2020 has been rough for many companies, yet for the world’s largest mobile chipmaker, Qualcomm (QCOM), it has been bountiful so far. A handsome earnings beat, the resolution of long-standing patent disputes and a prominent seat at the table for the upcoming 5G feast have been cheered by Wall Street. As a result, shares are up by 38% since the turn of the year.

Now that Qualcomm’s long-term licensing disputes with all leading smartphone OEMs have been put to rest, Canaccord Genuity analyst Michael Walkley’s most fielded question from investors is, “Can Qualcomm sustain EPS growth after a strong F2021 ramp anticipated due to QCT (Qualcomm CDMA Technologies) sales to Apple returning to the model along with licensing payments from Huawei?”

It is a long-winded question, but Walkley’s answer is succinct.

“We believe so,” the 5-star analyst said, while further noting, “Our take is the continued mix of 5G combined with a steady recovery in global smartphone sales will lead to sustained growth through F2022. In fact, we estimate the mix of 5G smartphones will grow from roughly 200 million units in C2020 to 450million-500 million units in C2021 to roughly 1 billion units in C2022.”

What’s more, with the potential to bring in 1.5x the dollar content in “similar tiered” 5G smartphones, compared to 4G units, alongside robust growth opportunities in neighboring markets such as IoT and automotive, Walkley believes QCT revenue will increase from $16.10 billion in F2020 to $24.2 billion in F2022.

Additionally, Walkley also expects Qualcomm’s other main arm, QTL (Qualcomm Technology Licensing), to keep on growing. The analyst estimates revenue will increase from $6.2 billion in F2021 to $6.6 billion in F2022 “primarily based on improving global smartphone sales.”

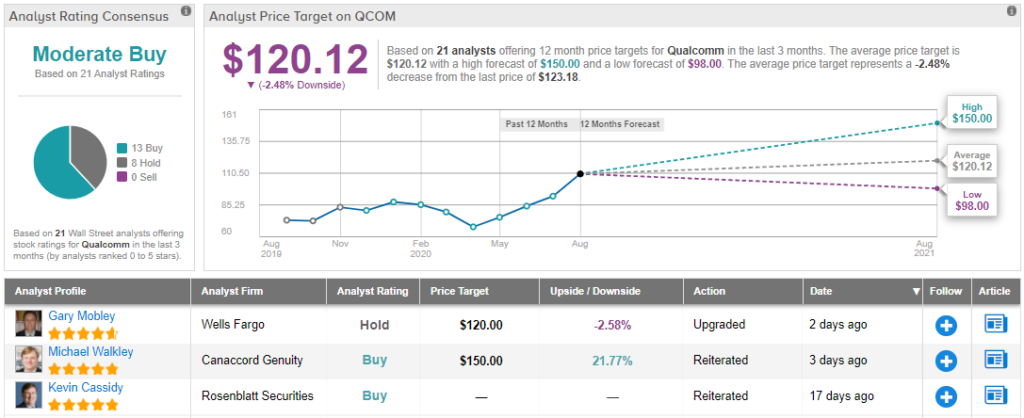

So, that’s all great for Qualcomm, but what does it mean for investors? Walkley reiterated a Buy rating on QCOM shares and gave the price target a bump. The figure moves from $137 to $150 and implies possible upside of 22% over the next 12 months. (To watch Walkley’s track record, click here)

While Walkley’s colleagues are by no means bearish, they take a more measured approach. Based on 13 Buys and 8 Holds, Qualcomm has a Moderate Buy consensus rating. However, the $120.12 average price target suggests 2.5% downside potential. (See Qualcomm stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.