Aurora Cannabis (ACB) was once the darling of the cannabis industry. In 2018, after having built Canada’s largest production capabilities, the company was eager to take on the newly legalized cannabis world. Unfortunately, success fell short and the latest earnings release sums up its inability achieve profitability.

During the past two months, there have been large swings in ACB stock price. I wanted to break down the financial numbers to get a sense of what a true value of the stock could be and show what Aurora needs to accomplish to get to profitability.

When we look at earnings, we try to determine future price levels based upon forward earnings multiples. Aurora Cannabis is not earning a profit, and is unlikely to become so any time soon. However, by projecting a few numbers it is possible to work through the losses and potentially glean enough information to calculate a valuation.

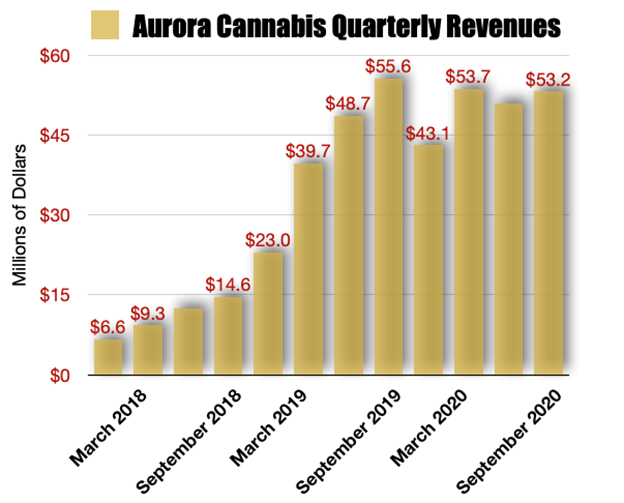

Here is a look at the most recent revenues for Aurora:

(Chart Data Source: Company Data – Author’s Chart)

In Canada, where Aurora primarily operates, total retail sales for the past three months is CAD ~$750M. At the same time, the latest quarter’s revenues for Aurora were some CAD $70M. That means Aurora is producing approximately 8.5% of all of Canada’s cannabis.

But, Canada’s total retail sales have increased some 130% YoY from October 2019 to October 2020. Aurora has struggled to gain momentum despite being one of Canada’s largest cannabis producers.

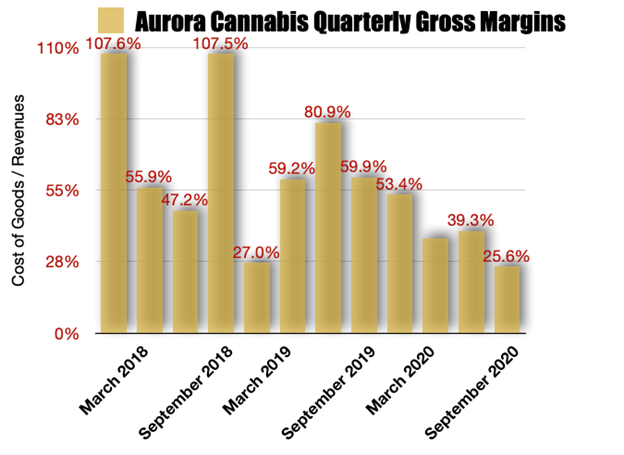

At the same time, while Aurora has produced very large amounts of cannabis, the margins the company is receiving are not competitive with the most competitive cannabis companies. After having reviewed so many cannabis companies, I can tell you that the very best companies have gross margins of ~60% or more. Here are Aurora’s gross margins over the past two years:

(Chart Data Source: Company Data – Author’s Chart)

The smallish boutique companies tend to produce smaller amounts of cannabis but have higher gross margins. However, there are exceptions to this where there are some “boutique” cannabis companies selling comparable amounts of cannabis every quarter but, with higher margins.

Aurora could feasibly maintain its current revenue levels while simultaneously increase its margins. Aurora’s business model was to produce very large quantities of wholesale cannabis. Nearly every single company that has attempted that is now on its way to finishing its restructuring phase of moving away from the wholesale side of the business and into premium branding.

Aurora’s new stated goal is to achieve significant growth in its premium brands. And, with enough time, the company just might pull it off.

First, if Aurora were to maintain its market share of wholesale and increase margins, this will add to the bottom line. I have looked at some 350 cannabis companies and it is difficult to find a producer who is sticking to the wholesale model. That may be an opportunity for Aurora since largely most of the other players in this field have left the game entirely.

If margins from the wholesale business were to improve from their lows of 25% and push back upwards to 50%, this adds an additional $17M to gross profits. At the same time, if Aurora’s premium branding continues to increase in sales and can add some $25M to the topline, this will add an additional $15M to gross profits.

With operating costs as low as $30M, Aurora Cannabis has the opportunity to start adding to the bottom line.

For now, the restructuring costs are adding significant losses to the bottom line. But, even that will end shortly and the bottom line can begin to improve.

So, where could that put Aurora’s stock price?

Using a forward look, we can look towards total revenues, margins, and operating costs to find a possible price target. Given a future potential of $75M in revenues with an approximate 14% net profits and 168M in outstanding shares, this puts ACB at ~$5.00 per share. Then, given a future growth rate of revenues and earnings, Aurora can then begin the long process of increasing shareholder value.

The majority on the Street remain Aurora skeptics. The stock has a Moderate Sell consensus rating, based on 4 Holds, and 7 Sells. Although the analysts see only ~6% downside, given the average price target currently stands at US$9.98. (See ACB stock analysis on TipRanks)

Disclosure: No position.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.