NASA successfully launched a Lockheed Martin (NYSE:LMT)-manufactured spacecraft, Orion, for a 25.5-day journey to the Moon’s orbit yesterday. It is a first-of-its-kind testing mission, called the Artemis I mission, with several more to be conducted under NASA’s Artemis program. This mission could be a game-changer for LMT stock, which has been lagging.

The mission aims to land a woman and a person of color on the moon’s surface in a couple of years, a feat last achieved in 1972.

The launch took place at 1:47 a.m. ET on November 16 from the Kennedy Space Center in Florida, while Orion will splash down off the coast of San Diego, California. During its journey, the Lockheed Martin-funded LunIR technology will take images of the Earth and Moon for further study in future endeavors.

Robert Lightfoot, executive VP of Lockheed Martin Space, said, “We’re witnessing history as Artemis I brings us one significant step closer to making NASA’s vision for human deep space exploration a reality.”

Lockheed Martin’s Success Attracts New Orders

Impressed with LMT’s spacecraft performance, NASA ordered three more Orion ships from Lockheed Martin in October worth $1.99 billion. Previous attempts to launch the rocket have failed due to technical glitches. If the Artemis I mission is a success, it could pave the way for even more business collaborations between LMT and NASA.

Moreover, on November 14, the U.S. Army awarded a $521 million contract to LMT for Guided Multiple Launch Rocket Systems to replenish GMLRS provided by the Department of Defense (DoD) inventory in Ukraine. This is in addition to a $179 million contract awarded to LMT this fall for replacing High Mobility Artillery Rocket Systems (HIMARS), which are also being shipped to Ukraine.

While the Artemis launch brings in good news, last week, Lockheed Martin’s stock price took a hit owing to a fake tweet on billionaire Elon Musk-led microblogging site, Twitter. The company saw its market capitalization decrease by roughly $7 billion due to the fake tweet.

Is Lockheed Martin a Buy, Sell, or Hold?

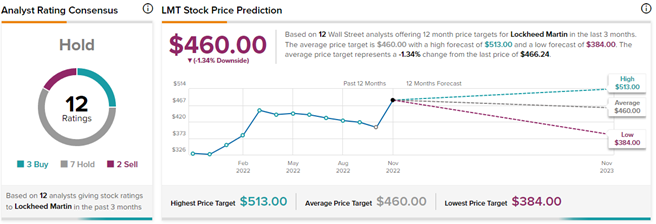

On TipRanks, Lockheed Martin stock has a Hold consensus rating. This is based on three Buys, seven Holds, and two Sell ratings. The average Lockheed Martin price forecast of $460 implies 1.3% downside potential to current levels. Meanwhile, the stock has gained 34.2% so far this year.

Ending Thoughts

Lockheed Martin’s manufacturing processes have been hit by supply chain issues and labor challenges. The company does not expect sales to increase significantly until 2024 when demand for defense systems and jets will translate into actual orders and sales. Along the same lines, analysts prefer to wait on the sidelines until the outlook for LMT turns positive. Having said that, the successful journey of Orion through the Artemis I Mission may provide a boost to LMT stock.