Elon Musk is a polarizing figure, to say the least, but the scope of his ambition cannot be denied. After Space X sent its first astronauts into space on Saturday May 30, Wedbush analyst Daniel Ives believes the star dust will rub off on Musk’s other venture, Tesla (TSLA).

“While SpaceX and Tesla are separate companies despite some R&D cross pollination in some key areas, from a consumer perspective the Musk DNA remains the linchpin to both of these next generation technology stalwarts and we would characterize the historic success of SpaceX as another major shot in the arm to the Tesla brand,” Ives said.

Having said that, there’s another catalyst on the horizon. On the surface, Battery Day might not sound like the most exciting event, but as it is a Musk & Co. affair, anticipation is ramping up.

The event is expected to take place this month, with Tesla set to reveal several potentially “game changing” battery developments. Ives argues the company is “getting closer to announcing the million-mile battery.”

“In our opinion this battery technology will be very advanced, potentially last for decades, withstand all types of weather/terrain, and be another major milestone for the Tesla ecosystem,” the 5-star analyst said.

Theoretically, the battery will be able to power an electric vehicle for 1 million miles and could represent “a major step forward when competing vs. traditional gasoline powered automotive competitors from both an ROI and environmental perspective.”

The Street is also hoping Battery Day will provide more information on Tesla’s progress when it comes to “reducing battery production costs to the key $100/kWh threshold.” Ives maintains this is important as it will provide Tesla with “much more financial flexibility around pricing on current and future EV models with price parity.”

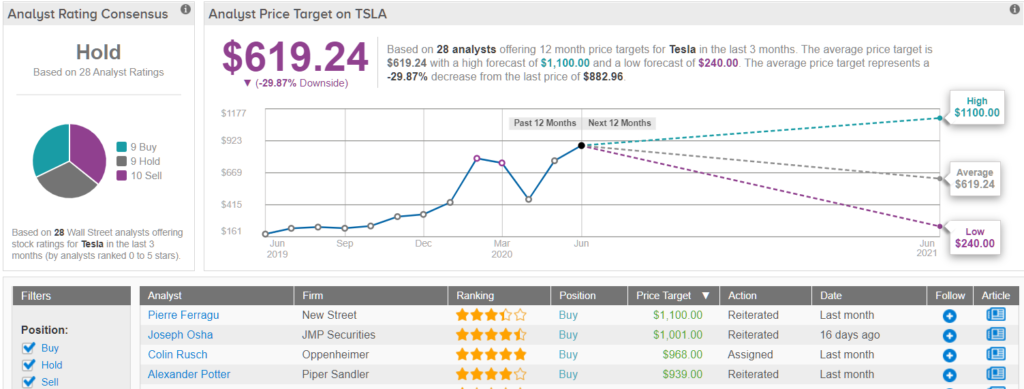

Despite the potential of these batteries, TSLA’s lofty valuation keeps Ives on the sidelines with a Hold rating. The analyst has an $800 price target on the stock, implying 11% downside potential. (To watch Ives’ track record, click here)

The analyst consensus rates Tesla a Hold right now, based on 9 Buys, 9 Holds and 10 Sells. Overall, the analysts have a $633.14 average price target for the EV pioneer. The Tesla juggernaut appears to have left the Street kicking dust, as its mercurial share gains (up 113% year-to-date) mean the figure presents downside potential of 30%. (See Tesla stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.