Hedge funds have a reputation for outperforming the average market returns, making it crucial to monitor their stock transactions. By utilizing TipRanks’ Hedge Fund Trading Activity tool (which uses data from Form 13-Fs to offer hedge fund signals), C3.ai (NYSE:AI) emerges as a stock these experts favor. C3.ai is an enterprise AI application software company.

Against this backdrop, let’s explore the future of this AI stock.

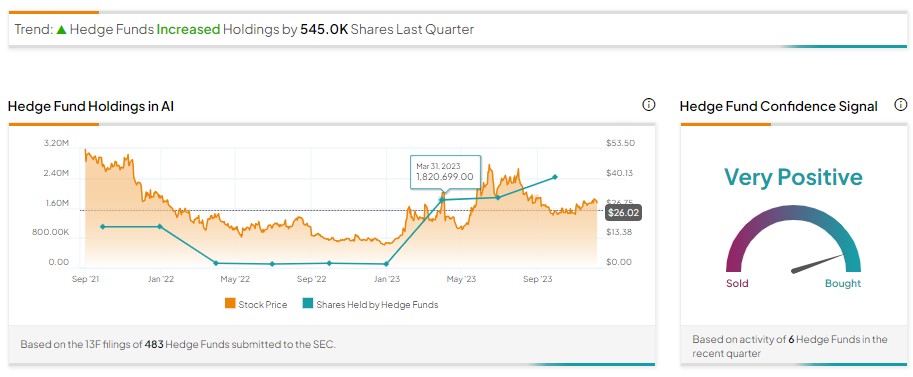

Hedge Funds Accumulate C3.ai Stock

AI-led tailwinds augur well for C3.ai. During the Q2 conference call, its management highlighted that interest in AI applications, especially generative AI, is growing substantially. Moreover, the company’s transition from subscription to consumption-based pricing will add to revenue predictability, which is positive.

The Hedge Fund signal remains Very Positive for AI stocks. TipRanks data shows that hedge funds bought 545K shares of AI last quarter, with Coatue Management’s Philippe Laffont and Hussman Strategic Advisors’ John Hussman raising their holdings in AI stock, among others.

Is C3.ai a Good Stock to Buy?

While hedge funds favor C3.ai stock, the lengthening of the sales cycle and widening of losses remain a drag. Wall Street analysts remain sidelined on AI stock, with Needham analyst Mike Cikos reiterating a Hold recommendation on December 7. Cikos said the unchanged revenue guidance despite solid demand and “wider operating losses” will “serve as an overhang on AI’s shares.”

Overall, C3.ai stock has three Buy, six Hold, and three Sell recommendations for a Hold consensus rating. Further, the average AI stock price target of $28.50 indicates that it has the potential to rise by 9.53% from current levels.

Bottom Line

C3.ai is a solid AI play with a Very Positive signal from hedge funds. However, Wall Street analysts remain sidelined on the stock. This indicates that retail investors should avoid forming judgments solely based on a few metrics. Instead, investors can use TipRanks’ Experts Center tools to make informed investment decisions.