently trading for $25.96, and their average price target of $29.29 implies a 12-month gain of 13%. (See NCLH stock forecast)

With the facts laid out, it’s clear that Truist analyst Patrick Scholes sees Norwegian Cruise Line Holdings as the superior cruise stock to buy in today’s environment.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.