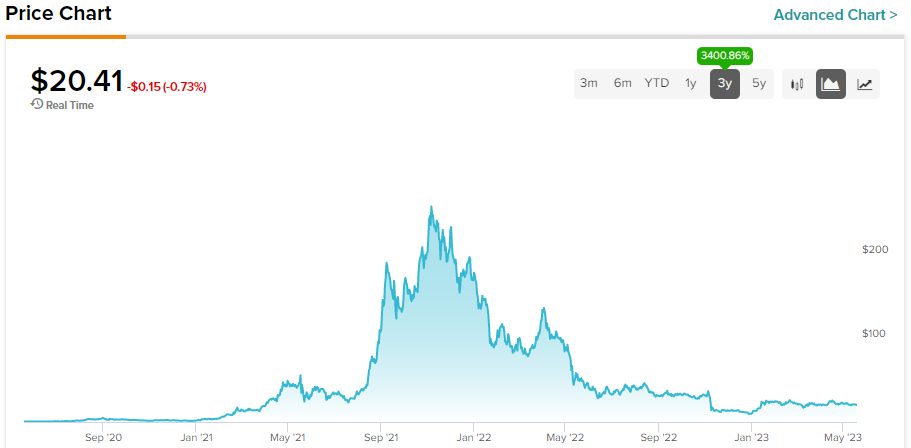

The Solana ecosystem and its star token SOL (SOL-USD) has seen its bull run hit particularly hard by one of the largest frauds in the cryptocurrency space — the November 2022 collapse of the FTX exchange, caused by extreme mismanagement of customer funds.

This is because FTX was among the largest sponsors of the Solana ecosystem, with the exchange and its infamous hedge fund arm Alameda Research being involved in funding the ecosystem, supporting liquidity, and even backing many of the bridged assets on Solana (tokens from other blockchains “wrapped” so that they could be used on Solana).

Just to list a few concrete examples, FTX was the primary “bridge” to bring assets such as USD Coin (USDC-USD), Bitcoin (BTC-USD), and Ethereum (ETH-USD). Thankfully, the former eventually gained enough traction to have a native Solana version issued by USDC’s creator, Circle, which helped reduce the magnitude of the eventual impact.

Serum, a decentralized exchange backed by FTX, was shut down in the wake of the FTX collapse. The platform was the backbone of Solana during its heyday, with many other decentralized finance (DeFi) exchanges drawing liquidity from it as well.

Overall, the impact of the FTX collapse was immense. From $1 billion in total value locked (TVL), a measure of the value of the assets placed in Solana apps, the ecosystem crashed to just over $200 million. What’s more worrying, even amid a broader market recovery since the lows of 2022, TVL remained largely flat on Solana.

Technical Woes Add Fuel to the Uncertainty

A further issue that’s haunted Solana since before the FTX debacle is the frequent chain halting. Normally, blockchains are supposed to be impossible to stop; at worst, fees will skyrocket to levels where only the most determined users will still be interested in using the chain.

Solana initially didn’t quite have a fee market like other blockchains, so when demand for transactions outstripped supply, the network simply stopped. When that was changed in mid-2022, other bugs caused halting. The last chain halt was in February 2023, and since then, no more episodes have been reported, according to the Solana uptime page.

However, the reputational damage is done. The chain has stopped 10 times in its history, often for many hours at a time — an unacceptable record in the blockchain space. Reliable uptime is one of the pillars of a healthy DeFi ecosystem, and Solana arguably lost a lot of trust from developers and users alike in the past 12 months. It’ll be some time before the community forgets about these episodes, which hopefully will not be happening again from now on.

If these issues are solved, then Solana remains an excellent alternative for deploying decentralized apps. With extremely low fees and high throughput, thanks to a number of optimizations to the underlying transaction processing, the Solana blockchain is a valid contender in the race for blockchain adoption.

The question now is, where will this next wave be coming from, and how is Solana positioning itself to take advantage of it?

Despite Everything, Solana is Still Keeping Up

The overall market slowdown in 2022 has impacted the entire space. Old narratives, such as the NFT mania, quieted down, and precious few new alternatives have emerged since. Thankfully, Solana has been keeping up with the new up-and-coming trends in blockchain.

One of these trends is so-called LSDs or Liquid Staking Derivatives. These are token wrappers representing an underlying amount of staked assets, or SOL in this case. They are useful because holders can gain access to nearly the full value of their assets just by selling LSDs or using them in DeFi, while still receiving a staking yield at all times.

LSD protocols like Marinade Finance and Lido have quickly gained market share and are now the top protocols by TVL, keeping the ecosystem visible in the overall charts.

Even meme coins like BONK had a good run on Solana, arguably starting the meme coin “trend” (however long it may last). There are also solid upticks in DeFi and NFT activity, with key partnerships such as the Chicago Board Options Exchange (CBOE) delivering on their promise, according to Messari.

It’s impossible not to mention the Solana Saga, the platform’s own Android flagship device, which has recently shipped. Though the idea is certainly out of the ordinary, reviewers seem to be praising the phone as well-made and tastefully integrated with Web3 features.

Finally, there’s a very good sign on the development front: activity hasn’t slowed down significantly in numbers, despite the chain issues from the past.

This is a great sign for things to come: the next killer app of blockchain is still out there, and as it stands, it looks like Solana is in a position to be there when it comes. If that happens, SOL should easily follow along, thanks to the LSDs and the new fee model.

So despite the massive crash and tough challenges, rumors of Solana’s demise may be greatly exaggerated. The chain has managed to retain a core set of loyal developers and users, which are keeping it relevant, even if still far away from previous heights. The future may still be quite bright for the ecosystem, even if it will likely need more time to recover.