When companies report mixed earnings, investors’ reactions can go either way. Sometimes, amidst so-so data an outstanding metric will stand out, causing investors to send shares higher. But the opposite also holds true. Looking at the reaction to CarLotz (LOTZ) Q1 earnings report, investors decided the negatives outweighed the positives and sent shares tumbling as a result.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

CarLotz reported revenue of $56.61 million, amounting to a 123% year-over-year uptick and beating the consensus estimate by $12.51 million. There was a one cent miss on GAAP EPS, which came in at -$0.15.

However, the disappointment was most likely based on vehicles’ soft GPU (gross profit per unit), which dropped from $1,637 in 1Q20 to $1,182 and fell beneath the guidance ranges of $1,300-$1,500.

CarLotz also failed to provide gross profit per unit guidance for Q2. As the company has already missed its original gross profit per unit targets for the last two quarters, investors might be feeling jittery.

However, Barrington analyst Gary Prestopino puts the decline down to an “alternative fee arrangement” with a corporate vehicle sourcing partner that made up roughly 60% of vehicles sourced in the quarter.

“Under this arrangement, vehicles are returned to the corporate vehicle sourcing partner from consignment if the vehicle has not been sold through CarLotz’s retail channel within a specified period with the company responsible for expenses incurred with respect to the vehicle,” the 5-star analyst explained. “During Q1/21, the company experienced an increase in the number of returned vehicles from consignment as a ramp up of sourcing in Q4/20 put pressure on processing centers resulting in slower vehicle processing time and increased days to sale.”

Following the quarter, there has been a clearing out of this “aged inventory,” and on a sequential comparable basis, Prestopino says the company is starting to see a rise in gross profit per unit.

While the company failed to provide an exact GPU forecast, it said it anticipates a “sequential improvement in retail GPU” in Q2. The company‘s plans call for the opening of another 11 to 13 hubs in 2021, most of which should open later in the year.

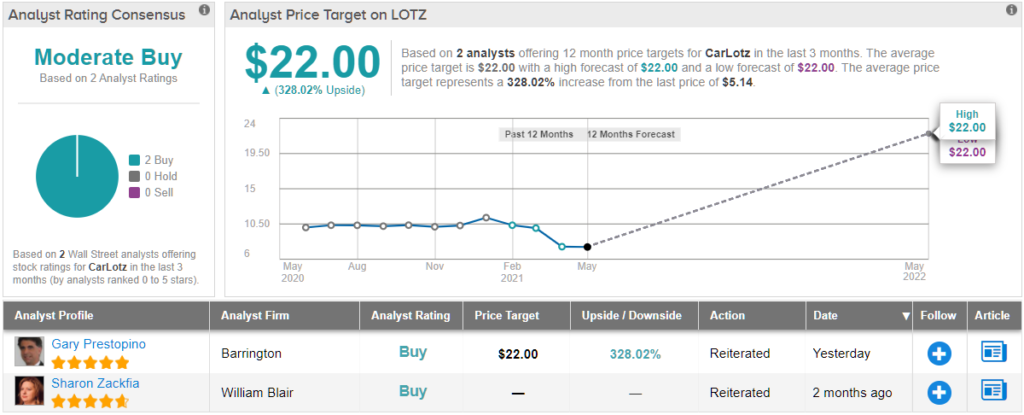

All in all, Prespotino reiterates an Outperform (i.e. Buy) rating on LOTZ shares along with a $22 price target. Investors could be pocketing gains of a huge 328%, should the analyst’s forecast go according to plan. (To watch Prespotino’s track record, click here)

One other analyst has thrown the hat in recently with a LOTZ review and the additional Buy gives the stock a Moderate Buy consensus rating. (See CarLotz stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.