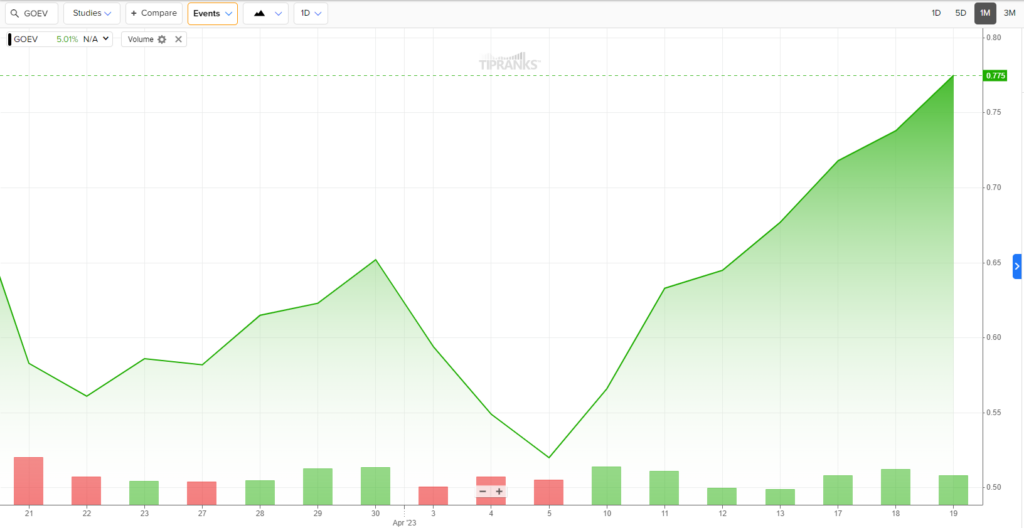

As a sub-dollar security, electric vehicle (EV) manufacturer Canoo (NASDAQ:GOEV) will almost surely attract attention among extreme speculators. However, those that did benefit handsomely from the stock’s multi-week bounce may want to consider exiting it. Fundamentally, as EV brands begin competing aggressively on price, legacy automakers may muscle out smaller no-name startups. Therefore, I am bearish on GOEV stock.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

It’s Not Personal. It’s Just the Numbers

Naturally, pessimistic assessments of publicly-traded enterprises tend to arouse raw, sometimes vituperative emotions. In an attempt to lessen the temperature, the bear case for GOEV stock doesn’t challenge the underlying industry. As advocates love to say, EVs could very well be the future of mobility and transportation.

In addition, the political framework should bolster electrification. As TipRanks reporter Shrilekha Pethe stated, demand for EVs “could see a surge this year as the U.S. Environmental Protection Agency (EPA) has proposed new tailpipe emissions limits which could result in 67% of all new vehicles sold in the U.S. being all-electric by 2032.”

On paper and outside any other context, this backdrop should lift GOEV stock. Additionally, Canoo generated early interest in its lifestyle EV – essentially a versatile van that can modulate to meet various needs. Again, on paper, Canoo should be a hit with millennials and consumers from the Generation Z demographic.

Unfortunately, the numbers just don’t work out for GOEV stock. Primarily, Canoo effectively runs as a pre-revenue enterprise. Sure, it posted $2.55 million in sales in 2020, but that’s it. In the following year and in 2022, Canoo fired blanks.

Problematically, its retained earnings line item now sits at a loss of $1.18 billion. Unless Canoo starts getting on track right away, the company may lose too much ground.

GOEV Stock Faces Pressure from Legacy Automakers

For the longest time, a lofty price point often prevented consumers from making the transition from combustion power to electric. In fact, the pricing problem worsened because of the inflationary crisis of last year. With the average price of a new EV hovering around $60,000, few could afford the luxury. However, the hefty price tag enabled a niche market for companies like Canoo to fill.

Moving forward, though, that advantage probably won’t be available for small startups. Instead, the big boys – the legacy automakers pivoting to EV production – should benefit from superior economies of scale. Once that happens, “opportunities” such as GOEV stock might suffer devastation. Without meaning to sound alarmist, it could go to zero.

According to a recent CNBC report, the day of the $25,000 EV will soon arrive. To emphasize, the news agency isn’t talking about a three-wheeled electric trike or some other (possibly dangerous) gimmick. No, consumers will have access to legitimate, four-wheeled, fully-functional electric cars, crossovers, or SUVs, just at a lower price.

Once this day arrives, it’s almost surely lights out for GOEV stock. After all, Canoo partially benefited from attractive pricing options. Once the legacy brands with their decades of pedigree offer even lower-priced EVs, what’s the point? Consumers will naturally gravitate toward the comfort and security of an established, globally-recognized enterprise.

Messy Financials Don’t Do Anything for Canoo

While GOEV stock may occasionally pop higher based on technical undercurrents such as short-squeeze attempts, over the long run, the fundamentals eventually matter. For Canoo stakeholders, the writing pretty much stains the wall for all to see.

Aside from a debt-to-equity ratio of 0.31 which sits favorably below the auto industry’s median value of 0.47, Canoo presents an ugly quantitative narrative. For instance, its three-year EBITDA growth rate sits at -0.9%, and both its return on equity and return on assets fell catastrophically below zero.

Finally, insiders have been selling GOEV stock. While it’s unpleasant to say, they were right in being pessimistic. In the trailing one-year period, shares hemorrhaged about 84% of their market value. Since going public, GOEV stock has fallen more than 92%.

Is GOEV Stock a Buy, According to Analysts?

Turning to Wall Street, GOEV stock has a Moderate Buy consensus rating based on two Buys, zero Holds, and zero Sell ratings. The average GOEV stock price target is $6.50, implying 755.6% upside potential.

The Takeaway: The Clock Mercilessly Ticks for GOEV Stock

As much fun as speculative traders might have had with GOEV stock in the past two weeks, it might be time to pocket those profits. Fundamentally, as EV prices start to fall, only the biggest enterprises will enjoy the economies of scale to sustain themselves. Therefore, Canoo faces the cruel winds of inevitability.