While used-car dealership CarMax (KMX) is down double digits on a year-to-date basis, economic realities may eventually provide an upside catalyst for the embattled company. Against a longer-term framework, I am bullish on KMX stock.

On paper, most economic metrics seem to have moved against CarMax and its ilk. Primarily, the soaring inflation rate has substantially reduced the purchasing power of the dollar, in turn eroding real household earnings. Since January 2020, purchasing power has declined by nearly 12%. For context, between January 2013 through December 2019, this metric declined by 10.4%.

Second, data from the U.S. Census Bureau shows that mean personal income has flatlined, peaking in 2019 at $54,219 and slightly fading to $53,996 in 2020. With overall reduced real earnings against the rising tide of inflation, now doesn’t seem to be an ideal time to purchase a vehicle, presenting natural obstacles to KMX stock.

If these headwinds weren’t enough to discourage plunking down funds for a new (or new-ish) ride, the ratio of income-to-vehicle-price has, of course, increased. Back in 2019, the median price for a used car sold at Cars.com (CARS) was $17,500. Two years later, this stat jumped to $25,000.

Put another way, in the pre-pandemic years, customers were paying about 32% of their income for a used car. Nowadays, they may be paying the equivalent of roughly 45% or 46% of their annual paycheck for a vehicle in the second-hand market, again imposing significant roadblocks for KMX stock.

Nevertheless, contrarian investors may want to consider the cynical argument supporting CarMax.

CarMax Stock Analysis

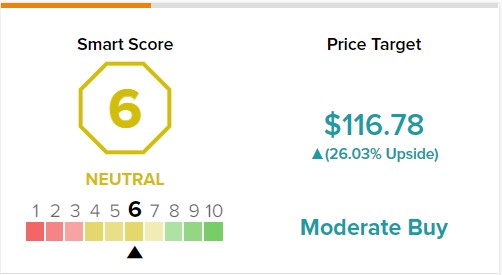

On TipRanks, KMX stock has a 6 out of 10 Smart Score rating. This indicates moderate potential for the stock to perform in line with the broader market.

The Economic Reality Bolstering KMX Stock

While the instinct to dismiss KMX stock as a discretionary – and therefore vulnerable – market idea admittedly features some valid arguments, CarMax ties into an economic reality that cannot be ignored: car ownership is vital to the proper functioning of the U.S. economy.

According to Statista’s Global Consumer Survey, 76% of American commuters use their own vehicles to move between home and work. Should the professional environment normalize and the grand work-from-home experiment fade out, this stat could fundamentally rise in favor of KMX stock. Logically, the more cars on the road, the better the outlook for CarMax.

Further, The Wall Street Journal provided what may be the biggest – though perhaps underappreciated – catalyst for the used-car market. It reported that the average age of vehicles on U.S. roadways hit a record 12.2 years, translating to drivers holding onto their rides for as long as possible to avoid costly replacements.

However, the arbiter of whether a car needs replacement is less about the driver’s concerns and more about the car itself. Even more cynically, the auto industry’s deployment of planned obsolescence means that when a vehicle finally breaks down, it may make better economic sense to replace the ride rather than to repair it.

At scale, the implications could be profoundly bullish for KMX stock.

Extended Warranties Can Pay for Themselves

Another factor to consider when assessing KMX stock is the power of the underlying company’s extended warranty program. Called MaxCare, at the point of purchase, customers have the option of paying for additional coverage based on their mileage needs. Considering that major auto repair bills can extend out to several thousands of dollars, MaxCare could pay for itself.

On the flip side, at a certain point, repairing a decades-old vehicle can run into the diminishing returns problem. For instance, the average American spent nearly $2,000 on car repairs in 2019, which is problematic not only because it’s so high but also because at an average age of 12.2 years, the typical car in the U.S. is well out of warranty protection.

Therefore, rather than constantly pouring precious capital into a four-wheeled money pit, rational economics suggest that customers should instead replace a problematic vehicle with a newer, warranty-protected one. Over time, this realization could help lift KMX stock despite inflationary headwinds.

Wall Street’s Take on CarMax

Turning to Wall Street, KMX stock is a Moderate Buy based on seven Buys, five Holds, and no Sell ratings. The average CarMax price target is $116.78, implying 26% upside potential.

Conclusion – CarMax is Still Relevant

To be fair, buying up shares of CarMax is not an easy narrative. People are hurting from inflation. As well, the reduction in collective consumer spending may spell mass layoffs, which would fundamentally pressure most businesses.

Still, personal transportation is, first and foremost, a necessity. If anything, for job seekers to be competitive in a potentially recessionary environment, they must hustle from one prospect to another. That’s not going to happen without a dependable ride, suggesting that KMX stock may be an attractive long-term play at its current discount.