Are stocks heading up again? Or is momentum about to stall once more? After losing some ground recently, the past couple of sessions have witnessed a resumption of the upwards curve for the main indices. However, reading which way the market will turn next is no simple task right now.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

So, what’s an investor to do? A tried and trusted strategy is to follow the top analysts’ picks – especially those primed for some serious gains.

With this in mind, the analysts at Canaccord Genuity, the largest indie stock investment firm in Canada, are pointing out stocks that show serious upside potential – potential to outperform the market’s gains, and surge upwards by at least 80% in the near-term.

Growth potential on that scale is bound to attract interest. Investors always want a solid return, and the promise of outperforming the S&P by a large margin is a real draw. We’ve used the TipRanks platform to look up the details on three of Canaccord’s picks – these are stocks chosen by analysts with the highest 5-star rating and in the top 3% among their peers. Let’s check out the details on their stock picks, and take a look at the analysts’ commentary, too.

Zeta Global Holdings Corp. (ZETA)

We’ll start in New York City, with Zeta Global, a cloud-based marketing tech company whose platform brings AI to data analytics and customer acquisition and retention. Zeta’s data platform can sort through more than 2.4 billion consumer identity profiles, making a wealth of data available to business marketing customers. Zeta boasts that it offers its customers the largest omnichannel marketing platform.

Data-driven marketing is a growth industry in the digital world, and Zeta’s numbers reflect that. The company posted 20% yoy revenue growth in 2020, which grew to 25% in the first quarter of 2021, while margins expanded from 11% for full year 2020 to 13% in 1Q21. Zeta’s biggest asset, however, may be its consumer data set – some 220 million American consumers have opted into the database.

This company, while not new in its field – it was founded in 2007 – is new to the public markets. ZETA shares hit the NASDAQ through a company IPO in the first half of June. Shares started trading on June 10, at a price of $10; the company put 14.77 million shares on the market. The initial price was lower than the proposed pricing, which had anticipated a $10 to $12 range. The stock closed on its first day at $8.89. Including the underwriter’s purchase rights, this put the IPO’s capital raise at $147 million, significantly lower than the $215 million initially hoped for.

Canaccord’s David Hynes, ranked #14 overall by TipRanks, describes Zeta as ‘a stock that’s probably too cheap.’ He says of it, “Zeta has assembled one of the marketing industry’s largest first-party data sets for consumer contact, interest and intent data, which, when combined with its AI/ML capabilities, is helping to drive adoption of its marketing automation solutions. In a world in which there are questions about the future of third-party tracking technologies, this is a unique asset… what we can say with certainty is that this is a cheap stock. With the dearth of value options for software investors these days, if management can execute as we expect, driving modest acceleration and continued profitability over the next few years, it would not surprise us to see this stock benefit from a bit of multiple expansion.”

Hynes rates ZETA as a Buy, and his $13 price target indicates confidence in a robust 115% one-year upside potential. (To watch Hynes’ track record, click here.)

In their short time on the public trading markets, ZETA shares have clearly made a splash. The stock has 8 reviews already, and they include 6 Buys and 2 Holds – supporting a Strong Buy analyst consensus rating. The stock is selling for $6.05 and its average price target is almost as bullish as Hynes’; at $12.58 it implies a 108% upside. (See Zeta’s stock analysis at TipRanks.)

Convey Holding Parent (CNVY)

Next on our Canaccord list is Convey Holding, another tech company. Convey lives in the healthcare space, offering its customers – mainly Medicare and Medicaid, government-sponsored providers and payers, along with pharmacy benefit mangers – solutions for a range of necessary functions, including compliance monitoring, data analytics, enrollment and billing, and supplemental benefits.

Like Zeta above, Convey held its IPO last month. The healthcare tech company filed in May with the SEC for a $100 million initial public offering; in the event, the company sold 11.667 million shares at $14 each, raising over $160 million in gross funds. The stock closed at $13 on its first day of trading, and has been sliding ever since, to its current value at around $8. Taking the share price drop into account, Convey has a current market cap of $582.65 million.

In filings before the IPO, Convey reported 1Q21 revenue of $82.63 million, up 27% from the year ago quarter. The company had $32.5 million in cash and short-term investments available, and total debt of $318.58 million.

Sometimes, a company or stock can be summed up quickly and easily, and Richard Close does that here when he says, “Convey looks uniquely positioned for sustained profitable growth for many years to come. The company offers Medicare Advantage MCOs a comprehensive technology and services platform that is purpose-built for administering Medicare Advantage, Medicare Part D, and Employer Group Waiver Plans. The demographic tailwinds are clearly at Convey’s back with the continued expected growth in Medicare-eligible population and the increased use of Medicare Advantage to manage this population.”

Befitting a bull on the stock, the 5-star analyst sets a Buy rating and an $18 price target that suggests room for 130% growth in the 12 months ahead. (To watch Close’s track record, click here.)

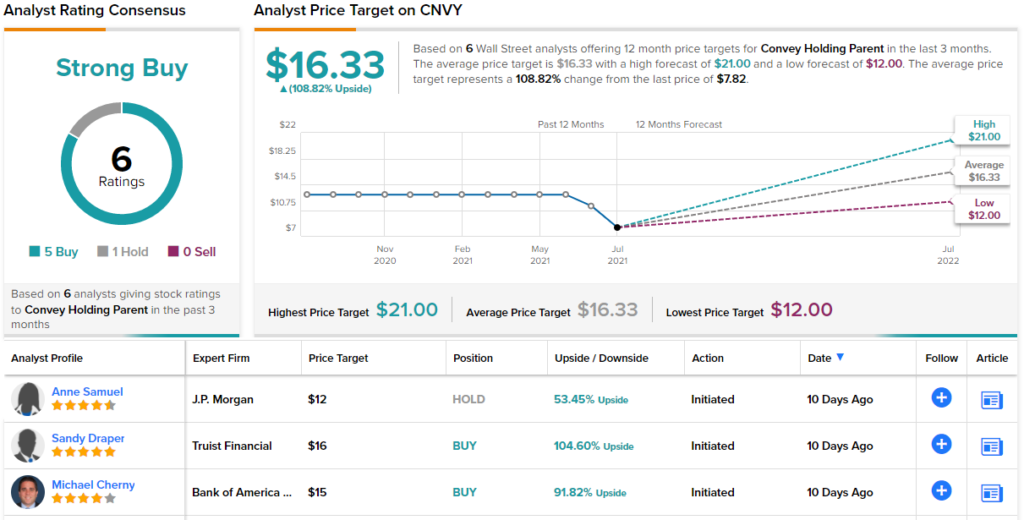

Again, this is a new stock that has quickly garnered a Strong Buy consensus rating. That amalgamated analyst view is derived from 6 reviews, breaking down 5 to 1 in Buys and Hold. The shares are currently trading for $7.82; their $16.33 average price target implies a 109% upside on the one-year time frame. (See Convey’s stock analysis at TipRanks.)

Original Bark (BARK)

Last up, let’s go walk the dog. The Original Bark is a unique pet supply company, which caters – as the name suggests – to dog owners and their canine companions. Original Bark designs, produces, and markets its proprietary lines of dog products, including treats, toys, and wellness supplements, all of which it distributes online. The company has grown since its founding 9 years ago, and also partners with Amazon, Target, and other big names.

Like the other stocks on our list, Original Bark is new to the public trading markets – but where the stocks above listed through IPOs, Original Bark used the SPAC route. SPACs, or special purpose acquisition companies, exist to organize investors, raise funds, and merge with a target firm. The SPAC starts out as a public company, and through the merger it brings the target company onto the stock exchange.

Bark merged with Northern Star Acquisition Corporation and completed the transaction on June 2, on which day the company began trading on the NYSE as BARK. The merger was worth approximately $427 million in cash for Original Bark, capital which will be used to expand both marketing operations and the product line.

Before completing the SPAC transaction, Bark reported its results for its fiscal year 2021, ending on March 31. In the full year, subscriptions grew by 91% yoy, with revenues posting a 68% yoy gain to reach $378.6 million. For the fourth quarter, revenue was up 79% year-over-year, at $112.2 million, and subscriptions were up 70%, to a total of 3.5 million.

In her note initiating coverage of BARK, 5-star analyst Maria Ripps points out the company’s unique attributes, writing, “BARK differentiates its offering by collecting product feedback via 250K unique monthly interactions with dog parents and then leveraging that data not only to enhance product recommendations but also to inform design and development of future toys. The company produces its products in-house, which ensures high-quality, strong brand association, and the potential for higher gross margins. BARK’s recent expansion into the food category should meaningfully increase its TAM, further improve unit economics, and extend its growth profile. Over time, we think investors will come to appreciate the low-churn, high-visibility subscription model and robust disclosures.”

In line with this outlook, Ripps gives BARK a Buy, and her $16 price target implies an 81% one-year upside. (To watch Ripps’ track record, click here.)

With BARK, we’re looking at a stock with a unanimous consensus – all 3 reviews call it a Buy, providing this name with a Strong Buy rating. The shares have an average price target of $15.33, for a 74% upside from the current share price of $8.83. (See Bark’s stock analysis at TipRanks.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.