The second quarter earnings season is starting to wind down, and data shows that – after more than 90% of S&P listed companies have reported – we’re looking at 60% earnings growth for Q2. Tech giants like Apple and Facebook, and major banks like JPM, have shown double-digit year-over-year earnings growth. It’s clear, at least from this metric, that we’re seeing the post-pandemic economic take-off.

But are we? Other data shows that second quarter GDP growth – the usual proxy for overall economic expansion – came in at 6.5%. That’s a fast clip for the US economy, but well below the 8.5% economists has predicted. It looks like something is holding the economy back. We can expect headwinds from persistent labor shortages and extended unemployment benefits tending to induce workers to stay home – but those extended benefits are scheduled to run out next month. Will this headwind turn out to be a temporary phenomenon?

Writing from JPMorgan, market strategist David Lebovitz states his belief that investors and analysts have shed caution recently, and should take heed of the slowing pace of growth.

“It feels like a little bit of the analyst community has missed the mark so significantly for the past year, they’re now recalibrating their outlook based on what we’ve seen rather than what they in reality should be expecting,” Lebovitz noted.

What we’ve seen, recently, has been growth and positive earnings; what we can expect is somewhat clouded. That’s not to say compelling plays can’t be found in the current financial environment. Wall Street analysts have been busy pointing out stocks that primed for strong gains in the current market condition.

In fact, they found three stocks in particular with, in their view, 100% or higher upside potential. Let’s take a closer look.

Processa Pharmaceuticals (PCSA)

We’ll start in the biopharmaceutical sector, where big return potential is not uncommon. Processa is a clinical-stage biopharma company, with a focus on finding new medicines to patient populations facing high unmet medical needs – in other words, few effective treatment options. The company currently features a pipeline with five drug candidates under investigation, three of which have been cleared by the FDA for clinical trials.

Of those three drugs, two – PCS499 and PCS3117 – are in the Phase 2 stage, while PCS6422 is at Phase 1. The drugs are being developed as treatments for a variety of cancers, including metastatic colorectal cancer, breast cancer, pancreatic cancer, and non-small cell lung cancer, as well as necrobiosis lipoidica (NL). This last is the focus of the lead drug candidate, PCS499.

NL is a disfiguring disease of the skin and connective tissue, and typically affects lower extremities. The disease is more common in men than women, and diabetes is a known risk factor. There is no treatment currently available with FDA approval, and the US patient base is estimated at 50,000+ individuals. Earlier this year, in May, dosing began on patients for the Phase 2b trial of PCS499, with interim results expected in 1H22.

PCS3117, the company’s other Phase 2 drug candidate, is the subject of a licensing agreement with Ocuphire Pharma. The agreement gives Processa exclusive world-wide rights in PCS3117, for development, manufacturing, use, commercialization, and sublicensing. This drug candidate is a proposed treatment for both non-small cell lung cancer and pancreatic cancers, two malignancies known to resist treatment.

Finally, PCS6422, in development as a treatment for breast cancer and metastatic colorectal cancer, dosed its first patient in a study on GI tract tumors. The trial is a Phase 1b dose-escalation safety study, and is expected to publish interim results by the end of year, with more complete results coming during 2022.

Oppenheimer analyst Francois Brisebois sees this pipeline, with multiple applications and new modes of treatment, as the key factor here.

“PCSA is a unique drug development clinical-stage biotech company with no attachment to a specific disease area or drug type. Led by a strong experienced management (CEO David Young, former CSO Questcor), PCSA in-licenses candidates with evidence of efficacy to fulfill unmet medical needs with a favorable risk/reward profile. While each pipeline asset has substantial commercial opportunity, PCS499 for rare uNL could be first to market. Based on strong scientific rationale, PCSA also has oncology assets in PCS3117 and PCS6422 that have potential to overcome shortcomings from cornerstone chemotherapy treatments in gemcitabine and capecitabine.”

The analyst summed up, “Although fairly early in development, we view PCSA as undervalued given its thoughtful de-risked approach.”

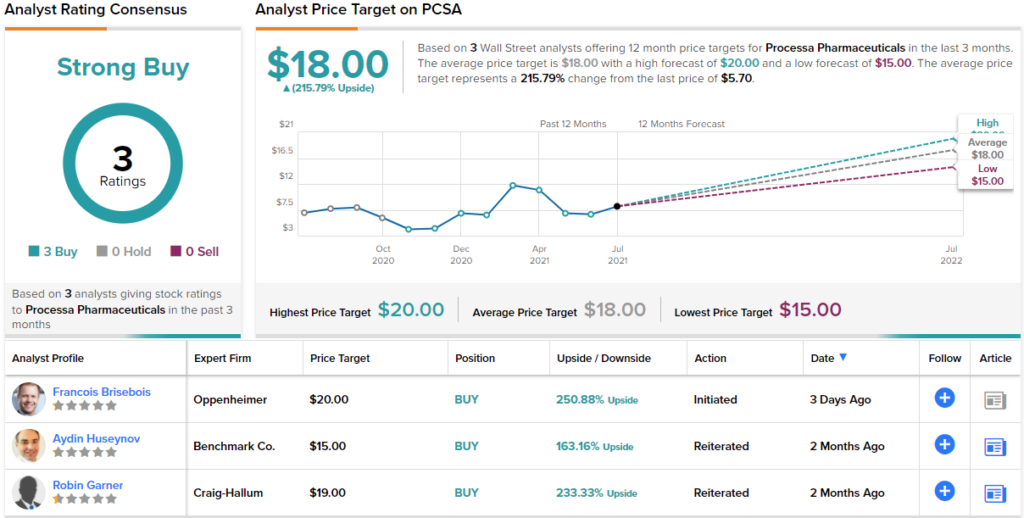

In-line with these comments, Brisebois rates PCSA an Outperform (i.e. Buy), and sets a $20 price target implying impressive growth of ~248% in the next 12 months. (To watch Brisebois’ track record, click here)

Judging by the consensus breakdown, opinions are anything but mixed. With 3 Buys and no Holds or Sells assigned in the last three months, the word on the Street is that PCSA is a Strong Buy. At $18, the average price target implies ~216% upside potential from current levels. (See PCSA stock analysis on TipRanks)

FREYR Battery (FREY)

We’ll change gears now, and look at Norway’s FREYR, a battery company on the cutting edge of its field. FREYR aims to ‘de-carbonize’ the planet with clean battery solutions. Powered by hydro and wind energy, FREYR is working on cost-competitive, high-density, lithium ion battery tech with a reduced carbon footprint. The company is targeting several markets, including electric vehicles, stationary energy storage, and marine and aerospace applications.

FREYR’s business model is based on creating partnerships with original equipment manufacturers. The Norwegian company will conduct R&D, while licensing the manufacturing processes to the OEMs.

Last month, FREYR completed its merger transaction with Alussa Energy Acquisition, a SPAC company, in a deal that brought $704 million gross proceeds to the combined entity. FREY shares started trading on Wall Street on July 8, and the company currently boasts a market cap of $1.12 billion.

Also last month, FREYR made progress on its plans to open a battery construction plant in Mo i Rana, Norway. The plant will be powered entirely by hydroelectric energy – feasible in Norway, whose long coast and strong tides provide plenty of opportunity for generating hydro power. The company aims to begin production in 2023.

This highly speculative green economy stock has caught the attention of BTIG analyst Gregory Lewis, who sees it as an entry investment into future energy technologies.

“FREY is positioning itself to be the cleanest battery cell manufacturer in the world. And with battery cell supply issues already rearing their ugly heads across the global EV supply chain despite EV market penetration still being in its infancy (~3% of global auto sales) and energy storage systems (ESS) set for multidecade growth as ESSs are used to complement the build-out of wind and solar across the developed world for now (emerging markets later), we believe FREY’s European location (~70% of the world’s battery cell manufacturing capacity in China) makes it an attractive cell supplier for European auto OEMs and ESSs across Europe,” Lewis wrote.

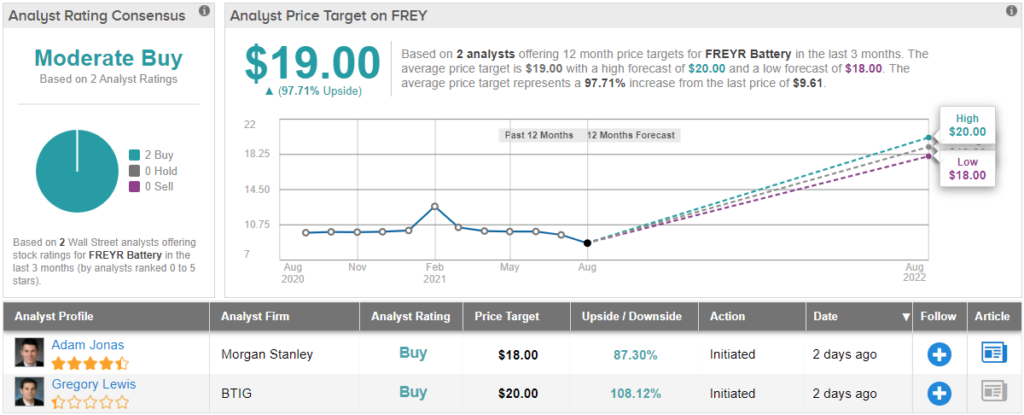

The analyst initiated his coverage of FREY with a Buy rating. His $20 price target implies an upside of ~108% for the year ahead. (To watch Lewis’ track record, click here)

Lewis’ is one of two reviews on record for FREY, and both agree that this is a stock to buy – giving this new ticker its Moderate Buy consensus rating. Shares are priced at $9.61 and their $19 average price target suggests a one-year upside of ~98%. (See FREY stock analysis on TipRanks)

Globus Maritime (GLBS)

We’ll now turn to the shipping industry. While we live in the digital age, and our financial transactions are handled by computer, there’s no way to escape the need to move raw materials around the world – and a substantial portion of that trade is carried in drybulk cargo vessels. These ships do the yeoman’s work of the carrying trade, plying the oceans with cargos of unpackaged bulk goods. Grains, ores, coal, cement, steel coils – all of this, and plenty more, find its way into the holds of the world’s drybulk fleet.

This is the universe inhabited by Globus Maritime. This Athens-based company has been in business since 2006, and operates a fleet of 8 vessels, ranging from 50,000 to 85,000 dry weight tons carrying capacity. This puts the vessels in the Supramax, Panamax, and Kamsarmax size ranges. The company’s fleet averages just over 10 years old, and totals more than 544,000 tons of carrying capacity.

The major news on Globus, for investors, comes from the company’s recent fleet updates. Two vessels have been acquired just this summer. In June, the company received the Kamsarmax carrier Diamond Globe for a purchase price of $27 million. The vessel has over 82,000 DWT capacity, and was built in China in 2018. The vessel was chartered in June for four months at a daily rate of $27,250.

The second fleet acquisition came in July, when Globus took delivery of Power Globe, also a Kamsarmax vessel, for $16.2 million. Power Globe was built in 2011 and has more than 80,000 tons carrying capacity.

A shipper’s fleet depends on charters to bring in revenue, and Globus announced at the end of June a three-month charter on its Supramax carrier River Globe, a 2007-built vessel with a 53,000 DWT capacity. This charter has a daily rate of $29,500. It’s important to note here that shipping rates are rising – and in the two weeks between chartering the Diamond Globe and chartering the River Globe, Globus was able to increase its daily rate by $2,250.

Globus’ last financial report was for 1Q21, and in it, the company reported having over $50 million in cash on hand, with bank balances of $21 million. This was an increase of 152% year-over-year, and came even as the company was completing the purchase and acquisition of two vessels.

Solid charter activity, high daily rates, an increasing fleet, and a sound balance sheet all combined to call Globus to the attention of Maxim’s 5-star analyst Tate Sullivan.

“GLBS ended 1Q21 with $21M of net cash whereas most shipping companies historically operate with much more debt than cash. Looking forward, we expect GLBS will still have a net cash position by the end of 3Q21… Given recent shipping rates, along with a 3-month rate of $29,500 for one of the company’s eight ships, we expect GLBS will generate $8M of net income over the next four quarters (2Q21 to 1Q22), a sharp reversal from $9M in losses over the previous four quarters,” Sullivan noted.

The analyst added, “We estimate GLBS ended 2Q21 with about 20M warrants outstanding compared to shares outstanding of about 21M… We incorporate the exercise of all these warrants into our shares outstanding forecast and still expect a book value per share of $4.87 in 4Q22, above GLBS’ current share price below $3.”

To this end, Sullivan rates GLBS a Buy, along with a $6 price target. Investors could be pocketing gains of ~122%, should the analyst’s forecast hit the mark over the next 12 months. (To watch Sullivan’s track record, click here)

Some stocks fly under the radar, and GLBS is one of those. Sullivan’s is the only recent analyst review of this company, and it is decidedly positive. (See GLBS stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.