COVID-19 pandemic tailwinds may have helped send Teladoc Health (TDOC) stock on an impressive run in 2020, and at the start of 2021. Yet in the past six months, it’s been all downhill for the telemedicine provider’s shares.

Trading for as much as $308 per share back in February, it’s since fallen by nearly 52%, changing hands at around $150 per share as of this writing. Shares have seemed to have found a floor at this level, but there’s not much to indicate that recovery is likely in the immediate future.

Why is that? For starters, the company’s recent earnings release failed to do much to change the current lukewarm sentiment around it. Wider-than-expected net losses outweighed a revenue beat for the preceding quarter.

In addition, analysts have pointed out concerns about its valuation, in light of rising competition. These negatives could continue to outweigh possible tailwinds from the Delta variant of COVID-19 extending the “new normal” environment that gave shares a tremendous boost in the first place. (See Teladoc stock charts on TipRanks)

TDOC Stock and Recent Earnings

After the market closed on July 27, Teladoc released its earnings for the fiscal quarter ending June 30, 2021. Revenues came in slightly better than analyst estimates ($503.1 million, versus $500.6 million). Still, it was a wider-than-expected net loss (86 cents per share, versus 53 cents per share estimates) that weighed more heavily among investors.

Yes, TDOC stock may have bounced back to the $150 per share price level, after plummeting post-earnings. Yet these results point to continued challenges when it comes to it making its way back to its highs.

Management’s full year guidance for 2021 sales remains in line with analyst expectations ($2.025 billion, versus $2.1 billion). But as mentioned above, analysts are concerned about how results will fare in 2022. Despite the fact it’s yet to become profitable, investors have been willing to pay up for Teladoc shares, based upon its high levels of projected growth.

Today, it trades for around 11.8x projected 2021 revenue, and 9.1x projected 2022 revenue. If more information emerges, indicating it could fail to hit 2022 numbers (estimated $2.6 billion in revenue), sentiment for the stock could continue to get worse, leading to even lower prices.

Why The Delta Variant May Fail to Move its Needle

Excitement for TDOC stock may still be on the wane. But couldn’t the worsening Delta variant situation be something that gets it back on track?

As cases rise, bringing the possibility of a repeat of 2020’s lockdowns in the United States, in theory, Teladoc’s prospects should be improving. Yet, even this may not be enough to encounter the concern highlighted above: rising competition.

That’s not only from existing telehealth pure plays like American Well (AMWL). Amazon (AMZN) is making major progress rolling out its Amazon Care service to all 50 U.S. states. Likewise, Wal-Mart (WMT), following its acquisition of rival MeMD, is another behemoth that could threaten this company’s ability to sustain prior levels of growth, and eventually scale up to the point of profitability.

An extended pandemic could soften the blow. However, barring rising competition proving to be overblown, don’t expect a material change in sentiment for Teladoc stock.

What Analysts are Saying About TDOC Stock

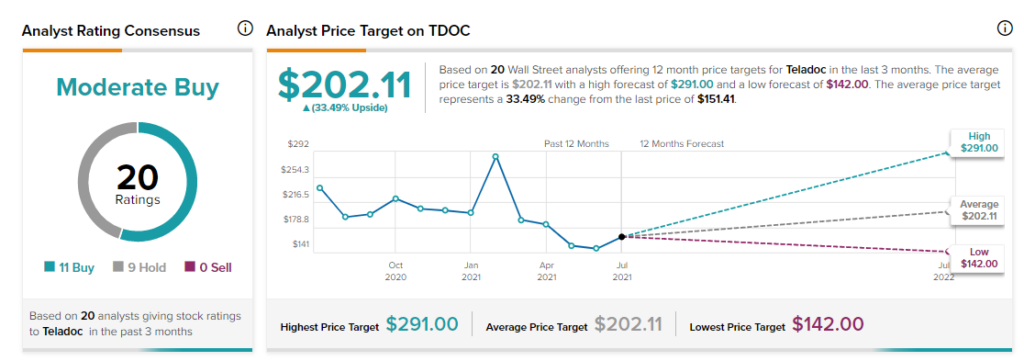

According to TipRanks, TDOC stock has a consensus rating of Moderate Buy. Out of 20 analyst ratings, 12 rate it a Buy, 8 analysts rate it a Hold, and 0 analysts rate it a Sell.

As for price targets, the average Teladoc price target is $202.11 per share, implying around 33.5% in upside from today’s prices. Analyst price targets range from a low of $142 per share, to a high of $291 per share.

Bottom Line: Expect Lukewarm Sentiment to Continue for Teladoc Stock

For the past six months, sentiment about TDOC stock has moved in the wrong direction. It may stay put at today’s lukewarm levels, but it is not expected to swing back to positive anytime soon.

Even with possible tailwinds from the Delta variant, rising competition could continue to challenge the stock in the months ahead.

Disclosure: Thomas Niel held no position in any of the stocks mentioned in this article at the time of publication.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.