Most of the tech giants have reported Q2 earnings but one marquee name has yet to present its quarterly statement. Next Wednesday, August 19, GPU heavyweight Nvidia (NVDA) will report F2Q21 results.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Nvidia has been one of the main beneficiaries of the viral outbreak’s consequences. The WFH culture and shelter in place measures inadvertently played into Nvidia’s two core strengths – Data Center and Gaming.

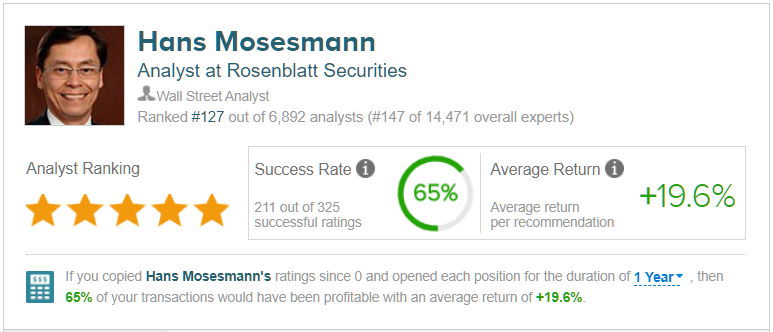

Looking ahead to the print, Rosenblatt analyst Hans Mosesmann expects Nvidia to deliver the goods and anticipates the company will post “a slight beat.”

The latest report will also mark the first full quarter in which the impact of newly acquired data specialist Mellanox will come into play.

Driven by the pandemic’s tailwinds, Mosesmann anticipates “continued momentum” in Data Center and with the addition of Mellanox expects “low teens quarter-over-quarter growth.” The 5-star analyst cites “increased demand from work-from-home dynamics, solid backlog and visibility, and strong traction from the new Ampere,” as reasons to be confident in the segment’s performance.

The Mellanox acquisition was a significant milestone and is expected to make up 12% of total revenue, strongly contributing to Data Center growth.

As for Gaming, Mosesmann predicts a “low single-digits quarter-over-quarter uptick,” driven by COVID-19 and the shift to e-tail channels. These will be slightly offset by the closure of retail stores.

Mosesmann also expects Nvidia’s Automotive segment to offset the overall positivity. So do Nvidia management, who have guided for a 40% quarter-over-quarter decline.

But looking ahead, Mosesmann expects Nvidia’s out sized performance (up a whopping 94% year-to-date) to continue and guides for “mid-single-digit q/q growth,” in the October quarter.

Summing up, the 5-star analyst said, “We see Nvidia well positioned to take advantage of key themes/trends over the next few quarters, including continued transition to software defined data center architectures, which includes both Ampere GPU compute momentum and the emergence of data processing (DPUs offloading of traditional CPU workloads) and the new gaming version of the 7nm Ampere GPU.”

Accordingly, Mosesmann reiterated a Buy on NVDA shares alongside a $500 price target. The implication for investors? Upside of 8%. (To watch Mosesmann’s track record, click here)

As far as Nvidia’s rating goes, the rest of the Street and Mosesmann are on the same page. Based on 26 Buys, 3 Holds and 1 Sell, Nvidia boasts a Strong Buy consensus rating. However, where price targets are concerned, the two diverge. Overall, going by the $415 average price target, Mosesmann’s colleagues expects the share price to decline by 9% in the year ahead. (See Nvidia stock analysis on TipRanks)

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.